Stocks Valuations and Market Psychology, Greed is the Winner, Fear is Waiting

Stock-Markets / Stock Markets 2010 Apr 06, 2010 - 12:14 AM GMTBy: Shaily

One of the best newsletters that I have read recently is the Greed and Fear, edited by Chris Wood. Remarkable for its clarity and yet leaving enough material for the analyst to make his own calls.

One of the best newsletters that I have read recently is the Greed and Fear, edited by Chris Wood. Remarkable for its clarity and yet leaving enough material for the analyst to make his own calls.

When you meet people around the world and see them change their views from that of extreme fear to extreme greed and euphoria, you have an important contrarian criteria to judge the market direction and more often than not, it beats the technical indicators. As US released its latest Jobs numbers of 163k new job addition, I was surprised at the speed with which some blogs have gone ballistic over the future US growth and the case of US dollar to touch levels like 90 and 95 and yen to decline to levels like 150 (am not joking. A very respected hedge fund trader who nearly lost his shirts last time markets crashed is now betting for the US dollar to reach out into stratosphere. Time to be vary?)

Presented are a few thoughts of mine juxtaposed along side Chris’s (CLSA) view, which coincidently match on almost all parameters.

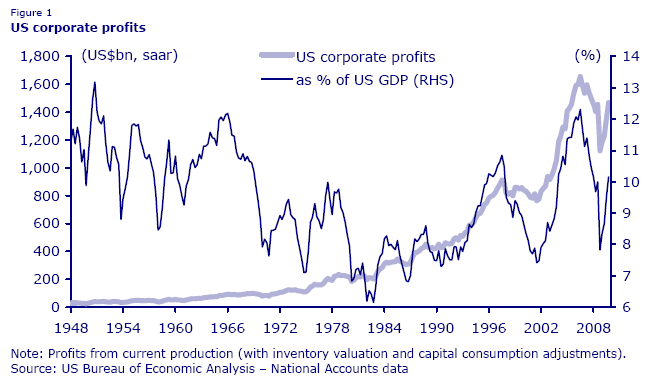

In the context of US, CLSA estimates a rapid, albeit short lived, upswing in the American economy and one which has been significantly discounted by the stock market. The upswing is being driven by capex which is being funded by a corporate sector which has abundant cash flow and which has seen a big pick up in profits from the recent low. Thus, according to the latest national accounts statistics, US aggregate corporate profits increased by US$108.7bn or 8% QoQ to an annualised US$1.47tn in 4Q09 and are up 30.6% from the low reached in 4Q08. As a result, the US corporate profits to GDP ratio rose from 7.8% in 4Q08 to 10.2% in 4Q09 the upswing is being driven by capex which is being funded by a corporatesector which has abundant cash flow and which has seen a big pick up in profits from therecent low. Thus, according to the latest national accounts statistics, US aggregate corporateprofits increased by US$108.7bn or 8% QoQ to an annualised US$1.47tn in 4Q09 and are up30.6% from the low reached in 4Q08. As a result, the US corporate profits to GDP ratio rosefrom 7.8% in 4Q08 to 10.2% in 4Q09.

US Corporate Profits

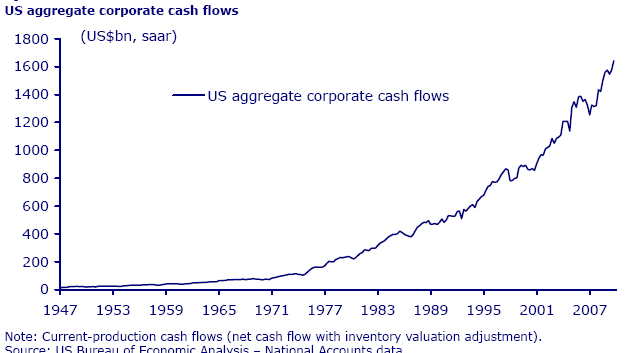

US Corporate Cash Flows

In keeping with the rapid rise of profitability of US corporates, aggregate corporate cashflow increased by US$69.1bn or 4.4% QoQ to a record annualised US$1.64tn in 4Q09

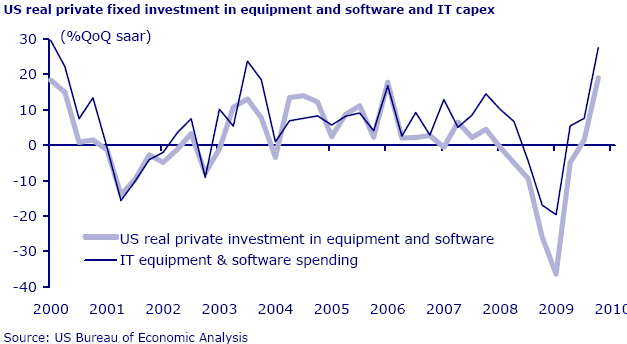

US Private Investments has been led by IT investments

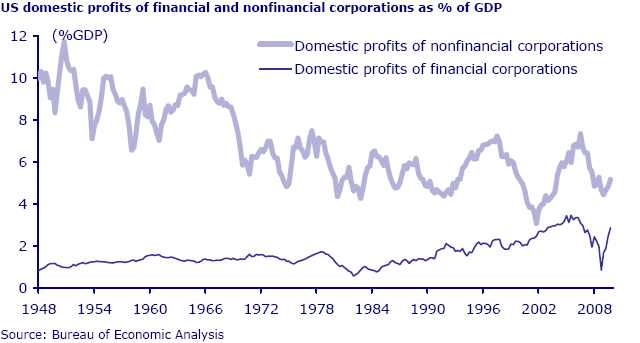

So far the pick up in capex has been dominated by the financial services sector spending on IT related investments. IT capex accounted for 88% of the quarterly expansion in US equipment and software spending in 4Q09. This makes sense since the financial sector, courtesy largely of federal government bailouts and related Federal Reserve largesse, has accounted for an extraordinary 79% of the increase in domestic corporate profits from the bottom reached in 4Q08. Thus, domestic profits of financial corporations rose by US$292bn or 240% from an annualised US$122bn in 4Q08 to US$414bn in 4Q09. By contrast, domestic profits of non financial corporations increased by only US$77bn or 12% to US$746bn over the same period.

Given these fundamentals, CLSA estimates that US economy to grow by 4% in 2010 while a shade under 1% in 2011/12 which will spell disaster for US.

While economists are in euphoric and unprecedented delight over the Jobs number last friday (Job addition of 162k+), we believe the numbers will get even better. Wait till you see numbers like 500+ job addition. And yet we see this as nothing more than an anomaly in a larger trend of consumer de leveraging. Just cause Jobs are getting created courtesy Government and Private part time workers, does not mean consumers will get back to re leveraging and consuming as before. US economy is a zombie without leverage and consumption. Even if the 6 million unemployed Americans get redeployed in the economy (assuming that for a moment no matter how impossible it may sound), it is the leverage in the system that is leading the economy down hill. Consumers will take more than 5 years to come back to leverage themselves as seen 2004, 2005. In other words it will be years before we see consumer equity reaching levels of 2004 and 2005.

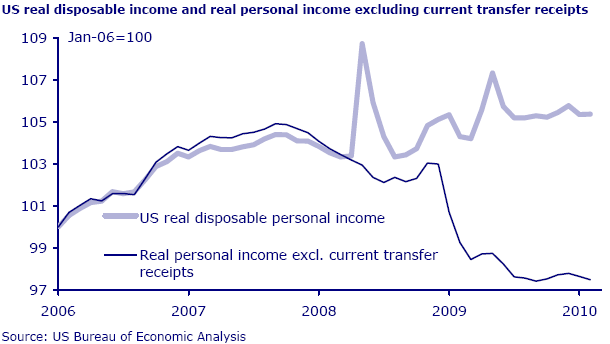

US Disposable Income has fallen 6% ( exc Transfer payments)

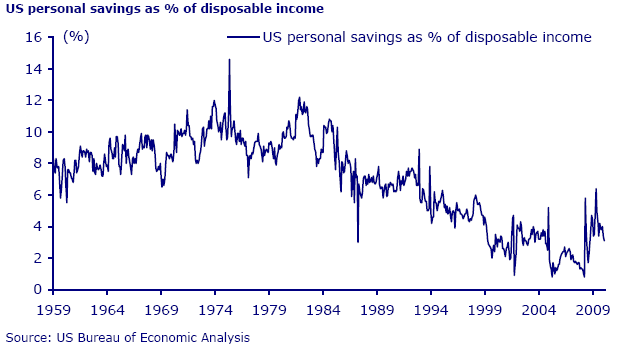

The problem about the recent pick up in US consumption remains the ability to sustain such a rise in consumption when the increase in disposable income is being driven by transfer payments and not by income growth. Thus, US real personal consumption rose by 0.3% MoM in February and is up 2.3% from the bottom reached in December 2008. While real US disposable personal income is up 1.8% over the past two years. By contrast, real personal income excluding current transfer receipts fell by 0.2% MoM in February and is down 6.0% over the past two years (see Figure 5). This is why the personal savings rate has declined from 6.4% of disposable income in May 2009 to 3.1% in February 2010 US Personal Savings.

If we may now for a moment look at Asia (China and India), the analysis is far more straightforward. Consumption here is led by real wag growth (net off inflation). In other words the Asian model of growth is one off wage growth leading to real economic growth while the west has grown on the back of unsustainable leverage growth whose leverage service costs has now started to take a toll on the economy even without the FED realizing it. (If they understood this concept they would not have loaded on more debt in the wake of a natural de leveraging cycle in 2009. If the cycle had been led to complete which would led to the death of large number of faulty business models including Investment Banks with the resultant unemployment costs rising to 13-14%, it would definitely have afforded the US a chance to repair the economy and adjust its economy to a more balanced growth in the coming years with some intermediate pain of adjustment. Right now the alternate path of re leverage has left the consumer completely helpless and debt service cost going to bankrupt the economy by 2012. Even with a 1 million new jobs, nothing in the economy will change as US consumers have no equity left to re leverage. There is no way out as we see it. US needs a real growth of 6%(annual) to keep just debt service costs at bay while they need far more than that to even come back to “prosperity” and build its “equity base”)

Coming back to China and India…..

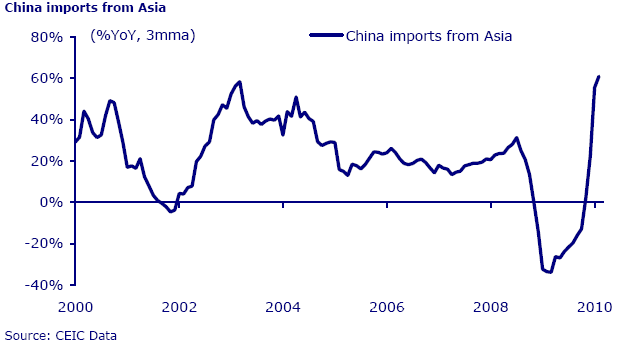

China Imports from Asia

The Guangdong provincial government announced recently that it will raise the minimum wage by 21% on average for both corporate employees and part-time workers beginning 1 May, should give you a flavor of the impending wage growth that lies in wait for the future growth of Asia.

It remains the case that for Asian markets to really perform China needs to join the party; most particularly as the major stimulus for most Asian economies of late has been import demand from China. Thus, China’s imports from Asia rose by 64% YoY in the first two months of this year to US$108bn. Indeed the strength of its import demand, and the possible resulting trade deficit in March, has allowed China to argue of late that it is not just a dumper of exports.

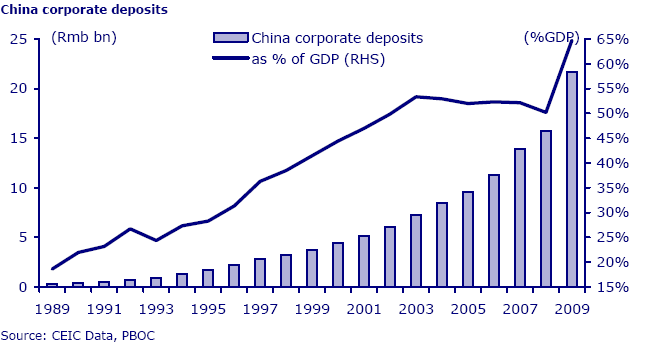

China Corporate Deposits

There is no doubt that the quality of Chinese companies has improved dramatically since the mid 1990s as has their financials as reflected at the macroeconomic level in the explosion in corporate savings. Thus, corporate deposits rose by 37.7% YoY in 2009 to Rmb21.7tn or 65% of GDP, compared with Rmb861bn or 24% of GDP in 1993

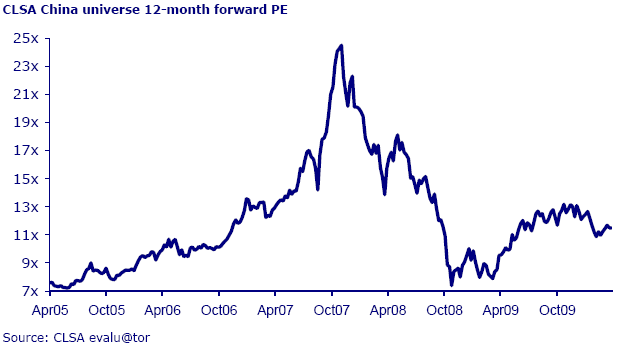

China 13 Month P/E

The CLSA China universe now trades on 13.4x 2010 forecast earnings and 11.7x 2011 earnings, assuming 21% and 16% earnings growth respectively. This compares with a peak forward PE of 24x reached in November 2007.

Here is the icing: If China lets currency appreciate, those corporate profits will look even bigger. Bless the ones who have seen this coming. Unfortunately, it is the devil (Goldman Sachs) himself, who seems to have seen this coming and has now made China its second home. If you ask Lloyd Blankfein about any crisis in the world, his unequivocal answer will include China.

•Will Greece default?

Lloyd Blankfein: “Oh BRIC is growing”

•US bond yields?

Lloyd Blankfein: “BRIC is growing”

•What about Inflation?

Lloyd Blankfein: “BRIC!!!”

Make a note of this next time you hear him speak.

But for the lesser mortals who are trying to make sense of the impending fall of the US, you may be dissapointed, as we believe there will be some stellar numbers out of the US and Timothy Geithner will use every opportunity to justify TARP and ask for more money from congress.

Source: http://www.investingcontrarian.com/global/greed-and-fear-greed-is-the-winner-fear-is-waiting/

Shaily

http://investingcontrarian.com/

Shaily is Editor at Investing Contrarian. She has over 5 year experience working with Hedge funds in derivatives.

© 2010 Copyright Shaily - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.