Stock Market Run Run Away

Stock-Markets / Stock Markets 2010 Mar 17, 2010 - 09:08 AM GMTBy: Toby_Connor

Last week I hypothesized that the markets are “On the Brink of an Asset Explosion”. If this is going to play out then we can probably expect to see runaway moves develop in virtually all assets soon.

Last week I hypothesized that the markets are “On the Brink of an Asset Explosion”. If this is going to play out then we can probably expect to see runaway moves develop in virtually all assets soon.

The rally out of the `06 bottom to the February `07 mini crash is a classic example of a runaway move (chart below). Note the brief measured corrections. Needless to say, if something like this develops soon, one doesn’t want to get caught on the bearish side of the tracks.

This kind of rally doesn’t happen that often, but when it does, it is a ticket to get rich on the long side of the market or poor if you choose to try and fight one of these runaway moves.

We already potentially have moves like this developing in multiple markets; technology, small caps, S&P500, platinum, palladium, silver, oil, & gasoline to name a few.

I think we may get a big clue when the markets move down into the now due daily cycle low if the correction is brief and mild like the late February pullback. If this scenario indeed transpires, the odds are going to increase dramatically that all markets are setting up for runaway moves.

I’m expecting that move down to begin at any time, although I think there’s a good chance the markets will hang in until options expiration on Friday.

Next week positive seasonality disappears. That will probably be the most likely period to look for stocks to move down into a cycle bottom.

Tuesday was the 26th day of this rally. That’s deep enough into the daily cycle that we can expect a top at any time. The cycle rarely runs longer than 35 to 45 days trough to trough.

Not only is it getting late in the cycle but multiple other signs are springing up suggesting this rally is starting to run on fumes. Sentiment is starting to skew extremely bullish (contrary indicator), there are signs that institutions are starting to take chips off the table, and breadth is deteriorating.

Next I want to call attention to the fact that the market made no attempt to test the Feb. 5th bottom. I’ve noted previously that there was also no test of the March ‘09 bottom or the last intermediate cycle low in July.

The Fed has literally flooded the world with liquidity (printed money) and that liquidity is pouring into the markets on every pullback. Apparently any test of the lows is out of the question in this hyper liquid environment.

Fundamentally, we have the setup necessary for a runaway move. These same ultra liquid conditions existed in `06 as the Fed went on a currency debasing spree to avoid a recession. It produced the runaway move shown in the above chart.

And I think we probably have the emotional conditions in place for a runaway move as well. Retail investors are still gun shy of this rally. If this does develop into a runaway move we will have a steady stream of retail money flooding back into the market as Joe Sixpack becomes convinced of the sustainability of the rally and fearful of missing the chance to recover his retirement.

Geez, what a recipe for catastrophe the Fed has created. When this very same liquidity unleashes the next crisis (most likely in the currency markets) it will release the return of the secular bear. Sad to say, investors 401K’s are going to get decimated again.

If all markets do enter a final runaway move, the S&P could rocket up to the 1300-1400 level in a matter of months. The euphoria from drinking that kind of Kool-Aid will intoxicate most investors and they will not notice the bear when he returns.

And return he will. It simply isn’t possible to create a sustainable long term bull market on a foundation of money printing. We already tried that approach last decade and the end result was one heck of a party followed by the second worst bear market in history.

We now have structural problems in the financial markets that are going to be with us for years if not decades.

The magnitude of liquidity spewing forth from the Fed dwarfs what Greenspan produced from 2000-2007.

Apparently the powers that be can’t figure out that it’s not the size of the dose that’s the problem; it’s that we are using the wrong medicine.

Now I want to see how the move down into the impending cycle low develops. The first correction back in late February dropped a little over 25 points. If the next correction declines somewhere around 25 to 40 points we will probably have a pretty good clue as to our correction size for the duration of any potential runaway move. (The theory would be for all corrections during the runaway move to fall in a range of 25 to 40 or so points)

Once we get past this correction and reset sentiment, one can probably buy just about any asset class, as I expect the flood of liquidity will flow into virtually everything.

But keep in mind, there are sectors that have been the clear leaders during this cyclical bull.

Of all assets gold was the first one to regain and then move above the `07 highs. As of today it’s still holding well above the previous high of $1025. A quick look at weekly volumes makes it crystal clear what smart money has been accumulating during this bull.

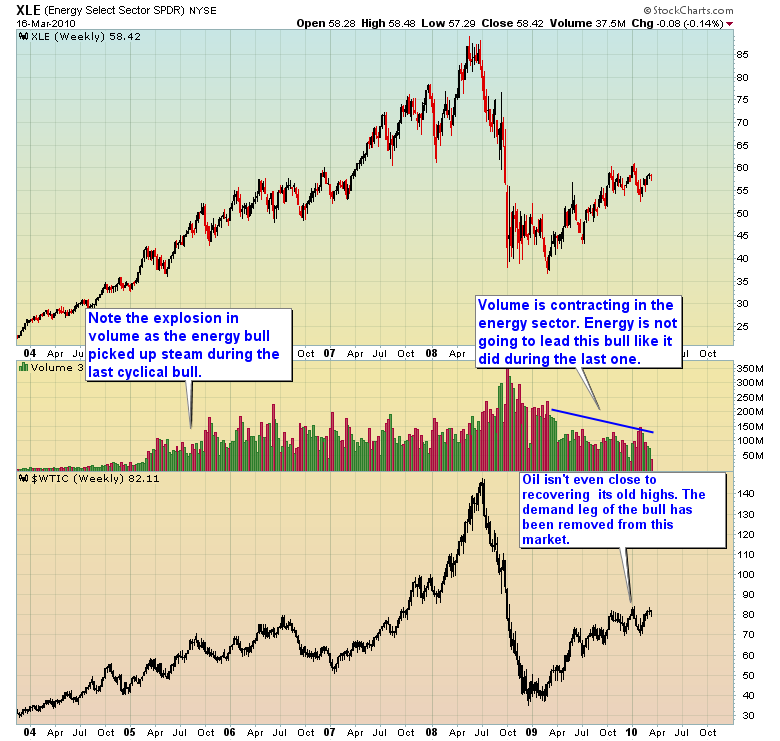

Despite the many energy bulls who would like to flock back into that sector, it’s readily apparent energy is not going to be the leader during this bull. (Rarely does the leader of the last bull lead the next one).

The world is going to be stuck in an on again, off again recession for many years. This sad reality has crippled one of the fundamental drivers of the energy bull, namely demand.

You can see in the chart above that volume is contracting in the energy sector. I expect this will continue as more and more investors come to realize that precious metals are the leaders of this phase of the commodity bull. We will likely continue to see volume leak out of the energy sector and flow into the precious metals as the secular gold bull progresses.

The key continues to be the dollar. Despite all the nonsense about how the dollar will continue to strengthen and that it’s the best of the global currencies, the fact remains that it’s simply not possible to print trillions of dollars out of thin air and have a strong currency.

It’s also not possible to rack up trillions and trillions of dollars of compounding debt and have a strong currency. Hey let’s face it, we don’t live in never, never land. Magic just doesn’t work in the real world.

I think the dollar is probably about to get smacked in the face by reality again.

Notice that despite a very strong rally over the last 4 months, the dollar still has been unable to move above the prior intermediate cycle top and now appears to be failing at the downward sloping 200 week moving average.

If the dollar is now ready to move down into the next intermediate cycle bottom (and I think it probably is) it is going to put a strong tailwind behind all assets. Maybe tailwind is too mild of an adjective. It’s probably going to be a hurricane driving everything willy nilly before it.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.