Euro Gold Rises to New Record High on Renewed Greek Concerns

Commodities / Gold and Silver 2010 Apr 06, 2010 - 06:39 AM GMTBy: GoldCore

Gold jumped to as high as $1,133/oz in New York before dropping slightly to close with a gain of 0.71% yesterday. It has since range traded from $1,124/oz to $1,130/oz in Asian trading this morning. Gold is currently trading at $1,125/oz and in euro and GBP terms, it is trading at €839/oz and £742/oz respectively. Gold priced in euros has risen to a new all-time high above €839 an ounce this morning due to renewed concerns about Greece's fiscal position (see News below).

Gold jumped to as high as $1,133/oz in New York before dropping slightly to close with a gain of 0.71% yesterday. It has since range traded from $1,124/oz to $1,130/oz in Asian trading this morning. Gold is currently trading at $1,125/oz and in euro and GBP terms, it is trading at €839/oz and £742/oz respectively. Gold priced in euros has risen to a new all-time high above €839 an ounce this morning due to renewed concerns about Greece's fiscal position (see News below).

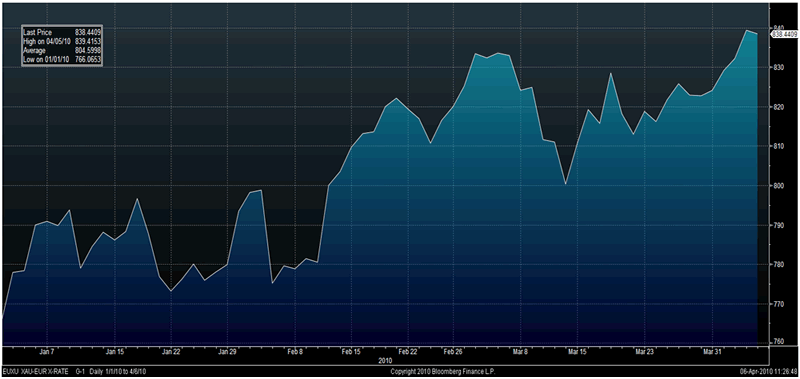

Gold in EUR (YTD)

After single digit returns for the first quarter, gold and silver gained almost 2% and 6% last week and continued their gains yesterday. Today has seen some profit taking with the dollar remaining firm and oil having given up some of its recent gains. However the recent gains seen in the commodity sector especially with oil over $86 a barrel and copper over $8,000 per metric ton will lead to inflation concerns and inflation hedging with gold.

Gordon Brown's election announcement and the prospects of a hung parliament will likely see sterling come under renewed pressure in the coming weeks and should see sterling gold rise to new record (nominal highs) near £760/oz - from £742/oz today.

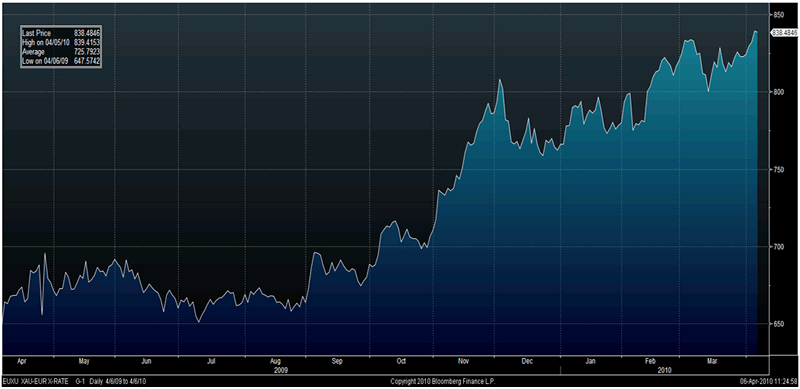

Gold in EUR (1 year)

Silver

Silver has range traded from $17.90/oz to $18.02/oz this morning in Asia. Silver is currently trading at $17.92/oz, €13.37/oz and £11.80/oz.

Platinum Group Metals

Platinum is trading at $1,695/oz and palladium is currently trading at $505/oz and rhodium at $2,600/oz.

News

Concerns about Greece have resurfaced amid a report that the country wants to amend a standby aid plan to avoid the imposition of onerous fiscal measures by the International Monetary Fund. The plan, formulated at a European Union summit last month, would see a combination of bilateral loans from eurozone countries and aid from the IMF if Athens is unable to meet its funding needs. Greek Prime Minister George Papandreou reportedly fears that added austerity measures that the IMF probably would require could cause social and political unrest. Papandreou reportedly wants to alter the plan to bypass an IMF contribution. Meanwhile, the Financial Times reported that Germany is at odds with other euro-zone countries over the interest rate on any bilateral loans that are offered to Greece under the plan. The Financial Times reports that Greece will target US investors with a dollar-denominated bond. Finance Minister George Papaconstantinou will lead a roadshow to the United States after April 20, but now no longer plans to travel to Asia.

Greece will this month launch a multi-billion-dollar bond in the US in its hunt for new investors, selling itself for the first time as an emerging market country as demand for its debt dwindles in Europe. This has implications for the euro as a global reserve currency and could lead to further pressure on the Euro.

UK Prime Minister Gordon Brown announced today that Britain will go to the polls on May 6, setting up a tight election battle over the UK's battered economy and soaring deficit that could result in political gridlock. Markets fear an election deadlock which could make it harder for whoever wins the election to push through the tough medicine the UK needs to confront a budget deficit that is the highest amongst major economies. It would also make king makers of parties such as the centrist Liberal Democrats and Northern Ireland's Democratic Unionist Party.

Australia's central bank has raised interest rates to 4.25% from 4% as it attempts to cool inflation and slow rises in house prices.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.