Stocks Sell Now, Buy Later the ABCs of Short Selling

Stock-Markets / Learning to Invest Apr 15, 2010 - 10:33 AM GMTBy: Casey_Research

By Jake Weber, Editor, The Casey Report writes:

The catch phrases “Buy low, sell high” and “The market fluctuates” are probably the two most frequently used clichés of the investment world. The latter statement is hardly astute, and the former far easier said than done. What both of these simplistic ideas overlook is a third concept largely ignored by the investing public, “Sell now, buy later.”

By Jake Weber, Editor, The Casey Report writes:

The catch phrases “Buy low, sell high” and “The market fluctuates” are probably the two most frequently used clichés of the investment world. The latter statement is hardly astute, and the former far easier said than done. What both of these simplistic ideas overlook is a third concept largely ignored by the investing public, “Sell now, buy later.”

The idea of selling something that you don’t yet own is a foreign concept to many. However, in a powerful bear market, it’s an important strategy to understand and utilize, though for reasons I’ll discuss below, only as a relatively small and closely watched speculative portion of your portfolio. The concept I’m referring to, of course, is short selling.

The basic mechanics of selling short a stock are not complicated, but, as with any investment, there are risks involved, and it requires discipline to execute these trades successfully.

What Is Short Selling?

If, after carefully scrutinizing a security, you conclude that there is nowhere for the stock to go but down and want to put your money where your brain is, there are a couple of different alternatives. One way to go is the options route, selling calls or buying puts on the stock. This is certainly a viable route with plenty of opportunity to profit; however, with options, not only do you have to be right about the direction, you also have to be correct about the timing and strike price.

The other alternative is to open up a margin account and sell the stock short. That requires posting a margin – cash or securities – in your account. With that condition met, your broker will undertake to borrow the stock from someone that owns it. Once your broker has acquired it, either from another client or another brokerage firm, he or she will sell the stock and deposit the proceeds into your account. What you own now is a liability to purchase back, or “cover,” those same shares at some point in the future, hopefully at a lower price. Because there’s a loan involved with this transaction, you’ll be charged an interest rate on the amount borrowed, likely in the area of about 4.5% annualized these days.

With a short sale, your maximum gain is capped at 100%, which you would only collect if the stock goes to zero – but your loss is technically unlimited because stocks have no cap on the upside. Of course, there are ways to limit your losses, which we’ll discuss in a moment, but first let’s look at what could happen to your account should the stock fall, as you hope it will… or rise, as you hope it won’t.

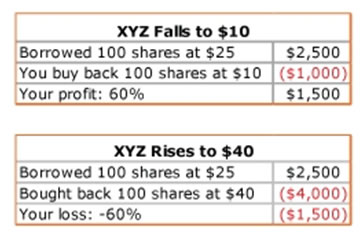

For the purpose of this example, let’s say you came to the conclusion that XYZ stock is overvalued at $25 a share and so you sell short 100 shares. Here are the implications of two different scenarios subsequently unfolding:

Your maximum profit of the XYZ short sale is $2,500, but the sky is the limit for your losses and will be magnified, should you use margin. This potential for open-ended loss is enough to deter most investors from shorting, and is the reason we recommend you do so only with the speculative corner of your portfolio.

Minimizing Risk

Short selling is an aggressive strategy to pursue. There are, however, measures you can take to help mitigate risk.

Limit Your Margin

One of the ways to avoid large losses is by limiting the amount of margin used to borrow the shares. To sell short in the U.S., regulations require that the stock be “marginable,” and an initial deposit is required – 50% for stocks above $5 per share and 100% margin for stocks below $5 per share. After you borrow the shares, the rules require you maintain equity in the account worth at least 25% of the total market value of the security.

These are the regulatory minimums; individual brokerages may have additional rules and limitations for margin accounts, so be sure to carefully review your margin agreement. Even so, to avoid being “chased out” of a trade, you may want to deposit more cash than required by your broker in order to further cushion your position.

Keep in mind that the interest paid on the borrowed money will eat into your returns, reducing your potential upside, the longer you hold open a position. Also, any dividends issued while you are borrowing the stocks will be transferred from your account to the original buyer. We highly recommend that you actively monitor your account to avoid any margin calls and minimize your risk by reducing the use of margin.

Use Stop-Loss Orders

If you aren’t able to actively manage your investment accounts, then stop-loss orders can help soften the blow if the trade quickly turns against you. When the general market or sector gains upward momentum, even the fundamentally weakest stocks can catch a free ride. In order to limit your loss, consider placing orders to “buy to cover” at a price above your initial short sale price and remember to review your stop-loss orders periodically to assure you are covered.

A Few Key Terms:

- Short Interest: This is the aggregate number of short sale positions on each security. This information is published monthly by the exchanges and also offered through many other websites such as Barron’s and Yahoo Finance. It’s important to monitor how many shares have been borrowed because they will eventually have to be bought back (see Short Squeeze, below). Generally, the lower the short interest, the better.

- Days to Cover: This is another important data point to track, because it’s an estimate for how many days it will take to unwind all the outstanding short positions. It’s calculated by dividing the current short interest by the average daily trading volume of the stock. The fewer days to cover, the better.

- Short Squeeze: Should a stock appreciate by a substantial amount, it is entirely to be expected that some number of short-sellers will decide to cover their short or be forced to it by margin calls. Of course, that requires closing their positions by buying the stock back, which gives the stock further upward momentum. This may in turn force other short-sellers to cover, thus creating a rush to cover known as a short squeeze. Using stop-loss orders will help prevent getting caught on the wrong end of a short squeeze.

- Called Away: This refers to being forced to cover your short position because the lender requires delivery of the stocks. While this technically could happen at any time, it is exceedingly rare and would typically occur only if a clearing house couldn’t find shares to borrow for exchange-traded funds. This is something certainly to be aware of, but it’s not a cause for great concern, in our opinion.

Proceed with Caution…

If short selling fits within your scope of risk tolerance, it can be very profitable. Even so, it’s important you avoid being overleveraged in any position and never, ever “bet the farm” with a short position. Rather, only invest with money that you can afford to lose and consider using stop-losses.

As Jake says, short-selling can be very lucrative – if you correctly assess the broad market trends. That’s what The Casey Report does: analyzing budding trends and finding the best opportunities to profit from them. And as a special Tax Day offer – for 2 days only – you can now get The Casey Report for $150 less… PLUS one free year of our two most popular precious metals and energy advisories. Click here to learn more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.