Stock Market Whipsaw Wednesday - Is Los Angeles Burning?

Stock-Markets / Financial Markets 2010 Apr 21, 2010 - 09:00 AM GMTBy: PhilStockWorld

Is Los Angeles Burning?

Is Los Angeles Burning?

Well, if not, it may be soon as 3,500 city jobs go on the chopping block including 61 firefighters in an area that routinely bursts into flames. Los Angeles County seeks to eliminate an additional 1,400 positions with both the County and the City looking to trim their budgets down from last year. “The mayor’s budget plan will make it harder to do business here, harder to raise a family and harder to keep neighborhoods safe,” the Coalition of Los Angeles City Unions said on April 16. The group represents 22,000 workers. The mayor’s proposed budget includes $63 million in savings from forcing some employees to take as many as 26 days off without pay.

We talked about this last month, Los Angeles, like hundreds of other cities across America, is simply out of money and, unlike the US Government, they can’t go endlessly into debt and pretend it doesn’t matter. Fitch just cut LA’s bond ratings to A- on the 16th following a similar cut by Moody’s on April 7th. Spending in LA County, with 9.8M residents, will be reduced by $885M or 3.7% from last year while the city is relying on one-time tricks like selling bonds based on future parking meter collections to avoid drastic cutbacks - this year.

We talked about this last month, Los Angeles, like hundreds of other cities across America, is simply out of money and, unlike the US Government, they can’t go endlessly into debt and pretend it doesn’t matter. Fitch just cut LA’s bond ratings to A- on the 16th following a similar cut by Moody’s on April 7th. Spending in LA County, with 9.8M residents, will be reduced by $885M or 3.7% from last year while the city is relying on one-time tricks like selling bonds based on future parking meter collections to avoid drastic cutbacks - this year.

As we get closer and closer to budget time (fiscal years begin July 1st) for local governments, we’ll get a clearer picture on what this recovery really looks like. Cities and Counties are collecting less income tax revenues not more, their expenses (inflation) are going up, not down and their taxable land bases and sales tax collections are down, not up. It’s easy to fudge national numbers as you only have to control a couple of dozen reports written by a hundred Federal employees operating under a strict hierarchy - try doing that on a national scale with 50 states, 3,141 counties and 18,000 cities and towns and things tend to fall apart and, from that rubble, you may actually get to the truth!

I sent out a special Alert to Members this morning titled "Notes on AAPL and Complacency" in which I warned that "I am DEEPLY disturbed by the combination of complacency AND bubble valuations I’m seeing in the markets." People are all excited that AAPL earned $3.33 per share yesterday but, as I pointed out: THAT’S PER $250 SHARE! While AAPL is still my all-time favorite company, they’d damn well better be earning $12 per share for the year as I really hate to wait more than 20 years for a return on my investment!

I sent out a special Alert to Members this morning titled "Notes on AAPL and Complacency" in which I warned that "I am DEEPLY disturbed by the combination of complacency AND bubble valuations I’m seeing in the markets." People are all excited that AAPL earned $3.33 per share yesterday but, as I pointed out: THAT’S PER $250 SHARE! While AAPL is still my all-time favorite company, they’d damn well better be earning $12 per share for the year as I really hate to wait more than 20 years for a return on my investment!

Investors are currently being driven into the stock and commodities market by FEAR. FEAR of inflation, FEAR of leaving money in the banks, FEAR of treasuries, FEAR of bonds (thanks PIMPCO), FEAR of missing out… There simply is nowhere else to put money and earn reasonable returns but that is no reason to be complacent about leaving money in the market. This is why we maintain our disaster hedges - even when things seem to be going great.

And things are CLEARLY not going great. I don’t even know what planet investors are living on that the VIX is down to 15.73 at yesterday’s close, a level of complacency not see since July of 2007 - right before things began to fall apart. At the time, the Dow was at 14,000 (now down 20%), S&P 1,550 (down 22%), Nas 2,700 (down 7.5%), NYSE 10,000 (down 24%), Russell 835 (down 14%), Gold $650 (UP 75%) and oil $65 (UP 30%). Investor confidence may be up but Consumer Confidence fell another 3 points yesterday to -50, just 4 points above the ALL-TIME LOW. Wouldn’t that be funny - making record highs in the market while making record lows on consumer confidence - could the markets possibly be any more disconnected from reality than that?

Of course the news is still Goldman, Goldman, Goldman and I’m sick of it already but John Stewart was very funny summing it up (thanks Leesal):

And, if you think consumers are the only ones losing confidence in this economy, you clearly haven’t spoken to Steve Wynn, possibly the man in the best position of all to judge whether China or the US is going to be the world’s future. Steve has chosen to build a third resort in Macau and will not be "taking advantage" of the collapse of many of his competitors in Las Vegas to expand his holdings there. Wynn also withdrew from his bidding to work on New York’s Aqueduct Racetrack project and is now saying:

I don’t think the Las Vegas market at the moment beckons a large investment. The economic outlook in the United States, the policies of this administration, which do not favor job formation, do not encourage investment at all… The governmental policies in the United States of America are a damper, a wet blanket. They retard investment, they retard job formation, they retard the creation of a better life for the citizens in spite of the rhetoric of the President.

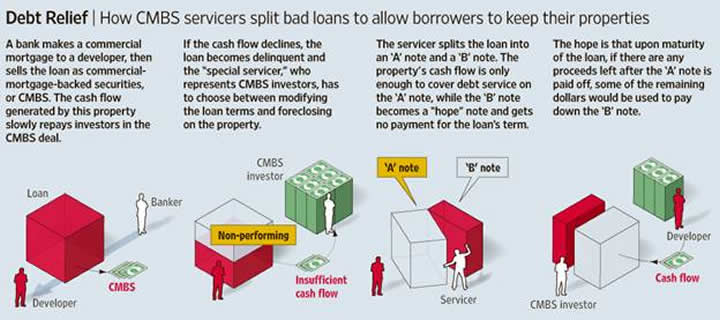

Perhaps Wynn is concerned that defaults on commercial mortgages bundled into securities are climbing to records, threatening bondholders with steeper losses and putting pressure on property owners and lenders to restructure their loans. According to Fitch Ratings, more than 11% of some $536 billion of loans packaged into commercial-mortgage-backed securities are expected to be at least 60 days past due by year’s end. The late-payment rate now is about 7% and has skyrocketed in the past year because of squeezed rent payments, making it hard for property owners to continue servicing their debt and the near-paralyzed market for new commercial-mortgage-backed securities. Banks have been sweeping MASSIVE losses under the table with clever restructuring plays, as highlighted by the WSJ:

This is how we can have record defaults on Commercial Properties AND incredible performance in that sector. The banks don’t lose money because they reclassify loans without having to foreclose and the new, smaller loan on the building improves the cash-flow of the REIT or whoever borrows the money. As illustrated in the above diagram, the bank simply takes a portion of the building that can’t be paid and declares it as an "asset" (that they can borrow and leverage against) while pretending the building’s owner has enough cash flow to pay for what’s left on the loan - BRILLIANT!

And who will end up paying for that very ugly B Block of unpayable debt? Well, hopefully, it will be paid off by the improvement in value everyone is wishing for and, if not, it will be paid by you and me and whatever taxpayers don’t have the foresight flee the country with Mr. Wynn.

In addition to the 92% of Americans polled who rate the economy in "bad shape," 58% of the people surveyed by Rasmussen do not believe that Social Security will be able to pay their promised benefits. Only 40% of voters surveyed are even "somewhat confident" that SS will pay their benefits and the very funny thing about that is that 100% of those people are putting 13% of their earnings into that account anyway - talk about a dumb investment! That’s almost as foolish as all those ETFs they keep putting their 401K money into. All will be well as long as they don’t catch on so - Shhhhhhhhhhh!

The Shanghai and the Nikkei jumped 1.8% this morning as tech stocks, airline stocks and commodity stocks (mostly fuel) jumped up on word that air travel was resuming in Europe and, of course, mighty Apple earnings. The Hang Seng, however, fell another 0.5% and the BSE was flat. Japan said they are looking to eliminate budget debt - sometime around 2020! Marc Faber says China’s “excessive” credit expansion and surging real estate prices are “danger signals” that growth is peaking but what else is new?

Europe is off a bit this morning just ahead of the US open with markets in Greece, Spain and Portugal falling hard as CDS rates and bond yields shoot back up as we’re having an "off again" day with Greece. That’s why this post is titled "Whipsaw Wednesday," as we have already gone up 60 Dow points since 7:40 on the futures following a 60 point drop from the 10pm high (Asia’s open) which was the top of a 70-point gain from Tuesday’s low at 10:30 (good thing we sell at 10!). We’re not just selling yesterday’s calls at 10 today but we’ll be going short on this idiotic run-up, happy to get out if we really break our levels but even happier if we get another pullback first.

Not much on the data front today - we should get a build in oil, especially distillates but that’s about it so this is all rumor trading and we have Greece and GS now to play with!

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.