Gold Stocks: Math Today, Magic Tomorrow

Commodities / Gold & Silver Stocks Apr 22, 2010 - 04:56 PM GMTBy: Jeff_Clark

Jeff Clark, Senior Editor, Casey’s Gold & Resource Report writes: Here at Casey Research, we eagerly awaited the release of quarterly reports from the companies in our favorite sector. Why? The gold price was substantially higher last quarter than during the comparable meltdown quarter of 2008, so we were anxious to find out if it would lead to a spike in profits.

Jeff Clark, Senior Editor, Casey’s Gold & Resource Report writes: Here at Casey Research, we eagerly awaited the release of quarterly reports from the companies in our favorite sector. Why? The gold price was substantially higher last quarter than during the comparable meltdown quarter of 2008, so we were anxious to find out if it would lead to a spike in profits.

Gold and silver producers posted substantially higher net profits, and yes, much of it due to higher metals prices. But amazing to many, higher profits did not lead to higher – or at least not significantly higher – stock prices.

While most saw their stocks rise the day of their respective announcements, some actually fell if gold or the broader markets were down on the day. And they certainly didn’t jump like you might expect when “soaring profits” splashed the headlines of their press releases.

What gives?

We have some answers straight ahead, including a big fat clue as to when gold stocks will take off and give us those “magical” price levels we think are coming.

Gold Stocks Are Still Going to Take Off, Right?

We think that at some point the public is destined to participate in precious metals stocks, and when they do, we’ll see volumes jump and share prices take off.

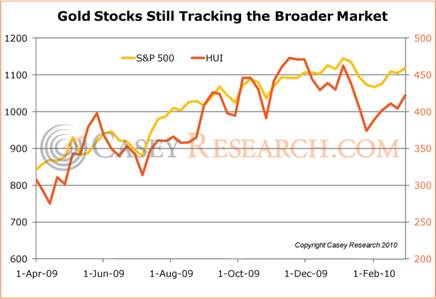

But for now, gold stocks are playing follow the leader…

… rising and declining in tandem with the S&P since last April. So, until gold stocks separate from the overall market, we should anticipate they’ll tag along if the markets slide. And we think the path of least resistance for the stock market is down, not up, so caution is warranted about going overweight our stocks.

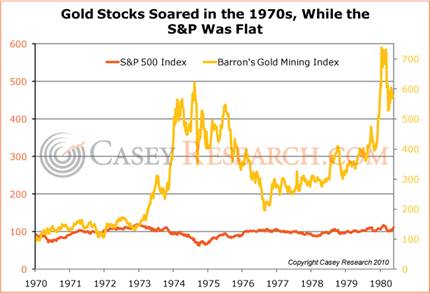

But just as we showed with gold last month, gold stocks will similarly propel higher when the general public crowds in, regardless of what the markets are doing. Here’s what gold stocks did in the last great bull market, compared to the S&P.

As measured by the Barron’s Gold Mining Index (a good substitute for the HUI that didn’t exist), gold stocks rose 652% during the 1970s (through January 1980), while the S&P returned a wimpy 22%. The action in the ‘70s was definitely in gold and gold stocks, despite two recessions that decade, and we think a repeat is in the cards.

When the masses finally wake up, it’s highly probable our returns will match the chart above or the late ‘90s surge in Internet stocks.

As investors, our goal is to get positioned in the best stocks at the best price. And buying low assures us of more profit when we eventually sell. So, are gold stocks “low” right now?

We have a couple clues to help answer that, with gold itself offering the most important hint. Let’s compare how gold stocks are performing in relation to gold to see if they’re overvalued or undervalued or somewhere in between.

The chart shows that gold stocks, as measured by the HUI Gold Bugs Index, outperformed gold until 2008. Since then, gold stocks have underperformed gold by a fairly wide margin.

This gold-stock-to-gold ratio tells us that in our bull market, gold stocks are currently undervalued relative to the gold price. This doesn’t mean they can’t get cheaper, of course, but it does signal they represent good value and that compared to their underlying asset, there’s lots of room to the upside.

So, if you have a long-term perspective and the patience to wait until gold stocks begin outperforming gold again, today’s prices are good prices.

So, do we buy? The answer depends on your current exposure to gold stocks, how much gold and cash you have, and your outlook. If you own equities exceeding one-third of your total investable assets, we wouldn’t rush to buy. If you have limited (or no) exposure and a patient mindset to see you through until the big payday, even enduring temporarily lower prices along the way, then buying some now is probably a good move. If you have very little in the way of savings and gold, we’d put money there first before committing a big chunk to gold stocks.

Basically, the larger your stable of gold stocks, the more stubborn you should be about price. And we wouldn’t go “all in” just yet. Your risk in loading up now is if markets were to take another nosedive. But if you’re light on stocks, adding some of the best of the best at this time should work out well, as long as you don’t panic into selling on general market weakness.

The #1 indicator that will tell us when gold stocks will take off has nothing to do with charts and is something you can monitor yourself: it will be when your neighbors and co-workers begin to express curiosity. You obviously want to be invested before them, but that’s when things will start to get exciting.

So when might “gold fever” strike your neighbor? History holds the best clue:

►In the 1970’s bull market, gold stocks began their big ascent when the gold price hit about $450/ounce. Adjusted for inflation, that would equal roughly $1,340 today. So, when we see gold rise decisively above $1,300 and stay there, that just might be the trigger that spurs the interest of the masses in gold stocks. That’s not a prediction, but it does give us an idea of what to look for.

Casey Research chief economist Bud Conrad was right when he called for gold breaking through the $1,150 barrier in 2009 – and now he’s calling for gold to break over $1,450 by year’s end. Weighing in as well, Doug Casey himself sees precious metals as the only asset class worth buying now, and gold stocks as being the best way to add speculative leverage to those investments.

Exciting? You bet. We’re convinced that, sooner or later, higher prices are ahead for the best gold- and silver-producing companies, along with the “magical” levels that can happen in a mania. So, while we encourage caution, we also encourage selective participation so you don’t get left behind. Waiting for the “perfect” time to buy is an exercise in self-deception; nobody can time the market.

Let’s be honest: no one can guarantee when or if a gold mania will happen. But all of our research points to higher prices for gold (and silver), so we remain confident we’re in the right sector. And we can make money before the mania gets here.

To learn where to buy physical gold and where to store it… and which major gold stocks, mutual funds, and ETFs are the safest while giving you handsome upside… read Casey’s Gold & Resource Report. At $39 per year, it’s a steal for the value you get out of it. Click here for more.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.