Natural Gas Futures Support Potential for Long Term Reversal of “UNG”

Commodities / Natural Gas Apr 14, 2010 - 05:19 PM GMTBy: Richard_Gateway

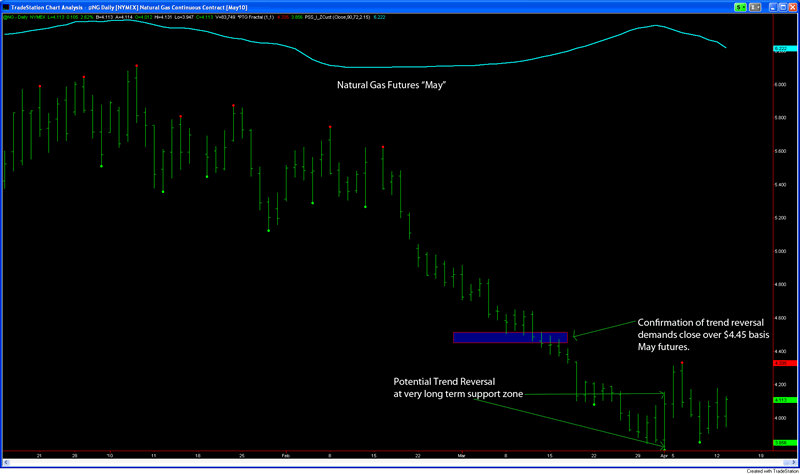

Several weeks ago autobottrading.com spoke of the natural gas sector and the possibility that a major trend change was potentially setting up for the commodity. Natural Gas futures had reached long term support, setting up a sector call similar to our encouragement to get long Crude when it was trading in the mid to high $30’s last year. We warned in the March 13th post, of the likelihood of a sharp spike lower into potential support at $3.75 and then the potential of a powerful trend changing reversal. On April 1st, May natural Gas had powerful rally which on the daily chart reflects the potency of the longest time series support we have mentioned over the last several weeks.

Several weeks ago autobottrading.com spoke of the natural gas sector and the possibility that a major trend change was potentially setting up for the commodity. Natural Gas futures had reached long term support, setting up a sector call similar to our encouragement to get long Crude when it was trading in the mid to high $30’s last year. We warned in the March 13th post, of the likelihood of a sharp spike lower into potential support at $3.75 and then the potential of a powerful trend changing reversal. On April 1st, May natural Gas had powerful rally which on the daily chart reflects the potency of the longest time series support we have mentioned over the last several weeks.

The six percent rally that day was a start to building cause for a major reversal in trend. The close over $4.26 on April 5th supports a long term trend change and would be confirmed on a close over $4.49 basis May. The price action today, April 13th is bullish, and may lead to the higher prices needed to confirm a trend change in this commodity.

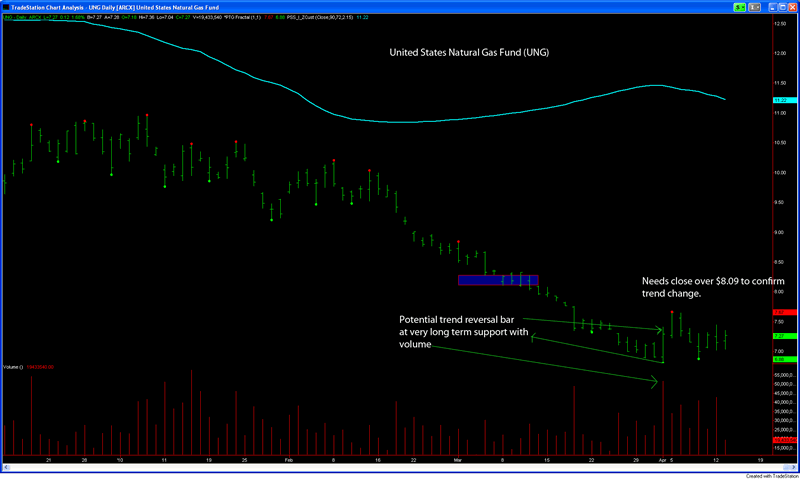

The Bullish engulfing daily bar shown in the chart of (UNG) below along with strong volume was potent. But even more so as it arose from very long term support in the futures market. The deep pullback since April 1st is not a problem for bulls. But prior to entering this ETF, waiting for trade over $4.45 basis May Natural Gas to confirm the change of trend would be wise or the equivalent of $8.09 on “UNG.” We caution against long term investors prematurely entering this market. There is no need, as the rewards in catching this move are likely to be large, even if one waits on the confirmations posted above. A move over $8.09 should reach $11.24, $12.26 and $13.29 in time. Downside risk is a close under $6.80. See chart of (UNG) below for details.

Though (UNL) trades significantly less volume on a daily basis than (UNG) some investors may wish to have a more direct investment in the underlying commodity with less volatility induced by rolling into front month contracts or issues which reduce it’s value when “contango” conditions occur in the futures market. We would encourage investors in (UNL) to use the front month Natural Gas futures pricing to guide both target and stop placement in this ETF.

Richard Gateway M.A, LPC. has studied human behavior for the last 25 years as psychotherapist, a trading coach and a money manager. He is a registered investment advisor and is vice president of http://www.autobottrading.com and provides analysis to http://autobottrading.com/blog

Copyright © 2010 Dr. Richard Gateway - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.