How “Correction Catalysts” Could Derail The Stock Market

Stock-Markets / Stock Markets 2010 Apr 30, 2010 - 03:26 AM GMTBy: Kent_Lucas

“Correction Catalysts” are everywhere, but the stock markets keep going up as investors don’t seem to care. You don’t have to get off the rising market train, but be wary of a looming correction.

“Correction Catalysts” are everywhere, but the stock markets keep going up as investors don’t seem to care. You don’t have to get off the rising market train, but be wary of a looming correction.

Hindsight is 20/20 and, unfortunately when it comes to stock markets, bad history repeats itself. Investors and economists tend to have short, selective memories. In most cases, major crashes or corrections shouldn’t come across as a surprise, but still can be quite painful, as most market participants typically can’t get out of the way in time.

After every bubble or meaningful market correction, there are always stories of those who successfully predicted the events behind such collapse – and stories of those who profited from it, even while most lost their shirts.

By now you might know that prominent hedge fund investor John Paulson made a killing off the subprime mortgage crisis. And in the news today is how firms like Goldman Sachs ended up profiting nicely while their clients took the knife.

And you probably know that a few government bodies, including Alan Greenspan and the Federal Reserve, essentially ignored and missed clear calls for concern and reform of the mortgage industry.

A 2007 New York Times article, titled “Fed Shrugged as the Subprime Crisis Spread,” talks about all the warnings that were given to officials and basically ignored:

Mr. Greenspan and other Fed officials repeatedly dismissed warnings about a speculative bubble in housing prices. In December 2004, the New York Fed issued a report bluntly declaring that “no bubble exists.” Mr. Greenspan predicted several times – incorrectly, it turned out – that housing declines would be local but almost certainly not nationwide.

The trouble now is that, once again, “correction catalysts” are in plain view. My point is that a lot of us believe something will upset this train ride, as there are potential global problems lurking. These “correction catalysts” include:

- an expansion of Greece and European debt problems

- implosion of U.S. commercial real estate

- the ill effects of a fragile jobless consumer

- the bursting of China’s bubble

- simply overvalued U.S. equity prices

We know of these, and there are several others. Could events like these cause a market crash or correction, or at least hinder more upside? Yes, they certainly could.

Walking down memory lane, we see that many events like the subprime crisis were visible and most, in hindsight, I would argue were “predictable.” In the 1920s, many economists even saw the Great Depression coming. They probably didn’t get the magnitude right, or the profound effect it would have on the market and our country, but the signs were out there. The same holds for global events such as Japan’s lost decade, or the Internet bubble and subsequent crash at the beginning of the last decade.

Of course, not all major events are predictable or contemplated in advance. Some major events are wholly unpredictable. These are defined as “Black Swan Events” by scholar Nassim Taleb, based on the 16th-century historic idea that black swans didn’t exist or were impossible to find.

These black swan events are a surprise, and count as major events that are understood only after the fact (although that doesn’t do investors much good). Taleb cites World War I, Sept. 11, 2001, and the impact of the Internet as examples.

But for the most part, we should worry more about events that we have a clue about, and less about potential black swan events. And as I hopefully have pointed out, the hardest part isn’t finding the “correction catalysts” – I listed a few that you’ve heard of already. The hard part is knowing if, when, and to what extent these events will hit us and our portfolios.

Corrections are a “natural” part of the cycle, and the market doesn’t just keep going up without taking a breather. So don’t be surprised; be prepared for a possible derailment. I’m just not sure which “correction catalyst” it will be.

Lumber Prices Going Through the Roof

One looming “correction catalyst” is the U.S. housing market. It’s hard to imagine that the U.S. demand for housing can truly rebound strongly, given very high unemployment rates and foreclosure levels.

But most recent data says it is. New home seasonally adjusted sales jumped 27% in March and building permits were up close to 7% – solid results even after factoring in the impact of tax credits and mild weather.

But the surge in lumber and timber prices is due more to supply issues than to the renewed demand for housing.

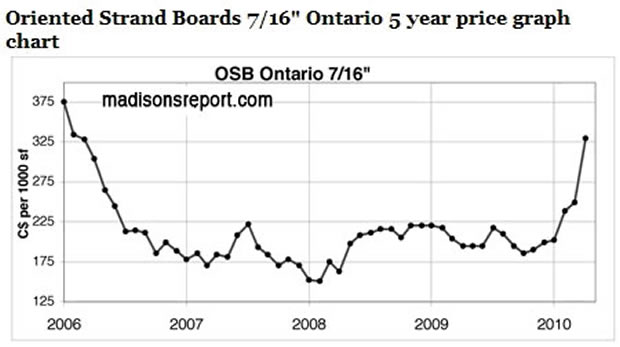

That chart below looks at Oriented Strand Board (OSB), which is an engineered composite wood board product, produced largely in North America, and is a substitute for plywood. Thus, it is a good proxy for lumber prices, which have similarly shot up to the highest levels since 2006.

The chart shows how OSB prices have more than doubled from 2008 lows, but are still short of 2005-2006 peak prices.

Source: Madison’s Lumber Report

Don’t let the news fool you – the high price for lumber is supply driven, not due to increased demand.

You see, when the housing market was headed toward disaster in 2008-2009, new home sales and the market came to a halt. Input demand was set to drop. Just as demand for appliances shut down, demand for the wood used to make houses also shut down. Timber plantings and mill production came to a screeching halt. For example, softwood timber production in 2009 was 50% less than levels in 2005, and over a hundred North American mills have shut down over the past few years.

Also, forest products companies, timber owners and mill producers dramatically cut their inventory, had to sharply cut prices and in many cases were forced to close or go bankrupt.

But now, as the housing market is showing signs of recovery, there isn’t enough timber and wood materials to go around to meet renewed demand. It will be a few quarters before wood products supply and inventories recover and bring down prices.

The consequences will be felt by homebuyers and construction companies. It could mute any housing recovery, given the extra costs being passed on to the homebuyer. In the meantime, imagine adding 20% or more to the cost of a new home – that has to deter or delay potential buyers. Another concern to keep an eye out for as the equity markets continue to defy gravity.

Source: http://www.taipanpublishinggroup.com/taipan-daily-042710.html

By Kent Lucas

http://www.taipanpublishinggroup.com/

Kent Lucas is the Editor of Taipan's Safe Haven Investor and a regular contributor for free market e-letter Taipan Daily. He has a Bachelor’s Degree in Economics from Harvard University, his Master’s from Stanford University and over 20 years of financial and business experience. His background includes seven years as a research analyst and portfolio manager for a leading investment management firm. He has also actively managed $1 billion worth of equity assets, with particular attention to multi-industrial companies along with auto, construction and farm equipment-related companies. Kent has also worked in leading financial institutions’ divisions including tax-exempt derivatives, corporate trust, and equities sales and trading.

As the Editor of Taipan’s Safe Haven Investor, Kent uses his stock market investment system and the 13F Disbursement Plan to uncover the most profitable opportunities found in the SEC 13F Disclosure Form. Kent extensively combs through thousands of stocks, managed securities, and the total market value of companies listed on Form 13F, and then isolates the one or two stocks that are poised to deliver the best gains with the least risk.

Copyright © 2010, Taipan Publishing Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.