Gold Supported by Growing Inflation Concerns and Record Low Interest Rates

Commodities / Gold and Silver 2010 Apr 22, 2010 - 07:04 AM GMTBy: GoldCore

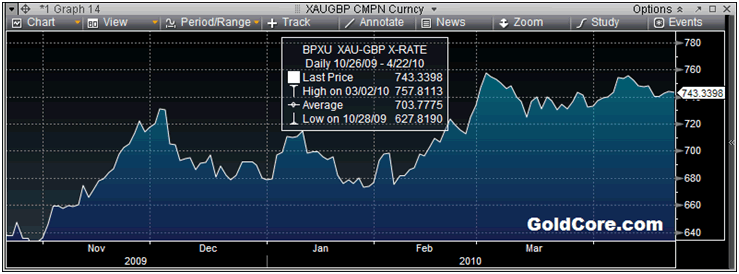

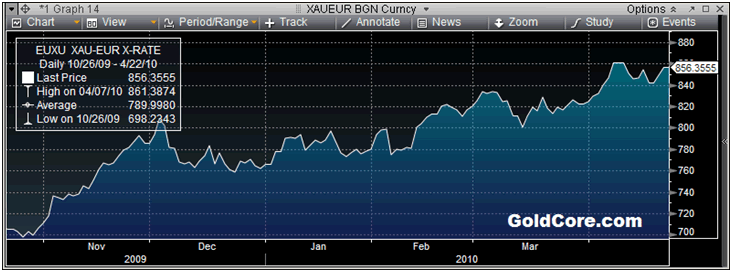

Gold touched over $1,150/oz late in New York before dipping slightly to close with a gain of 0.79%. It has range traded from $1,144/oz to $1,149/oz in Asian and early European trading this morning. Gold is currently trading at $1,147/oz and in euro and GBP terms, trading at €856/oz and £743/oz respectively. While gold remains essentially flat in most currencies, trading has been volatile this morning.

Gold touched over $1,150/oz late in New York before dipping slightly to close with a gain of 0.79%. It has range traded from $1,144/oz to $1,149/oz in Asian and early European trading this morning. Gold is currently trading at $1,147/oz and in euro and GBP terms, trading at €856/oz and £743/oz respectively. While gold remains essentially flat in most currencies, trading has been volatile this morning.

Gold remains near record (nominal) highs in the beleaguered euro and pound but is lagging in the dollar due to recent dollar strength. The risk of contagion remains and may even have increased - this is leading to increasing talk of gold becoming an important reserve currency again.

With negative real interest rates and savers and many bond holders internationally effectively losing money due to low yields and rising inflation, gold remains an attractive diversification. Gold's lack of yield - the opportunity cost of owning gold - is no longer the disadvantage it once was and this scenario looks likely to continue for the foreseeable future. Prospects of a hung parliament in the UK and a possible sterling devaluation are leading to increasing diversification into gold by UK citizens (see News).

Gold is likely to be supported today by the fact that Greek bond yields have surged again. Greece's benchmark 10-year bond yield rose to 8.13 percent, the highest since 1998 and more than twice the comparable German bond rate. The cost of insuring government debt against default also climbed to a record. Markets remain sanguine in the short term about these risks but that will likely change soon and lead to a new bout of risk aversion which should again lead to higher gold prices.

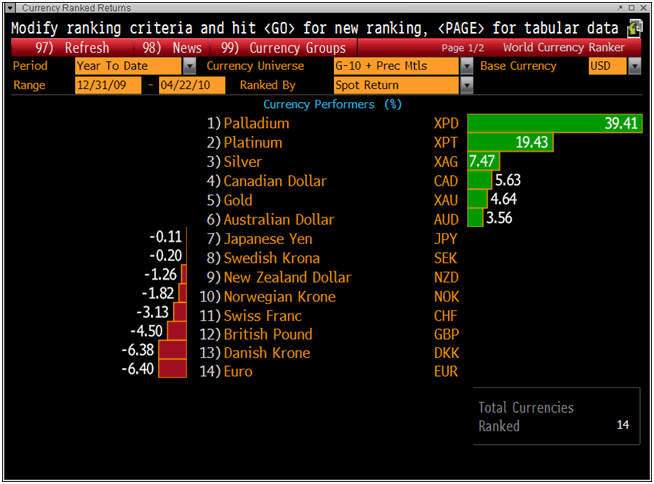

G10 Currencies and Precious Metals Performance (YTD)

Silver

Silver has risen from $18.02/oz to $18.15/oz this morning in Asia. Silver is currently trading at $18.12/oz, €13.49/oz and £11.72/oz.

Platinum Group Metals

Platinum is trading at $1,752/oz and palladium is currently trading at $570/oz. Rhodium is at $2,950/oz. Palladium for immediate delivery advanced to the highest level since July, 2008. Platinum for immediate delivery rose to the highest level since August, 2008. Chinese and Asian imports remain strong and higher demand from the automotive industry internationally is also leading to buying. GFMS is due to publish its 2010 Platinum and Palladium Survey at 1300 GMT.

News

UK savers worried about the political risk of a hung Parliament are seeking a safe haven in gold according to the Telegraph. Savers worried about rising inflation, shrinking sterling, dismal returns on bank deposits and even the political risk of a hung Parliament are seeking a safe haven in gold. Bullion pays no income and, after storage costs, can be seen to have a negative yield but it has delivered much better returns than shares during the last decade - and has a history of doing particularly well in election years. While the FTSE 100 remains below its level 10 years ago, the sterling price of gold has soared by more than 320 pc to £745 at which individual investors can buy today. That is lower than the record of £754 it hit earlier this month but gold analysts claim there are good reasons to expect a recovery. Uncertainty created by general elections appears to boost the sterling price of gold. During the year after the last election in May, 2005, the bullion price increased by 62pc. That was its biggest ballot year rise since Margaret Thatcher's first election victory in May, 1979, when the gold price soared by 89pc. While the price fell by 10pc and 12pc respectively during the election years of 1987 and 1997, bullion's average one-year gain over all national ballots since 1970 has been 18pc. While history is not a guide to the future, those who fear a hung Parliament may draw some comfort from the fact that gold even staged a modest increase of 6pc after the last indecisive election in February, 1974. Governments in a tight spot can print money or let inflation devalue the currency to float them off the rocks of excessive debt. But they cannot make more gold or debase this precious metal.

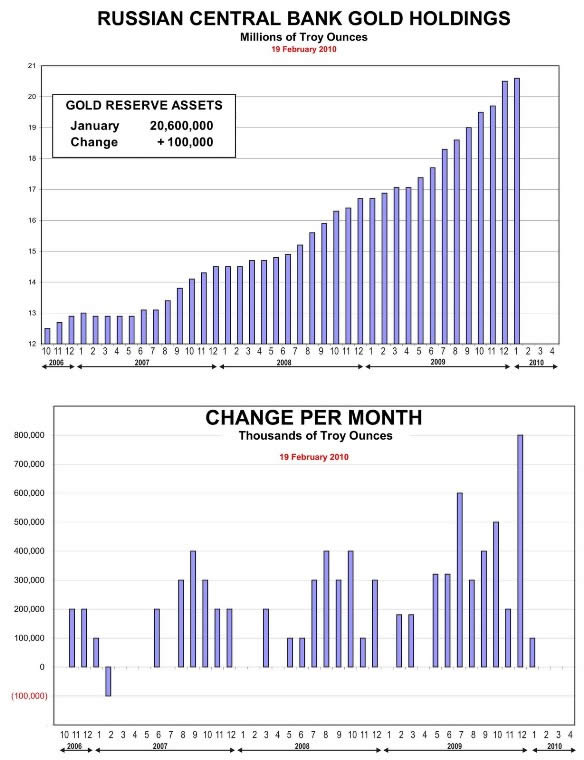

The Russian Central Bank has again increased its gold reserves. Central banks internationally were net buyers in 2009 for the first time since 1987. And given the increased sovereign debt risk and currency risk, will likely be net buyers again in 2010. Especially the Chinese with their near $2.4 trillion ($US1.5 trillion in American debt) in foreign currency reserves.

(Source: The Golden Truth)

The IMF has forecast further price rises for commodities The strengthening of the global economy will exert additional "upward price pressures" in the near term to commodities markets, the International Monetary Fund warned yesterday according to the Financial Times. The commodities market pays attention to the IMF's views as the Washington-based organisation has accurately predicted some recent price movements. In particular, it was among the few official institutions to bet that the downturn was a mere pause in the "commodities super-cycle", rather than its end. "Over the medium term, commodity prices are projected to remain high by historical standards," it said. As the global recovery matures, the IMF said that "tension between rapid demand and sluggish capacity growth" was likely to re-emerge, "thereby keeping prices at elevated levels by historical standards".

Respected analyst John Embry has said that he believes that gold should rise by some $500 in the coming months. "If gold isn't up at least $500 in the next six months, I will be surprised," says, John Embry, Chief investment strategist at Sprott Asset Management. Embry said that the price of gold is on the rise for two main reasons. The first of these is the rapid increase in sovereign debt among many Western nations and the risks attached to it. Embry told Mineweb that while Greece is the one at the top of the page right now it is just one of many countries or states including the UK and many in the Mediterranean and the US which have equally as serious debt issues. He adds "We are in the early stages of what I think might turn into some sort of a hyper-inflationary condition because there are not enough savings in the world to even remotely service the amount of sovereign debt that is going to be created in the next few years. So you are going to see the creation of paper money the likes of which we have seldom, if ever, seen in history. So, as the value of the paper money goes down because of its proliferation, by definition, gold, which is in limited supply, the price of it will go up in these paper currencies.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.