U.S. Unemployment Increasing Seasonal Adjustment Amplitude

Economics / US Economy Mar 31, 2010 - 02:34 PM GMTBy: Mike_Shedlock

My question is on the the increasing amplitude of BLS seasonal adjustments as noted in BLS Seasonal Adjustments Gone Haywire; 11% Unemployment Coming by May?

My question is on the the increasing amplitude of BLS seasonal adjustments as noted in BLS Seasonal Adjustments Gone Haywire; 11% Unemployment Coming by May?

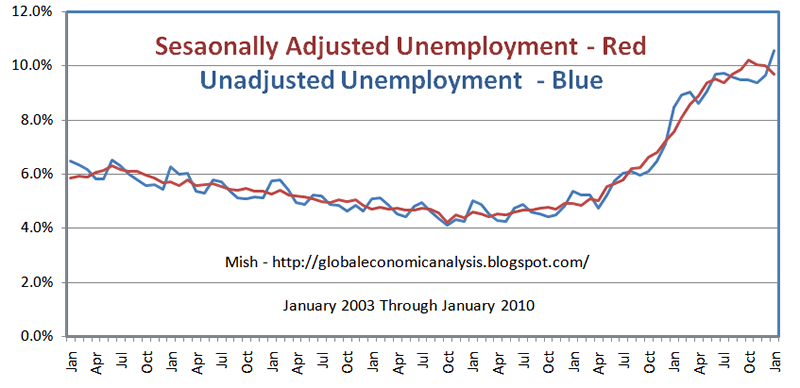

Seasonally Unadjusted Unemployment vs. Unadjusted Unemployment

The above chart shows how the BLS smoothes the unemployment rate to account for seasonal trends. It also give as hint as to an increasing magnitude of that smoothing.

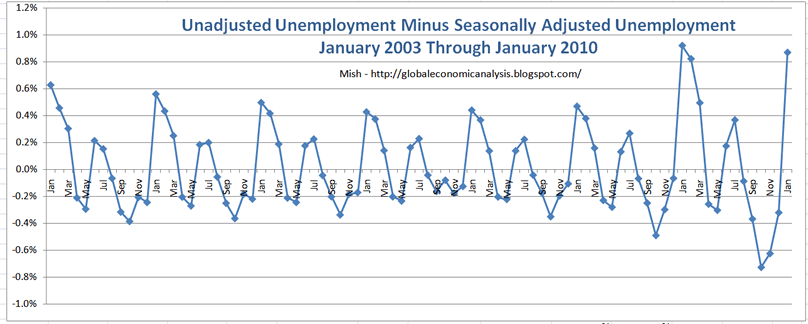

To highlight the month to month variances, I added a column to show the amplitude of the seasonal adjustments. The result is this chart.

Unadjusted Unemployment Minus Seasonally Adjusted Unemployment

Seasonal Adjustment Highlights

- There is always a big BLS adjustment in January

- There is always a reversion to the mean that overshoots to the downside between March and April

- There is always a secondary rebound back above the 0.0% line in July, followed by a smaller overshoot to the downside in October.

The BLS attempts to smooth trends in unemployment with seasonal adjustments but those swings have increasing amplitude for the last two years. One explanation I have heard is the BLS is assuming a normal population basis and applies seasonality to that.

If so, I believe their methodology is distorted by the fact there are 14.9 million unemployed. One should not assume the same seasonal bounce with so many out of work permanently.

Without an explanation from the BLS though, we are guessing at the cause.

Even without the increasing amplitude, the pattern shows the BLS overcompensates in January (understating unemployment by approximately .5% most years), with understatement on unemployment in 2009 by nearly 1%, and the same this year as well (although census reporting may distort 2010).

While we cannot expect seasonal adjustments to be perfect, we should not see what appears to be the same cyclical over-corrections year in and year out in exactly the same months. If the BLS has an explanation for this, I will post it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.