Gold and Silver Price Manipulation, The world Largest Fraud, 5.5 Trillion?

Commodities / Market Manipulation Apr 04, 2010 - 12:09 PM GMTBy: Fresbee

The Gold and Silver Manipulation spanning decades (going back well back into 1980s) has now taken mammoth proportions, one that could bankrupt not just a few banks but entire countries along with their central banks. Prime in this network are the Bank of England and the FED reserve who have been caught on the wrong side.

The Gold and Silver Manipulation spanning decades (going back well back into 1980s) has now taken mammoth proportions, one that could bankrupt not just a few banks but entire countries along with their central banks. Prime in this network are the Bank of England and the FED reserve who have been caught on the wrong side.

In an age of technology, Truth has started to take its stand against the mammoth cartel of the spider web of giant Investment Banks and Dealer Networks who are fronts for the governments and shadowy agencies (Rothschilds and the likes) whom they represent. Truth shall win and they better know this for their own sake.

Hitler spoke proudly about Gold manipulation “Gold is a state policy” meaning anyone found holding Gold will be punished. It is almost as if we are living in Hitler market in the precious metals pit.

For the first time now, the CFTC (The regulator) has a whistle blower testimony to make a legal move against the cartel of JPM and other trader network. In an incredible audio interview, the London based former Metals trader, Andrew Maguire, chronicled the silver manipulation, Trade by Trade in his running commentary to CFTC. This testimony is being ignored and being pushed under the carpet. Am yet to see main stream coverage of this mammoth fraud clinically and brilliantly uncovered by Andre Maguire, who is now a marked man for the cartel. He already has been involved in a Hit and Run case where a speeding car almost took him down. What is even more interesting, the driver has been caught and yet his testimony is still not being published. Why did he do it? Who paid him to do it? None of the details have emerged.

But for those who are on the Internet and can help in letting this be know to all, this is that interview and must be downloaded and kept for records. No one knows when the King Wold News website will be taken down which brought us this interview with Andrew and Adrian. We have already had one extraordinary attack on the website couple of days back through a coordinated DOS attack.

King World News today received more detail about yesterday’s attack on its Internet site, which happened soon after the posting of Eric King’s half-hour interview with GATA Chairman Bill Murphy, board member Adrian Douglas, and your secretary/treasurer about last week’s hearing of the U.S. Commodity Futures Trading Commission.

The major Internet hosting company that maintains the King World News site reported to King World News: “Your hosting account is the target of a distributed denial of service attack. To protect the network resources, we have temporarily placed your Web site behind a network filter. Once the attack has ended, service will be restored to normal. … Computers were attacking your account.”

Those who have not heard the interview of Andrw Maguire, please do listen to this bombshell and make your judgement on why it is not being given the importance in US justice department. This man while guilty along with the others had the nerve to stand up to the cartel.

The century biggest Fraud revealed

At a point within the interview Adrian Douglas makes the point that the Gold Market in LBMA (London Metals Exchange) is to the tune of $5.5 Trillion. And that is Gold contracts cleared only in London. Imagine COMEX when added to those volumes. We are talking of a market which is more than the economy of China and nearly 60% of US economy.

That market was closer to a few Billions in 1997 as noted by this article published in FT.

Literally at the crack of London dawn on January 30, 1997, the London Financial Times printed the following:

Deals involving about 30 million troy ounces, or 930 tonnes, of gold valued at more than $10 billion are cleared every working day in London, the international settlement centre for gold bullion.

This is the first authoritative indication of the size of the global gold market, and was revealed yesterday by the London Bullion Market Association.

With the blessing of the Bank of England, the association overturned years of tradition and secrecy to provide statistics illustrating the size and depth of the London market.

The volume of gold cleared every day in London represented nearly twice the production from South African mines in a year, Mr. Alan Baker, chairman of the association, pointed out.

It was also equivalent to the amount of gold held in the reserves of European Union central banks.

The size of the gold market will surprise many observers, but traders insisted the association’s statistics were only part of the picture because matched orders are cleared without appearing in the statistics. Mr. Jeffrey Rhodes, of Standard Bank, London, said the 30m ounces should be “multiplied by three, and possibly five, to give the full scope of the global market”.

Mr. Baker said the association would produce average daily clearance figures every month. “They will provide a useful benchmark for comparison and analysis of trends in the volume of the global bullion business,” he predicted.

He denied suggestions that the move might drive business away from London by upsetting clients who preferred secrecy. “These figures do not in any way affect the confidentiality of the market. While discretion and integrity will always be bywords in the London bullion market, the LBMA is nevertheless conscious of the general call for greater transparency in markets.

“The statistics demonstrate the prominence of London in the world of bullion, something we have long been aware of but which until now has been difficult to demonstrate with statistics.”

LBMA members were divided over the move. One said he was puzzled. “What will people make of it?” Another said the exercise was “futile” because it did not give a complete picture of bullion market activity.

But Standard Bank’s Mr. Rhodes suggested the statistics would “become the key indicator in the world of gold, providing the numbers by which the market can be monitored”.

Mr. Martin Stokes, vice-chairman of the association, said: “This shows we have a serious market with a lot of depth and deserving of more attention.” The statistics showed, for example, that the 300 tonnes of gold sold recently by the Dutch central bank – a disposal that badly affected bullion market sentiment – was not a large amount by the market’s standards. The association was “making a bid to attract investors’ interest”.

The association also gave details yesterday about the silver market. Roughly 250 million ounces of silver valued at more than $1 billion are cleared daily in London.

It also published the results of a Bank of England survey of turnover that the 14 market-making members of the LBMA in the London bullion market conducted in May last year. This showed about 7 million ounces of gold, worth nearly $3 billion, was traded daily by these market-makers.

The important point note is that the market is not made of Physical Gold but paper contracts exchanged in the form of Futures trades. This gives us the illusion of Price discovery and allows the players in the market to control and manipulate Gold and Silver Prices at will.

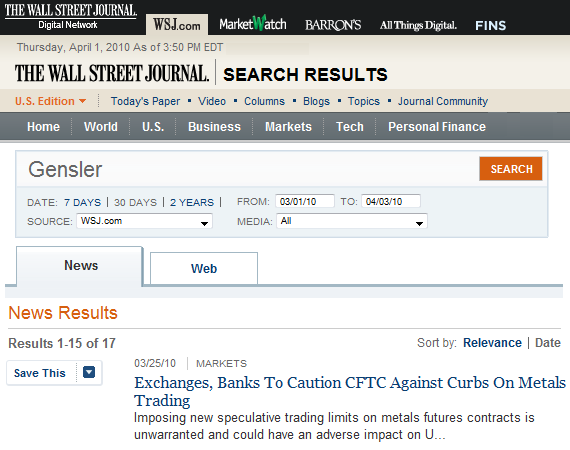

The recent hearing at CFTC were already under scrutiny of the cartel as this rather innocuous headline in Wall Street Journal indicates

The article continues its rant which can make one angry at even the language being used to describe the ones aho are trying to bring justice to this dark and ill understood market:

One of the staunchest believers in the allegations of gold manipulation—the chairman of the Gold Anti-Trust Action Committee—will testify as well.

But others, including the CME’s Mr. LaSala and John J. Lothian, a commodity trading advisor, futures broker and the head of a well-known markets newsletter, will urge the CFTC not to pay attention to arguments that there has been manipulation.

“Those who believe gold and silver markets are manipulated to keep prices low are nothing more than politically opportunistic rent seekers in my book,” Mr. Lothian planned to say. “They are parasites on the body public profiting from selling fear and seeking political change that will benefit their world view and related market position.”

The CFTC called in a hearing n march 25 2010 post Andrew Testimony, which was to be live cast. Now, there were more than a few strange going ons at the hearing, one of which was that the video feed went dead just as Bill Murphy was about to detail the Maguire story for the CFTC. Here’s the video (that no one was able to see at the time) in which Murphy details Maguire’s charges that massive short positions by HSBC and JP Morgan aimed out flushing out longs occur regularly and predictably, in a coordinated fashion.

Let me address the cartel if ever they come across my writing: Truth will come out. Your days are counted. You will be taken down.

Every reader of this should make your own judgments on the sequence of extra ordinary events that have occurred from Jan 2010 to March 2010 including the Andre Maguire Testimony, his near Death, CFTC hearing going blank at critical times, and most importantly the forced ignorance of this mammoth Fraud which is being ignored by Main Stream even to the point of not having the desire to look one level deeper into all the Mire and dirt in the Precious metal markets.

Source: http://www.investingcontrarian.com/global/the-world-largest-fraud-5-5-trillion-time-you-stood-up/

Fresbee

http://investingcontrarian.com/

Fresbee is Editor at Investing Contrarian. He has over 5 year experience working with a leading Hedge fund and Private Equity fund based out of Zurich. He now writes for Investing Contrarian analyzing the emerging new world order.

© 2010 Copyright Fresbee - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.