Gold Strong On Eurozone Debt Crisis 'Canary in the Coalmine' as U.S. Deficits Soar

Commodities / Gold and Silver 2010 Apr 29, 2010 - 05:24 AM GMTBy: GoldCore

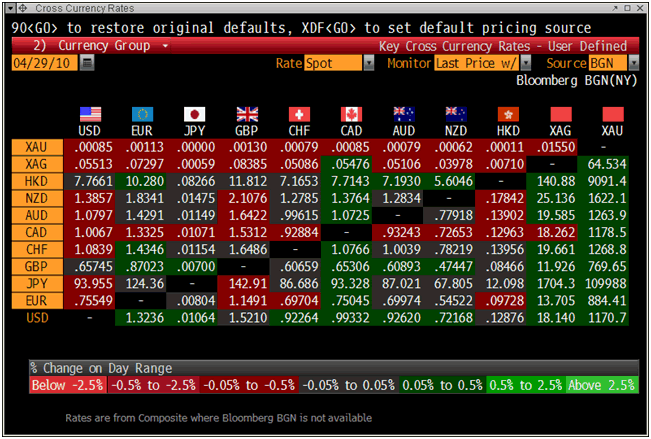

Gold finished at its highest level since early December and had its fourth consecutive day of gains Wednesday as a debt ratings downgrade for Spain and surging credit spreads created new fears of the eurozone sovereign debt crisis spreading and financial contagion. Gold for June delivery gained $9.60/oz, or 0.8%, to $1,171.80 an ounce on the Comex division of the New York Mercantile Exchange. Gold remained near record nominal highs in pounds, euros and Swiss francs. Some of the gains were given up in Asian trade overnight prior to gold rising again in all currencies in early European trade this morning. The US dollar and British pound have fallen and this is seeing gold rise again today (see currency table below).

Gold finished at its highest level since early December and had its fourth consecutive day of gains Wednesday as a debt ratings downgrade for Spain and surging credit spreads created new fears of the eurozone sovereign debt crisis spreading and financial contagion. Gold for June delivery gained $9.60/oz, or 0.8%, to $1,171.80 an ounce on the Comex division of the New York Mercantile Exchange. Gold remained near record nominal highs in pounds, euros and Swiss francs. Some of the gains were given up in Asian trade overnight prior to gold rising again in all currencies in early European trade this morning. The US dollar and British pound have fallen and this is seeing gold rise again today (see currency table below).

Gold is currently trading at $1,170/oz and in euro and GBP terms at €884/oz and £769/oz near recent record (nominal) highs at €894.25 per ounce and £774.53 per ounce. Resistance at $1,165/oz was taken out yesterday which should lead to gold challenging the December 2009 record high at $1,224/oz.

Cross Currency Rates at 1000 GMT - Showing Gold as Strongest Major Currency Today

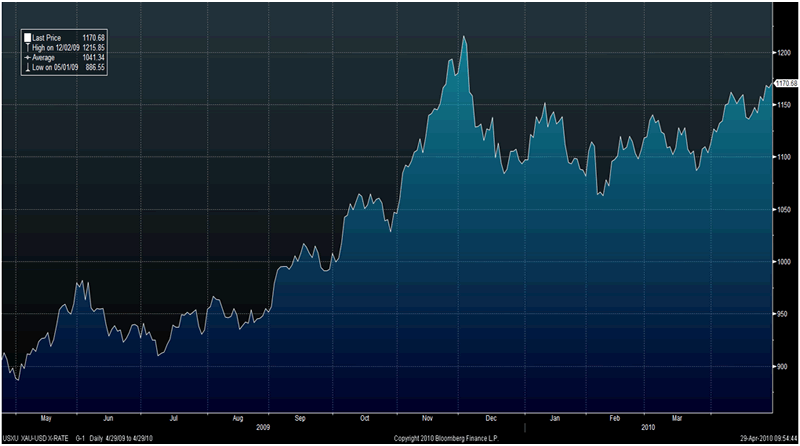

Volatility has risen in equity and bond markets as risk aversion has increased; this is also the case in the gold and currency markets. The increased volatility seen in the gold market in recent days suggests a sharp move in prices is imminent. Given the continuing risk of financial contagion it seems very likely that the move will be to the upside and gold will target new record highs in dollars (see "gold in US dollars 1 year" chart below) as it has already done in Swiss francs, euros and British pounds.

While all the focus has been on sovereign debt issues in the eurozone, markets have as of yet not put the poorly fiscal situation of the US under the spotlight. There is a real, and largely unacknowledged, risk that the sovereign debt crisis being experienced by eurozone countries could soon envelope other large industrial nations including the US. Greece may be the canary in the coalmine that presages other governments experiencing similar difficulties - this is the 'elephant in the room' which markets remain sanguine about.

Gold in US Dollars - 1 Year (Daily)

President Barack Obama's top budget adviser, Peter Orszag, warned yesterday that the US government must significantly alter its policies in order to tackle a growing mountain of debt. Orszag warned that huge deficits could cause the market to lose confidence in a government's creditworthiness. Out-of-control deficits could also "require increased borrowing abroad which will mortgage our future income to foreign creditors." President Obama echoed his adviser and told a commission that will suggest ways to rein in soaring US budget deficits to consider every possible remedy to put the country on a path toward fiscal health.

In the US, federal spending is set to soar to almost $4 trillion in fiscal 2011, up from $3.5 trillion. The deficit last year hit $1.4 trillion, a post-World War II record, which equaled about 10% of the nation's $14 trillion economy. The Congressional Budget Office forecasts that the yearly gap between spending and tax revenue will be in the trillion dollar-plus range for much of this decade, with the public debt skyrocketing from $9.2 trillion this year to $20.3 trillion in 2020. These debts will pose a challenge even to the world's largest and most dynamic economy. But as sizeable as these debts are, the even long term threat is from the massive unfunded liabilities for such services as Social Security and Medicare, as well as a myriad of additional federal government obligations. These unfunded liabilities are now well beyond the $100 trillion level. Some calculate the number is closer to $137 trillion.

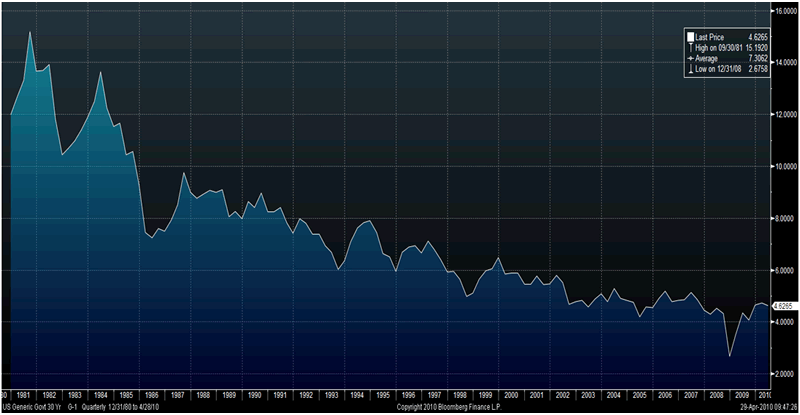

US Treasury 30 Year - December 1980 to April 2010 (Quarterly)

Factor in the demographic challenge of the baby boomers retiring in the coming years and future rising interest rates from their current multi-generational lows (see chart above) and it is clearly evident that America's debt picture is far from rosy. It will pose long term challenges to the dollar and likely lead to much higher inflation and rising interest rates. These macroeconomic conditions would favour gold as they did in the 1970s.

Silver

Silver has dipped from $18.13/oz to $18.05/oz this morning in Asia. Silver is currently trading at $18.13/oz, €13.70/oz and £11.92/oz. Silver remains very undervalued on a historical basis vis-à-vis commodities, precious metals and gold (see News).

Platinum Group Metals

Platinum is trading at $1,718/oz and palladium is currently trading at $547/oz. Rhodium is at $2,850/oz.

News

Bloomberg reports that holdings in the SPDR Gold Trust, the biggest exchange- traded fund backed by bullion, expanded 0.5 percent yesterday to a record 1,152.91 metric tons, according to figures on the company's Web site. Gold assets of ETF Securities in London and Zurich jumped 0.4 percent to 7.7 million ounces.

Prices may rally to a record $1,500 an ounce this year as the European sovereign debt crisis escalates, with Greece "going under" and investors losing confidence in paper currencies, David Crichton-Watt, manager of Phoenix Gold Fund Ltd., said in an interview today (Bloomberg).

Nouriel Roubini said yesterday that rising sovereign debt from the U.S. to Japan and Greece will ultimately lead to higher inflation or government defaults. "While today markets are worried about Greece, Greece is just the tip of the iceberg, or the canary in the coal mine for a much broader range of fiscal problems," Roubini, 52, said today during a discussion on financial markets at the Milken Institute Global Conference in Beverly Hills, California. Increasing tax revenue won't be enough "to save the day" (Business Week).

Richard Russell, the venerable and highly respected newsletter writer wrote in his most recent newsletter about how he remains bullish on gold and particularly bullish on silver.

"I firmly believe we're witnessing a great primary bull market in gold. This bull market is opposing a long-term bear market in fiat or non-intrinsic currencies. Since there is no discipline putting a limit on fiat-currency production, I believe in our lifetimes we will see the end of fiat currencies as acceptable substitutes for real money. When that happens, there will be no ceiling for gold. In their guts and in their hearts, every seasoned investor knows this, which is why the bull market in gold will continue.

How high will gold go? Wrong question, how low will fiat currencies go? The answer, as Bob Dylan might say, is "blowin' in the wind."

I think gold is now under heavy accumulation. I note that gold is often knocked down in the thin after market. I'm beginning to think that this is done on purpose. Large interests who want to accumulate gold have a reason to want to knock gold down, and thereby be able to accumulate it at "reasonable" prices. The last thing they want is for gold to run away on the upside before they have accumulated as much as they are able. I think this is particularly true of China and Russia and other Asian nations.

Silver has been called "the poor man's gold." Never mind, what I'm interested in is whether silver will remain in this ascending channel. A year ago silver was selling like something out of a compost heap. In early 2005 you could have bought all the silver you wanted in the six dollar range. Now silver will cost you around 18 dollars an ounce. Today an ounce of gold will buy 64 ounces of silver. The historical ratio has been around 16 to 1, so silver compared with gold is cheap. Nobody knows whether silver will climb back to that old ratio, but we do know that silver is cheap."

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.