Stock Market Trend 2010, It's 2007 All Over Again!

Stock-Markets / Stock Markets 2010 Apr 12, 2010 - 03:17 PM GMTBy: Toby_Connor

Several weeks ago I speculated that we were "On the brink of an asset explosion" . So far events are unfolding about as expected. I might even say they are moving more aggressively than I thought. Well actually, there’s no doubt this cyclical bull is unfolding much more aggressively than anyone expected.

Several weeks ago I speculated that we were "On the brink of an asset explosion" . So far events are unfolding about as expected. I might even say they are moving more aggressively than I thought. Well actually, there’s no doubt this cyclical bull is unfolding much more aggressively than anyone expected.

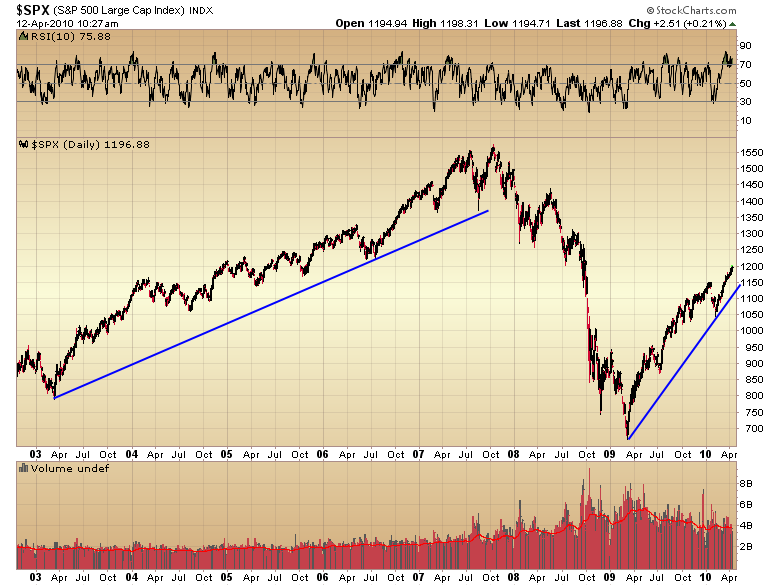

Compare the angle of assent of this cyclical bull to the last one.

It’s readily apparent what affect the trillions and trillions of dollars central banks have pumped into the system is having. I think Ben has clearly proved his point that in a purely fiat monetary system deflation is a choice, not an inevitability.

As long as a country is willing to sacrifice its currency there is no amount of deflationary pressure that can’t be printed away.

However, no amount of printing can erase the underlying problems. And those problems are going to persist until they are cleansed from the system. In his mad attempt to avoid the mistakes of the depression Bernanke is going to create a whole new type depression. This time the depression will materialize as a hyper-inflationary storm.

What the powers that be fail to understand is that we are going to suffer a depression that is unavoidable when a credit bubble forms and pops. All we are doing is choosing the form of the depression. In this case the memory of the deflationary depression in the 30’s has sent us down the other track into the beginnings of a hyperinflationary state.

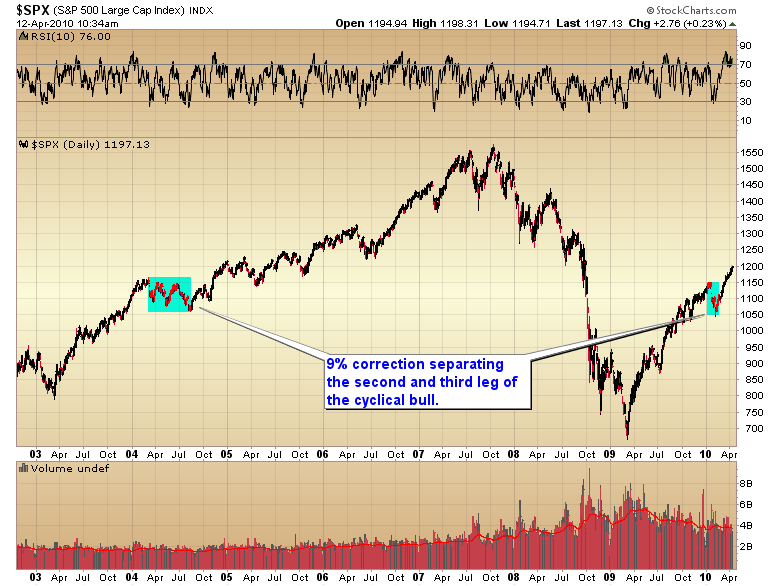

Going back to our charts you can see that the February correction separated the second leg of the bull from the third and almost exactly matched the `04 correction in magnitude if not in time. Remember everything is unfolding faster this time.

I think we have by passed the middle years (2004-2006) of a normal bull market and have now entered the final stages of this cyclical bull. I tend to think we are now in the same state as the runaway move in late 2006 and early 2007.

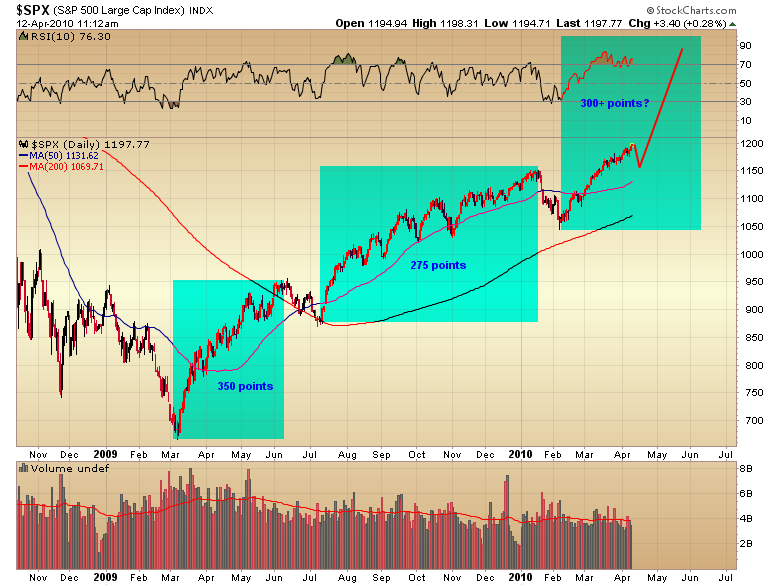

I don’t really expect this stage to last as long as it did during the last bull though. Everything else is unfolding much faster I don’t know why this stage won’t either. Ultimately these extreme momentum moves usually fail dramatically with a violent correction that gives back several weeks or months worth of gains in just a handful of days. I’m expecting some kind of mini-crash (4-6%) at some point during earnings season.

Once that correction has run its course we should enter the final parabolic stage of the bull. That’s when I expect we will really see asset prices explode higher.

The first two legs of this bull gained 300 and 275 points respectively. I wouldn’t be surprised if the last leg gains another 300+ points before the whole house of cards comes crashing back down.

And what is going to bring it down? The same thing that destroyed the economy in 2008 …oil!

Without exception, every time oil spikes 100% or more within a short period of time (one year or less) it has eventually led to a recession. Well Bernanke’s insane monetary policy has virtually guaranteed that will play out again as oil has now risen over 140% since this cyclical bull began.

Amazingly enough oil has done this in a very low demand/high supply environment. This fact could only be true if the cause for oil’s rise in price is directly attributed to the Fed’s monetary policy.

Once the market corrects I think we can back up the truck in virtually any asset class for the final parabolic move as the Fed completely loses control of money supply. We just need to keep in mind this will be an end game not the beginning of a new secular bull.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

sourav paul

30 Jan 11, 01:45 |

about stock market

want to know wether the indian market will go downward or upward. |