The Institutional Stock Market Index is Facing a Major Test Today

Stock-Markets / Stock Markets 2010 Mar 18, 2010 - 11:22 AM GMTBy: Marty_Chenard

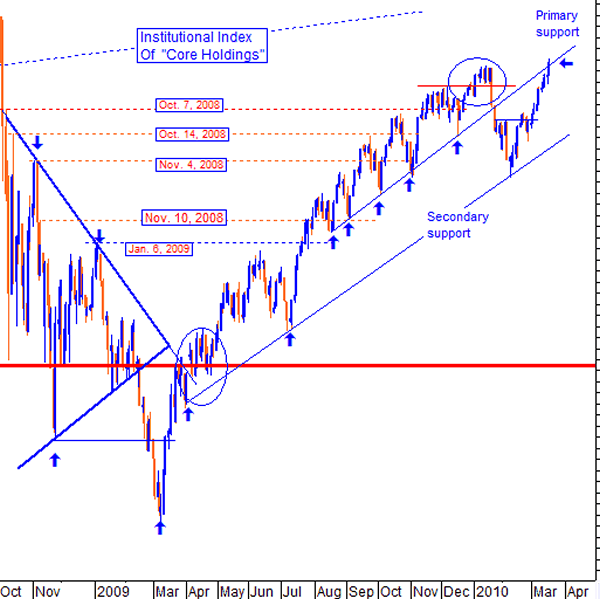

The Primary Support (now Resistance) Test is happening today ...

You all know how important the Institutional Index of "core holdings" is ... it is not really an index so it cannot be hedged, manipulated, or played with in any way. It is a pure representation of what the "core holdings" are doing relative to the market.

It has more accuracy relative to support and resistance lines, and more accuracy relative to Fibonacci studies. For example, on October 11th. 2007, the Institutional "core holdings" index hit an EXACT 61.8% Fibonacci retracement while the other indexes did not. That day marked the EXACT top of the market.

In April of 2009, the Institutional Index broke above its down trend and started its new Bull market as seen on the chart. During this course of time, two very clear and important support levels became apparent ... a Primary and a Secondary support level as seen below.

From April of 2009, everything was running pretty smooth until the Index fell below its support on January 22nd. The Index then dropped to the Secondary support on February 5th. where it held its support and the market moved up from there.

At the close yesterday, the Institutional Index closed slightly above the resistance coming from the Primary Resistance line.

That takes us to today, March 18th. 2010. It is now 11 AM, and the index is exactly at the same level as yesterday's close.

So what does this all mean? This is no ordinary day ... It means that the market is facing a Major (see Primary line) Resistance level test today. This challenge could last into Friday or Monday. In any event, this is a very important market juncture. (Realize that a close above the Primary line would have to withstand holding a test of that support.)

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.