Stocks Bucking Bronco Market

Stock-Markets / Stock Markets 2010 Apr 05, 2010 - 04:13 AM GMTBy: PhilStockWorld

What a crazy week!

What a crazy week!

The markets were bucking like a bronco but were they trying to throw off the shorts prior to a move back down or trying to flush out the weak-handed longs prior to a big breakout to new levels? After gapping open to 10,900 on Monday morning we went up to 10,950, down to 10,830 and back to 10,950 - all to finish the week at 10,927, which is up 39 points since March 23rd so don’t tell me we’re wasting out time as that’s 5 points a day baby (if we round up).

We had the day off on Friday but we did get the critical Non-Farm Payroll data for March but, as noted in my report (and in the Member Chat), despite the very excited reaction from the futures, there is no clear indication there that either the Bulls or Bears have a lasting point. So perhaps the wild market action is nothing more than good old-fashioned indecision - the futures flew up but then Goldman said they saw "Little Underlying Improvement" in the data and that "Productivity Gains Have Diminished Sharply" - clearly mixed signals that may take some time to resolve.

Last weekend, I complained that it was a "6-Point Weekly Wrap-Up" as that’s all we got from the S&P, which finished at 1,166. This week I am happy to report that we gained 12 points - all the way to 1,178 and we are closing in on that 1,080 mark, which we did touch briefly at Thursday’s open (which gave us the great shorting opportunity we had looked for in Thursday morning’s post!). It’s not that I don’t respect the rally - technically, you have to respect the rally but that’s why we’re in cash: We can take advantage of these huge intra-day moves down (and sometimes up) - getting our 6-second bull rides and scoring as many points as we can before the rodeo clowns turn on the buy programs and stop the ride.

Overall, it’s a pretty mindless market. You can go long at about 2pm and flip short about 10 am the next morning - in the futures that can add up to shocking amounts of money and it sure isn’t bad when you are using options for leverage either. We’re sure the game will collapse one day and hopefully we’ll be able to pull the rip cord without making too much damage but, as you can see from our plays - once we make more than 5 plays that make 20% or more - we literally have nothing to lose!

Wow - what a ride, right? When you consider that Dow Futures pay $5 per point, per contract and that we can reliably pick up 20% gains on the DIA option contracts on moves of 50 points or more it’s no wonder the rich get richer in this country - just imagine what Goldman Sachs, who are making 50% of these trades and can time their entries and exits to perfection, must be making on this crazy action. We’ll find out on April 20th but estimates are already pushing over $4 per share - up 15% from last year’s record pace and roughly $2Bn for the quarter. Oh and keep in mind that that is NET to the bottom line - roughly 1/2 of GS’s trading profits go out as salaries and bonuses to the traders.

In fact, GS made so much money last year ($45Bn in gross profit) while doing virtually NO M&A work (which is how they usually make money) that the CTFC is finally looking into this nonsense because, as the Washington Post says: "No company has benefited more than Goldman Sachs, market analysts say. During the financial crisis, when most of the firm’s other business activities were suffering, commodities trading produced "particularly strong results," according to its annual report. Goldman does not disclose how much it earned from these trades. But along with its bonds and currency divisions, commodities activities generated about half of its net revenue of $45 billion in 2009, Goldman reported. Financial analysts estimated that these activities in typical years account for about a tenth of the firm’s revenue."

Anyway, this is the Wrap-Up so we aren’t here to complain about GS manipulating the markets and making obscene profits. Our job is simply to identify HOW they make their obscene profits and play along at home and our Super-Secret Buy at 2pm and Sell at 10 am Strategy is one way to follow Goldman’s trade-bots until they shift the pattern again. Of course, we won’t make as much as Goldman because we can’t borrow tens of Billions of Dollars at 0.25% to play the markets with like the can even though (and it’s a funny thing) WE are the ones subsidizing the lending rate to THEM!

So it’s only fitting that we play along with our friends at GS, JPM, MS etc. - as I often say to members: "We don’t care IF the game is rigged - as long as we understand how it’s rigged so we can make the right bets." Sure it’s cynical, but it works! So far, cashing out at S&P 1,166 on March 19th has worked for us. We made plenty of good plays last week with just 4 misses out of 35 trade ideas. Of our misses from last week: AMZN Apr $135 calls were sold for $3.60 last Thursday and hit $3.80 at Friday’s close (down 5.5%) but are now down to $1.65 (up 54%) so we’ll change that status to winner. TNA $56 calls were closed down 3%, so no saving those and a good thing too as they are lower now. SPWRA May $18 puts were sold for $1.35 and finished last week at $1.45 for a .10 loss but are now down to $1.05 for a nice 22% gain and our other loss was a closed one on the oil futures, but we play those almost daily so we got right back on that horse. This week, as I said, was fairly dull:

We had a fabulous week of trading last week (as detailed in the Wrap-Up) so we’re not looking to spoil it by deploying our cash ahead of the holiday weekend but that won’t stop us from taking a few opportunities when they present themselves. Still, overall we’re having fun watching the shenanigans and we’ll see if it’s enough to get to that magical 11,000 mark. With the low volume we expect this week it will be very sad for the bulls if they can’t pull it off.

- Oil futures short at $82.50, out at $82.10 - up $10 per penny per contract

- Oil futures short at $82.50, out at $82.10 - up $10 per penny per contract

- ARNA complex spread - on target

On Tuesday,

We looked at the CPI and the hidden inflation that is being held down by the Owners Equivalent Rent calculation as well as the usual nonsense from the ratings agencies and we had Liz Warren’s dire warning that by the end of 2010 (this year--for those of you keeping track), about HALF of all Commercial Real Estate mortgages will be underwater. LNR property was my prime example of how fast things are falling apart and NYC commercial properties are suffering and even the Case-Shiller Report wasn’t very encouraging.

Wednesday’s Worry - World Wide Cash Crunch

I don’t wake up every morning looking for bearish news - I read everything and try to talk about the things I think are most relevant to the markets that day. Wednesday I saw debt bubbling up to the top of the news flow and I won’t even get back into it here as it’s just sooooo depressing--even Richard Fisher seemed depressed and was moved to warn us that "Even under the most optimistic of scenarios, large deficits will be run for as far as the eye can see." So I called it right that morning and we held bearish under the crush of bad news despite our general belief that there would be an attempt to run us back to 11,000 on the Dow.

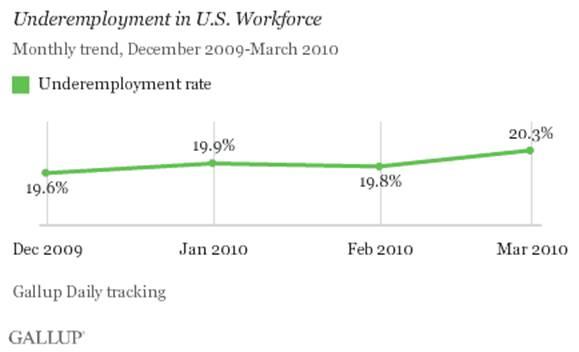

The chart on the right really bothers me but it doesn’t seem to worry the MSM. Of course, the funny thing about the MSM is - they all have jobs! So do the people they interview and those people spend a good portion of their lives flying around the country, sitting in business class seats next to people who have jobs and staying in hotel rooms with people who are generally there for their jobs so, when you ask them what they think of the economy, it’s not too surprising that they tell you have great everything looks to them, is it?

My take on the Jobs report is in the Friday post and another major "green shoot" you’ll be hearing about this weekend is the rise in state tax receipts, which are up 3.5% this year, which would be wonderful news but they are still down 10% from 2008 and, of course, 90% of that 3.9% recover is coming from capital gains etc. from the top 10% and corporations. State budget gaps are still over $200Bn in 2010 and projected at $180Bn in 2011 and $120Bn in 2012 - providing things stay as "wonderful" as they are. Revenues are projected to possibly return to 2008 levels in 2013 so, as long as they keep costs down, everything should be just peachy.

Of course the markets didn’t want to wait and they are back to 2008 levels already, 3 years ahead of the actual economy - Man, that’s what I call a FORWARD-LOOKING mechanism! If all this seems a little crazy to you - then perhaps you understand our concerns…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.