Gold New Record Highs on Safe Haven Demand

Commodities / Gold and Silver 2010 Apr 28, 2010 - 05:53 AM GMTBy: GoldCore

Gold rose to its highest level in 2010 (highest since December 4th, 2009) and new record highs in euros, Swiss francs and British pounds as ratings downgrades of Portugal and Greece fanned sovereign risk and contagion fears. Gold dipped to $1,146/oz early in New York before rising sharply to $1,164/oz on the downgrade news. It then saw profit taking and closed with a gain of 0.7%.

Gold rose to its highest level in 2010 (highest since December 4th, 2009) and new record highs in euros, Swiss francs and British pounds as ratings downgrades of Portugal and Greece fanned sovereign risk and contagion fears. Gold dipped to $1,146/oz early in New York before rising sharply to $1,164/oz on the downgrade news. It then saw profit taking and closed with a gain of 0.7%.

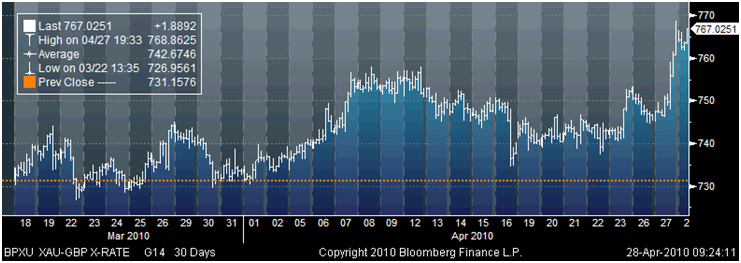

Gold is currently trading at $1,165/oz and in euro and GBP terms, at €885/oz and £767/oz respectively. Importantly, equities and commodities (including oil and copper) sold off aggressively yesterday after the downgrades sent investors out of riskier assets. Gold due to its safe haven currency status was one of the few commodities to rise.

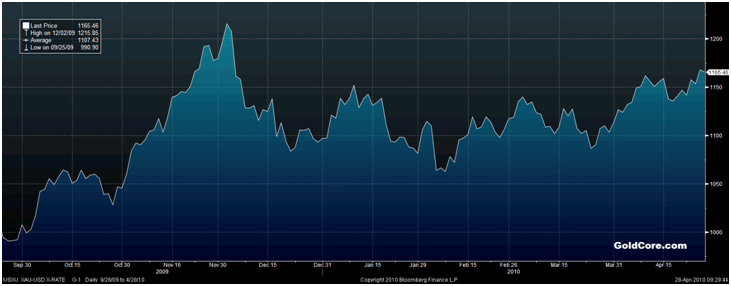

Gold in British pounds - 1 year (daily)

Gold is rising on the growing realization that while the Greek debt tragedy may be reaching its end, we may only be in the middle acts of a wider international tragedy. Fixed income traders are beginning to price in worst case scenarios with a significant spreading of sovereign spreads. Indeed, market participants not known for alarmism are now warning that there is the potential for another Lehman style systemic meltdown. Some are even advocating the nuclear option of governments creating money in extremis in order to directly purchase government bonds on a massive scale. Given this scenario and the fact that we remain in the worst crisis since the Great Depression, investment and central bank demand is set to remain robust for the foreseeable future (see News).

Gold in British pounds - 30 day (tick) - new record highs last night at £768.86 per ounce

In a new Lehman style scenario gold could be susceptible to another bout of short term weakness (as leveraged players move to the sidelines) but increased safe haven demand for gold should see it recover quickly and continue to outperform other assets. In a world of continuing debt monetisation, quantitative easing and currency devaluation, gold is likely to remain an important asset allocation.

Soon after Portugal's downgrade by Standard & Poor's gold surged (rising from $1,145/oz to $1,172.60/oz) on safe haven demand. It rose strongly in dollars but by even more in other major currencies - indeed it was strong in all major currencies except the yen which was strong yesterday despite increasing concerns about the Japanese fiscal position. Investors are increasingly skeptical of governments abilities to magic away the significant fiscal challenges facing sovereign nations and the very uncertain situation is benefitting gold.

Gold needs to close above resistance is at $1,165/oz (which was breached yesterday but not closed above) before it can challenge the December record high at $1,226/oz (see chart below).

Gold's recent gains do not the severity of the Greek debt and European sovereign debt crisis justice. Indeed, it looks like there may be delayed reaction to the crisis with many markets remaining complacent about the ramifications of contagion in international debt markets. It is difficult to tell why gold has not gotten a bigger bust yet. The operative word here is likely 'yet'. As was the case at the outset of the crisis, some bears pointed to gold's fall in price when Bear Stearns collapsed and then Lehman's collapsed as some kind of proof that gold was no longer a safe haven. In the fullness of time, how wrong they were. Those keeping a historical perspective and remaining patient will be rewarded.

Gold in USD - 6 months (daily) - resistance is at $1,165 and then at $1,200 and $1,226 per ounce

Indeed the recent record (nominal) highs for gold in euros and Swiss francs likely portend coming new record highs in dollars in the coming weeks.

It is hard not to like gold at this time as the fundamentals are extremely favourable. Having said that those taking speculative punts using leverage could get burnt as gold prices could fall in the short term prior to challenging the record at $1,224/oz and possibly as high as $1,500/oz later this year.

Silver

Silver has dipped from $18.21/oz to $18.04/oz this morning in Asia. Silver is currently trading at $18.09/oz, €13.74/oz and £11.91/oz.

Platinum Group Metals

Platinum is trading at $1,727/oz and palladium is currently trading at $553/oz. Rhodium is at $2,900/oz.

News

Gold holdings in the SPDR Gold Trust, the biggest exchange-traded fund with gold bullion holdings, increased for a second day to a record 1,146.83 metric tons yesterday.

Gold assets in exchange-traded products of ETF Securities Ltd. in London and Zurich rose 0.4 percent yesterday to 7.68 million ounces, according to information on the company's Web site. All of the gain was in London, according to the company. (Bloomberg)

Embattled Goldman Sachs Group Inc. has reduced its gold forecasts because of expectations that a "broadening economic recovery" will lead to higher U.S. interest rates. Gold will average $1,165 an ounce this year and $1,350 in 2011, Eugene King, Peter Mallin-Jones and Andrew Byrne said in a report yesterday. It is worth remembering that Goldman Sachs have been bearish on gold in recent years and do not have a great track record at predicting gold price movements.

Russia's total gold output was down 7.9 pct y/y in Q1, 2010. Total gold output, including gold produced as a by-product and refined from scrap, fell a smaller than expected 7.9 percent year-on-year in the first quarter to 28.9 tonnes, the industry lobby said. That was slightly less than the 10 percent decline forecast by the lobby, the Russian Gold Industrialists Union.. Mined output fell 11.9 percent to 23.3 tonnes, while the volume of gold produced as a by-product and refined from scrap rose, the lobby said in a statement on Tuesday. Russia is the world's No. 5 gold producer and its reserves are second only to South Africa's. The country raised gold production by 11.2 percent to 205.2 tonnes (6.6 million ounces) in 2009 and plans further increases as new mines come on stream. "The fall in gold mining output occurred mostly in three regions -- Krasnoyarsk region, Amursk region and Chukotka," the union said. "The main reason was the fall in the gold content in the ores being mined." (Reuters)

Reuters reports that central banks are set to remain "large net buyers of gold for the foreseeable future, for years to come," according to the CPM Group. Their latest report said that central banks turned to buyers from sellers of gold for the first time in 20 years in 2009, driven by Chinese stockpiling and worries over global currencies. Investment demand in gold is expected to grow further this year, due to safe-haven demand amid economic uncertainty, the New York-based company said in its Gold Yearbook 2010. The annual report said, official gold demand resulted in net buying of 15.1 million ounces (470 tonnes) in 2009, the sector's first net addition since 1988. Central banks rekindled interest in gold as a hedge against potential repercussions after the worst economic crisis since the Great Depression.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.