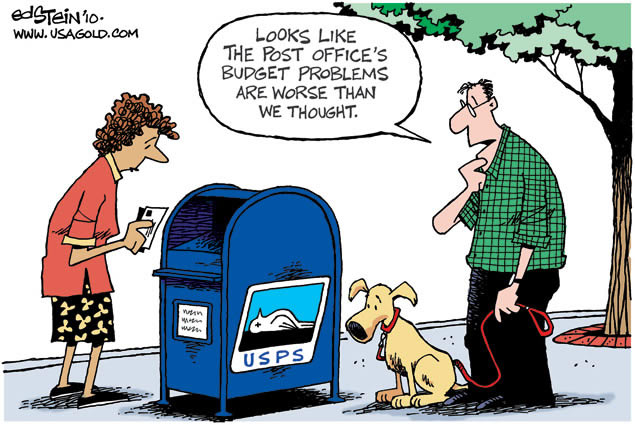

the Post Office has effectively "gone postal", Choose Gold

Commodities / Gold and Silver 2010 Apr 26, 2010 - 01:22 PM GMTIs it just me, or does anybody else now sense an ominous foreboding in the post element of the Post Office's name?

"U.S. Post office finances dire . . ." Reuters yesterday reported that the U.S. Postal Service faces a potential shortfall of $238 billion in the next 10 years. Postmaster General John Potter told members of Congress, "Today we stand at the brink of financial insolvency." He went further, pitching for legislation that would allow changes to how the postal service calculates payments for retiree health benefits, potentially to a "pay-as-you-go system" rather than the prepayments currently used. Ensuing discussions of cutting Saturday delivery or closing post offices prompted concerns from both Democrats and Republicans.

In letting its budgets sprial out of control, the Post Office has effectively "gone postal" on itself. Irony, or inevitability (what's in a name?) -- you decide. At any rate, this budgetary meltdown into operational disfunction is just a microcosm of what's in store for the U.S. Government as a whole.

Speaking of irony (or inevitability, depending on how you see it,) consider the recently introduced "Forever" stamp -- effectively a sort of stamp-like promissory note (in the form of an undenominated First Class stamp) that ostensibly pledges first class delivery "forever", even following any subsequent hikes to the First Class postal rates. But what good is it exactly if the whole system folds prior to you exercising the promises for delivery anytime within those wide margins of "forever"?!

We do, nevertheless, continue to buy rolls of postage -- pocketing the Forever stamps and comfortably dismissing all notions that the Postal System might ever completely cease to be. But in truth, our actual comfort (with regard to our holdings of un-used stamps) abides in the fact that, being a relatively small investment, we can bear to suffer a complete loss in the event of its bleeding demise. In sharply contrasting sentiment, however, we turn our view to the analogous realm of financial derivatives -- where the contract represents another mere pledge for some sort of future financial 'delivery'. Yet no matter how enticing it might appear at the outset, it can all end in tears if the counterparty buckles under the weight of too many unfulfillable promises, vaporizing a significant portion of your life's savings in the process.

Therefore the key to financial peace-of-mind, it would seem, is to take a cue from your postage-spending habits and thus commit no more than a disposable pittance toward defaultable promissory investments of any kind (which rules out just about everything that the financial houses are offering these days.) For solid savings and a solid future, choose hard assets -- choose gold.

If you would like to broaden your view of gold market news and analysis, please feel welcome to join our free NewsGroup to receive by e-mail periodic gold news alerts, USAGOLD Market Updates, and relevant commentary like this one!

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael Kosares has over 30 years experience in the gold business, and is the author of The ABCs of Gold Investing: How to Protect and Build Your Wealth with Gold, and numerous magazine and internet articles and essays. He is frequently interviewed in the financial press and is well-known for his on-going commentary on the gold market and its economic, political and financial underpinnings.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.