Gordon Brown GOLD Sale Could Cost Labour the Election

ElectionOracle / UK General Election Mar 28, 2010 - 06:03 AM GMTBy: Shaily

The decision to sell Gold in 1999/2000 at rock bottom prices, was probably one of the worst mistakes by a supposedly sophisticated treasury, the Treasury team of UK. Mr Gordon Brown was the chancellor as he almost single handedly pummeeled his decision to sell Gold even with all the dissenting voice, almost giving an impression if there were other motives.

The decision to sell Gold in 1999/2000 at rock bottom prices, was probably one of the worst mistakes by a supposedly sophisticated treasury, the Treasury team of UK. Mr Gordon Brown was the chancellor as he almost single handedly pummeeled his decision to sell Gold even with all the dissenting voice, almost giving an impression if there were other motives.

A decade has past those dark days. And yet the ghost returns to haunt Mr. Brown, who incidentally is the PM now. Prize for mediocre performance may just be the route the downing street. And this was the country that ruled the world once.

The decsion to sell has cost the tax payer 7 billion pound!!!

It is slowly snowballing into an avalanche which could potentially bury Brown for ever in UK politics.

Telegraph quotes:

The sale is expected to be become a major election issue, casting light on Mr Brown’s decisions while at the Treasury.

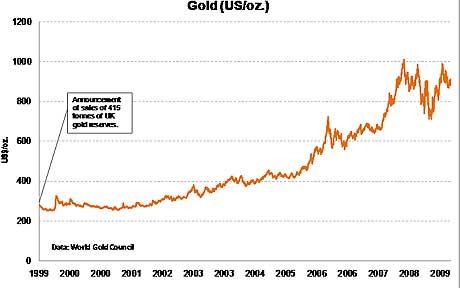

Between 1999 and 2002, Mr Brown ordered the sale of almost 400 tons of the gold reserves when the price was at a 20-year low. Since then, the price has more than quadrupled, meaning the decision cost taxpayers an estimated £7 billion, according to Mike Warburton of the accountants Grant Thornton.

It is understood that Mr Brown pushed ahead with the sale despite serious misgivings at the Bank of England. It is not thought that senior Bank experts were even consulted about the decision, which was driven through by a small group of senior Treasury aides close to Mr Brown.

At the time gold was trading around $282 an ounce. During the course of 17 auctions, between July 1999 and March 2002, the Treasury raised £2.2bn at an average price of $276.60 an ounce.

Why did Brown sell Gold? Who bought that Gold? Where is it today?

One needs to follow the trail of money to find out who and how they got hold of this money.

Brown answer “We sold to balance our investment portfolio” adds further speculation to his decision.

Mr Brown might find himself in probably the worst mire if the dirt on this comes out. And the way the media has latched on to this one, looks deadly dangerous for Brown, who for once might have a lot more to worry than his bottom.

Source: http://investingcontrarian.com/global/gold-sale-this-could-cost-brown-the-election/

Shaily

http://investingcontrarian.com/

Shaily is Editor at Investing Contrarian. She has over 5 year experience working with Hedge funds in derivatives.

© 2010 Copyright Shaily - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.