A Deflationary Impulse Would be a Catalyst for Gold Stocks

Commodities / Gold & Silver Stocks Apr 15, 2010 - 08:37 AM GMTBy: Jordan_Roy_Byrne

While Gold is a hedge for inflation and deflation, that doesn’t mean that gold stocks are a hedge or outperformer in either environment. As we wrote last year, gold stocks tend to perform better when deflation is the concern.

While Gold is a hedge for inflation and deflation, that doesn’t mean that gold stocks are a hedge or outperformer in either environment. As we wrote last year, gold stocks tend to perform better when deflation is the concern.

The reason is two fold. First, Gold is a leading indicator of inflation and commodity prices. Gold outperforms ahead of actual price inflation. The second reason is that Gold’s outperformance, allows margin expansion for the gold producers. When inflation hits the economy, commodities (and sometimes stocks) will outperform Gold. Also, the inflation (especially rising oil) cuts into the margins of gold producers

All of this is very obvious when looking at some charts.

In the chart below we show two ratios: Gold Stocks/Commodity Stocks and Gold Stocks/Gold. Note the strong outperformance of gold stocks during periods of economic contraction and/or deflationary concerns.

We can get an idea of the outlook for the HUI/Gold ratio by tracking some ratios. In the chart we show Gold/Oil and Gold/Gyx, a proxy for industrial-related costs. Note that while these ratios usually trend in the same direction (with HUI/Gold), they actually can be a leading indicator.

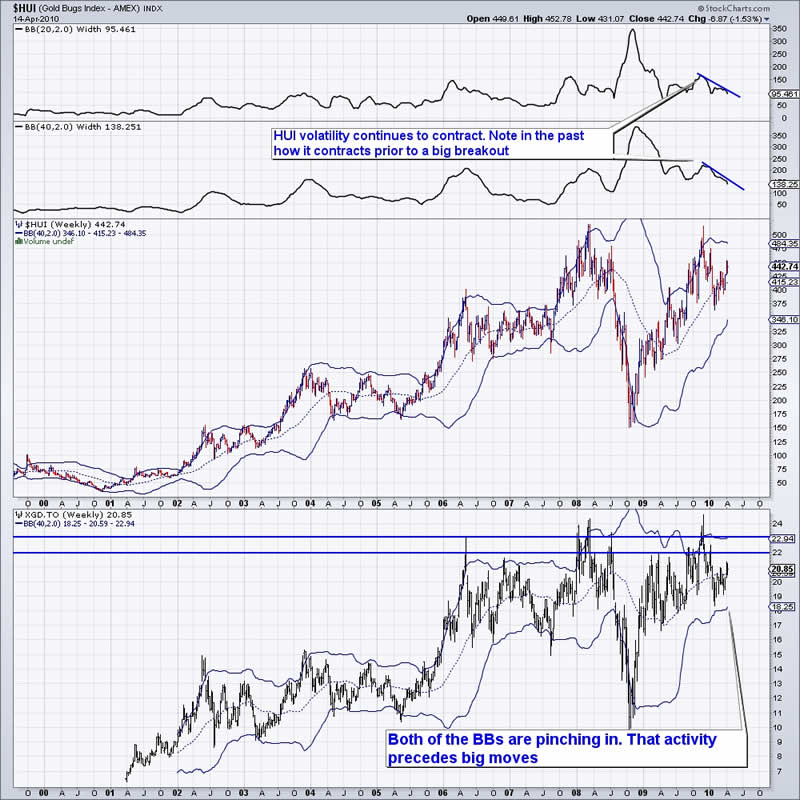

In terms of the technicals, the gold stocks are in position for a major breakout sometime this year. In the following chart we show the HUI index along with the XGD.to (Canadian ETF).

Conclusion

The gold stocks are in position for a major breakout in 2010. For a sustainable breakout, the current trends in the capital markets need to at least shift, if not change. The precious metals sector has held up well as stocks, commodities and corporate bonds have recovered and sustained their recovery. However, as long as those assets continue to be strong, how will the gold stocks forge the type of breakout suggested by the charts? Hence, a deflationary impulse, even a slight one, could serve to be a major catalyst.

Such an impulse, while initially positive for Treasuries, would exacerbate the medium to intermediate term outlook, as deficits would worsen. Meanwhile, the margins of gold producers are already strong. A deflationary impulse would ultimately result in Gold outperforming its “input costs” and so margins would expand even further.

For more of this kind of analysis and for actionable information, and gold/silver stock analysis, consider a 14-day trial to our premium service, by visiting: http://www.thedailygold.com/newsletter.

Good luck ahead!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.