Was Friday The Stock Market Top Or The Start Of A Correction?

Stock-Markets / Stock Markets 2010 Apr 19, 2010 - 02:14 PM GMTBy: David_Grandey

Was that it? Was that the top? While many are asking this question the answer is yet to truly reveal itself. If it is then it's of the trendline break variety.

Was that it? Was that the top? While many are asking this question the answer is yet to truly reveal itself. If it is then it's of the trendline break variety.

But more often than not usually you get some sort of rally attempt after it pulls back and then we need to be on our toes. What we really need to see is if this is just a bump in the road or the start of something more.

We suspect something more as the markets have been looking for a catalyst and it got one. We'll find out we assure you in the coming weeks, if not sooner. Right now though we have to treat this as a pull back. One step at a time.

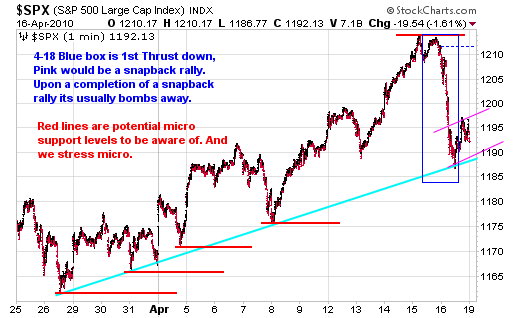

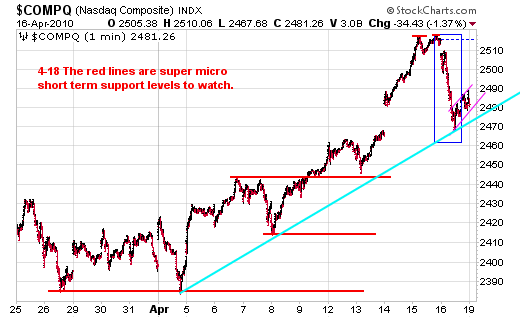

In the short-term we want to pay attention to what we call a FirstThrust Down Pattern.

NOTE: Every Index out there is showing this same pattern!

Notice where each index stopped for the day on Friday? Yep you guessed it, right on an uptrendline - It's All About Trends as we say.

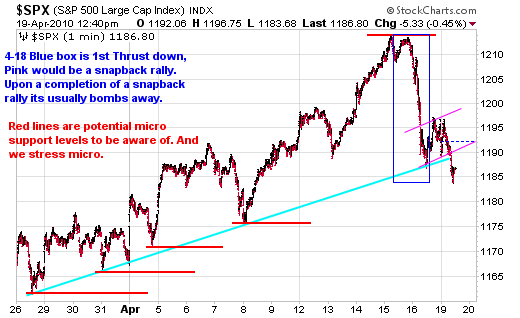

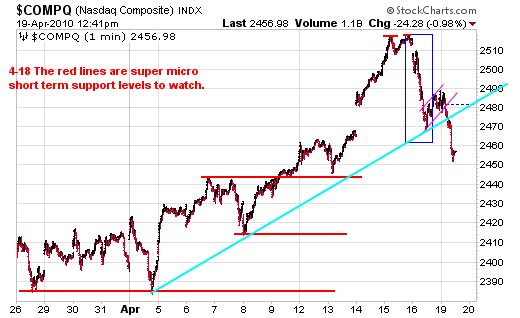

So IF this is going to be a classic All About Trends First Thrust Down Pattern then the next move is Bombs Away to the downside.

And a few hours into the trading day Monday, sure enough here we are in bombs away mode after a little chart time above the light blue trend lines that formed the snapback rally.

From here the order of the day on the long side is "Let Them Come To You." Many names as you'll see in our long side watch list are getting better everyday HOWEVER we need to see where the indexes shake out over the next day or so first.

1150 on the S&P 500 would be our best guess for next stop before any serious bounce could ensue. We'll take it one step at a time.

On the longside we will continue to add names that have that look. On the short side we still need to see what happens when this leg down in the indexes is complete and what happens on bounce mode.

We suspect that we will see a boat load of these same names that we are looking to trade on the long side for a trade will end up putting in big picture tops. But that's still a few weeks away. Let's stop going down, stabilize, bounce then we talk. That's the mantra over the next few weeks.

Stop going down, hit support/50 day averages, bounce then be on our toes for a full-blown break down at that time.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.