Why Does This Stock Market Rally Give Me the Creeps?

Stock-Markets / Stock Markets 2010 Apr 26, 2010 - 04:13 AM GMTBy: PhilStockWorld

I’m sorry, I am trying so hard to get bullish but it’s not working…

I’m sorry, I am trying so hard to get bullish but it’s not working…

My only solution is to, as we often joke, switch of my brain and stop reading the news (listening to it is great as everything is coming up roses in TV-land) and ignore the now-exposed shenanigans on Wall Street (why should I worry about my investments just because the people running the game are up on fraud charges) and for goodness sakes don’t even look at something as depressing as "The Economic Elite vs. the People of the United States of America," neither Parts 1-3 or Parts 4-6 because that can lead to thinking and thinking makes it REALLY hard to go to sleep at night with your money riding on the top of an 80% market while gold is trading at $1,150 an ounce because of overwhelming global instability and a total lack of faith in the global financial markets.

Yep, if we don’t think about all that stuff and focus on the good stuff, like the fact that Unemployment is only 3% for those of us who earn $150,000 a year (for the poor it’s 31%), and 93% of our virtually fully-employed analysts predict the S&P will finish the year even higher (although not too much higher) with only Andrew Garhwaite of Credit Suisse in need of an "attitude adjustment" with his puny target of 1,175, which is 32 points lower than Friday’s close. Fortunately, enlightened analysts like Deutsche Banks Binky Chad think we can still squeeze another 100 points out of this rally (about 10%) although Goldman Sachs is wimping out at 1,250, their partner in "whatever you want to call it", JP Morgan is up at 1,300. So it’s BUYBUYBUY from the gang of 12 and we’ll be whipping Andrew into shape by the next report or he may find himself the fall guy for the next scandal…

Oops, sorry, I wasn’t supposed to mention the scandals as that’s not really a buying premise unless of course you look at the sheer volume of things the IBanks were getting away with and then look at the virtual nothing that is being done about it and then we can conclude there is no reason they can’t pump this market back up to Dow 14,000 because we already know it was such total BS last time that we dropped 50% like a rock in 2008 so what’s another 3,000 points of BS in 2010?

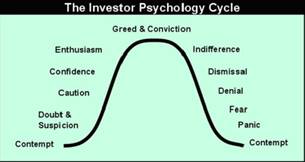

Pieur du Plessis put up the old "Investor Psychology" chart this weekend and makes the case that we are ONLY moving out of the caution phase and into the enthusiasm just now (it’s that damn Andrew Garhwaite again!) while I have been thinking we are moving past "Greed and Conviction" (maybe because bankers are finally starting to be convicted) and into the Indifference/Dismissal/Denial zone as MOUNTAINS of negative news are being shaken off by new rounds of cheerleading accompanied by pathetically low-volume market rallies that have, frankly, only moved the Dow up 200 points in the past two weeks despite "fantastic" earnings reports that "blew the doors" off estimates.

Pieur du Plessis put up the old "Investor Psychology" chart this weekend and makes the case that we are ONLY moving out of the caution phase and into the enthusiasm just now (it’s that damn Andrew Garhwaite again!) while I have been thinking we are moving past "Greed and Conviction" (maybe because bankers are finally starting to be convicted) and into the Indifference/Dismissal/Denial zone as MOUNTAINS of negative news are being shaken off by new rounds of cheerleading accompanied by pathetically low-volume market rallies that have, frankly, only moved the Dow up 200 points in the past two weeks despite "fantastic" earnings reports that "blew the doors" off estimates.

Can an entire market rally really be engineered by a few computer programs using low-interest government loans from the Fed to make Billions of dollars for the same investment banks and their media lackeys who rate the market a BUYBUYBUY no matter how awful life is getting for the bottom 90%? Of course it can! Ellen Brown, from Web of Debt has an excellent article on the subject so I won’t get into it here.

Jeremy Grantham calls the market move "nothing but Fed-sponsored monetary pornography" (h/t Zero Hedge) and perhaps that’s what’s really bothering me - if I think of my investors like children than I guess I see all these little market concerns like one of those one of those predator maps that has way too many red tags around where my kids are playing!

Jeremy Grantham calls the market move "nothing but Fed-sponsored monetary pornography" (h/t Zero Hedge) and perhaps that’s what’s really bothering me - if I think of my investors like children than I guess I see all these little market concerns like one of those one of those predator maps that has way too many red tags around where my kids are playing!

Now don’t get me wrong, I don’t want to compare our fabulous IBanks to child molesters (although they certainly do enjoy taking candy from babies)--it’s only your money they are after and, as we see in the news every day--that’s hardly illegal at all! So the market is forever blowing bubbles and the children are dancing without a care in the world. P/E multiples are flying, risk premiums are at zero and, as Grantham points out, alternate investment returns are so low that all of the sheep are being herded into the blind alley of equity and commodity investments, like lambs to the slaughter, as the saying goes. Yeah, just a little creepy…

We are not, of course, above riding the market movement higher but I cautioned Members to lighten up this weekend on our 566% plays while they are only halfway to goal. The 566% plays were established 2 weeks ago because we were "worried" the market would head higher and damage our bearish position. We ended up getting the best of both worlds as the market swung wildly up and down, giving us a chance to cash in on both sides. Now that we have broken our upside watch levels of Dow 11,000, S&P 1,200, Nas 2,500, NYSE 7,700 and Russell 720 and SEEM to be holding them, we can begin establishing some bullish plays, using the 3 of 5 rule as a sign to get the heck out if we fall back below. As a new disaster hedge, I like the following play on TZA (ultra-short on the Russell):

Buy Oct $6 calls for $1

Buy Oct $6 calls for $1- Sell Oct $10 calls for .50 (net .50)

- Sell Oct $4 puts for .30 (net .20)

This hedge pays $4 (up 1,900%) on a market crash that sends the Russell down about 20%. TZA was over $10 in early February, when the Russell was just below 600 (now 741). With TZA now at $5.41, your risk of assignment comes on a $1.41 drop in TZA (26%) which would require roughly an 8% gain in the Russell to 800. You can commit $1,000 to this hedge with 50 contracts and margin on the trade should be roughly $5,000 and you have a commitment to buy 5,000 shares of TZA at $4 ($20,000). You can roll or adjust that play as time goes on of course but since even the most bullish of the Gang of 12 only expect a 10% move up from here for the whole year, we’re not anticipating getting blown out of the position by October options expiration.

What we do buy with protection like this is peace of mind because we structure most of our Buy List plays to have a 20% margin of error (see "How to Buy Stocks for a 15-20% Discount") and, generally, all we need is a flatline to make a 20% profit on our positions. That means, if we have a $100,000 portfolio, we can commit just $1,000 of cash and $5,000 of margin to the TZA spread and we are protecting $100,000 worth of bullish positions from a 20% loss - THAT’S GOOD HEDGING! Should the Russell rise 20% and force us to buy TZA at $4, we are pretty damn sure we will have made a lot more than $20,000 on the way up, especially if we throw in a couple of new 566% plays along the way (we will!).

Of course, getting TZA put to us at $20,000 (assuming we don’t roll) does not mean we are taking a $20,000 loss. If TZA drops about 50%, all the way to $3, our loss taking it at $4 would be $1 times 5,000 shares or $5,000 against projected gains of well over 20% on $100,000 - not a bad price to pay for the ability to sleep at night and owning 5,000 shares of TZA at $4 might be pretty darned clever as we hit the next set of major resistance points. Let’s keep that one thing in mind as we switch the rest of our brains off and try to get more bullish in this creepy rally - we will ALWAYS have our hedges and we will ALWAYS have our stopping out levels to the downside because danger lurks around every corner and we want to keep our precious assets safe!

Of course, getting TZA put to us at $20,000 (assuming we don’t roll) does not mean we are taking a $20,000 loss. If TZA drops about 50%, all the way to $3, our loss taking it at $4 would be $1 times 5,000 shares or $5,000 against projected gains of well over 20% on $100,000 - not a bad price to pay for the ability to sleep at night and owning 5,000 shares of TZA at $4 might be pretty darned clever as we hit the next set of major resistance points. Let’s keep that one thing in mind as we switch the rest of our brains off and try to get more bullish in this creepy rally - we will ALWAYS have our hedges and we will ALWAYS have our stopping out levels to the downside because danger lurks around every corner and we want to keep our precious assets safe!

It has been a very interesting week as we recovered off of Friday’s option expiration day catastrophe with Goldman’s SEC news and, of course, the on again - off again - on again news coming out of Greece. We finished this week more than 50 points over that Thursday’s close so yay bulls and all that. Our week’s picks were surprisingly pretty good considering what BS I thought the whole thing was:

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.