The U.S. Jobs Report, Stock Market Rally or Finale?

Stock-Markets / Stock Markets 2010 Apr 02, 2010 - 02:16 AM GMTBy: Steven_Vincent

BullBear Trading Service members have been following my charts and posts as we approached the US Non-Farm Payrolls report to be issued on Friday morning. It seems as though the entire future of the market is pending on this single news item. This is, of course, known to be an economic release which tends to move the markets. Or does it?

BullBear Trading Service members have been following my charts and posts as we approached the US Non-Farm Payrolls report to be issued on Friday morning. It seems as though the entire future of the market is pending on this single news item. This is, of course, known to be an economic release which tends to move the markets. Or does it?

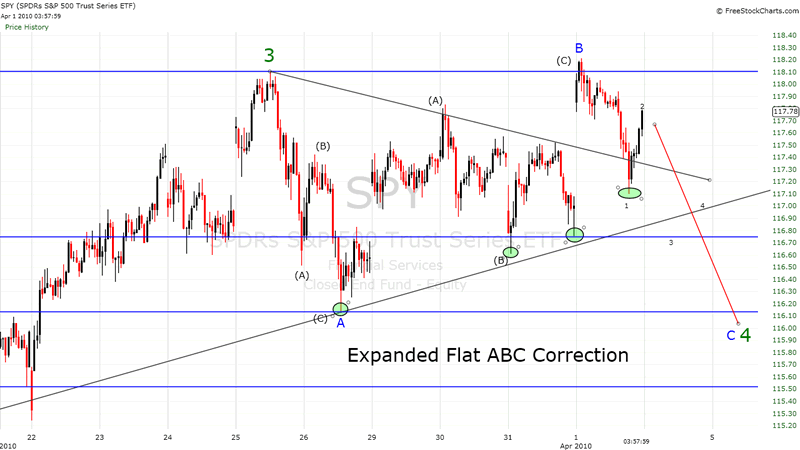

In expanded flats, wave B of the 3-3-5 pattern terminates beyond the starting level of wave A, and wave C ends more substantially beyond the ending level of wave A.

My guess is that, regardless of the news, the market is still a tad top heavy with sellers who want to take profits (and shorts who are ...well...anxious more pain) and so the inital reaction will be a sell off to support. I expect buyers to take the other side of that reaction and bid the market higher. An intraday upside reversal is possible, or it could take a few days. I view this as the stronger possibility of the two presented here.

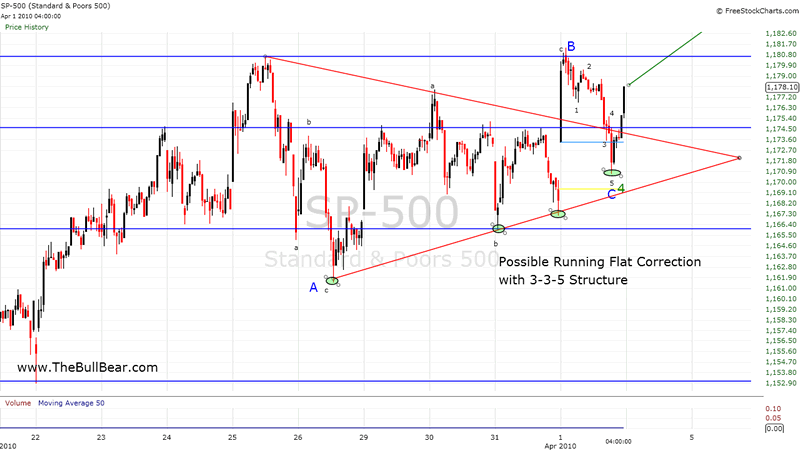

In a rare variation on the 3-3-5 pattern, which we call a running flat, wave B terminates well beyond the beginning of wave A as in an expanded flat, but wave C fails to travel its full distance, falling short of the level at which wave A ended. Apparently in this case, the forces in the direction of the larger trend are so powerful that the pattern becomes skewed in that direction. It is always important, but particularly when concluding that a running flat has taken place, that the internal subdivisions adhere to Elliott's rules. If the supposed B wave, for instance, breaks down into five waves rather than three, it is more likely the first wave up of the impulse of next higher degree. The power of adjacent impulse waves is important in recognizing running corrections, which tend to occur only in strong and fast markets. We must issue a warning, however. There are hardly any examples of this type of correction in the price record. Never label a correction prematurely this way, or you'll find yourself wrong nine times out of ten.

I offer this primarily because if it fulfills it will mean that we may have an extended wave 5. The underlying condition of the market may be one of bear and sideline money capitulation and we may see undignified chasing of prices higher for a good period of time and a significant distance on the chart. An running flat correction can and often will lead to a blowoff top to a wave 5 of 5. The setup is there on the chart. Will it complete? If it does, shorting the market should be banished from your mind until Wave 5 is complete and all the bullish impulse is exhausted. That said, I think it is the less likely to fulfill of the two scenarios. The five wave structure of the ending C wave is iffy and could need a few days of work.

Or the whole thing could just roll over and collapse into ruins. I see no evidence of that, but heck, stuff happens.

Generally these reports as well as twice weekly video reports are prepared for BullBear Trading Service members and then released to the general public on a time delayed basis. To get immediate access just become a member. It's easy and currently free of charge.

Disclosure: No current positions.

By Steve Vincent

The BullBear is the social network for market traders and investors. Here you will find a wide range of tools to discuss, debate, blog, post, chat and otherwise communicate with others who share your interest in the markets.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.