Stock Market More Bearish Food For Thought

Stock-Markets / Stock Markets 2010 May 01, 2010 - 08:02 AM GMTBy: Adam_Brochert

I do not believe in "pure" technical analysis (i.e. in a vacuum). Knowing that we are in a secular general stock bear market and secular Gold and Gold stock bull market colors my views. A pure chartist may see blue skies from here to Dow 20,000, but a deflationary secular private sector debt collapse plus helicopter Ben and his crew does not equal a new secular general stock bull market in my opinion. While I understand that currency debasement can mask real losses by propping up nominal price levels, I am a long-term Gold investor - not a paperbug. I understand the game and how its played, at least as much as a retail ant is allowed to.

I do not believe in "pure" technical analysis (i.e. in a vacuum). Knowing that we are in a secular general stock bear market and secular Gold and Gold stock bull market colors my views. A pure chartist may see blue skies from here to Dow 20,000, but a deflationary secular private sector debt collapse plus helicopter Ben and his crew does not equal a new secular general stock bull market in my opinion. While I understand that currency debasement can mask real losses by propping up nominal price levels, I am a long-term Gold investor - not a paperbug. I understand the game and how its played, at least as much as a retail ant is allowed to.

However, it is always important to remember that governments and central banks DO NOT CREATE THE PRIMARY TREND. They can distort it and prolong it, but they cannot change it. The secular turn in the private credit markets has already occurred. No banksta or apparatchik can change this fact. They can replace private sector debt with government debt, but the government is a lousy customer and makes the private debtor, in aggregate, look like a paragon of virtue. Governments will not only default without remorse, but will prosecute the lenders for lending them the money (and good luck repossessing any potential collateral backing the loan...)!

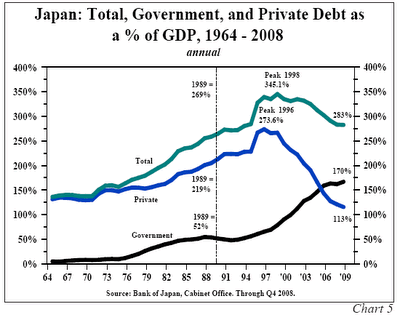

Let this chart of Japanese public versus private debt be a reminder of where we may be headed:

Just because the government steps up borrowing doesn't mean a recovery is going to take hold. I previously posted on a number of global stock indices, INCLUDING CHINA, that look like they might be breaking down. I'd like to continue the theme, as I see the U.S. stock market topping here, not continuing on to higher and higher levels in some type of eternal Keynesian bliss.

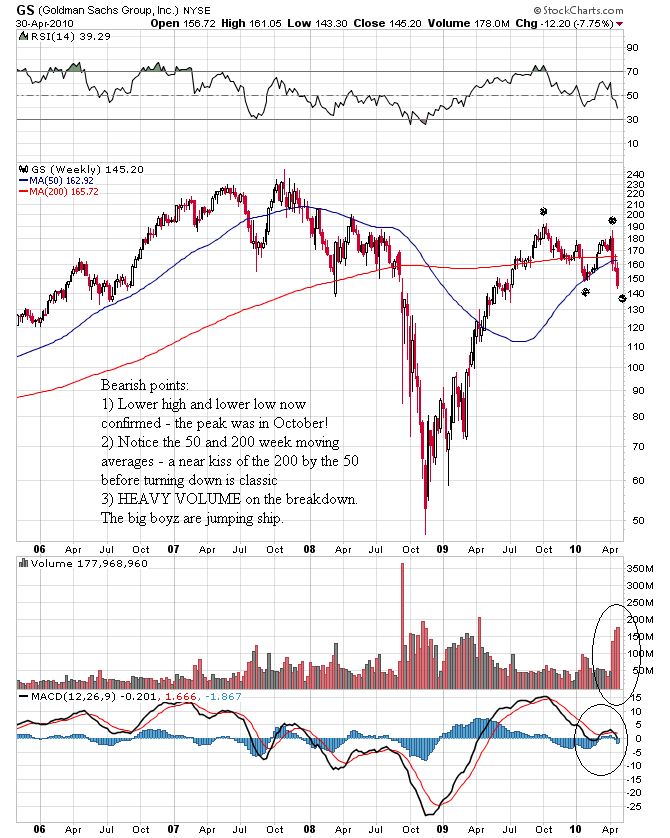

The poster child for all of people's economic and investing frustration (and not necessarily unjustly so) is Goldman Sachs (ticker: GS). Here's a 4 year 6 month weekly log scale candlestick plot of the price and volume action in this stock:

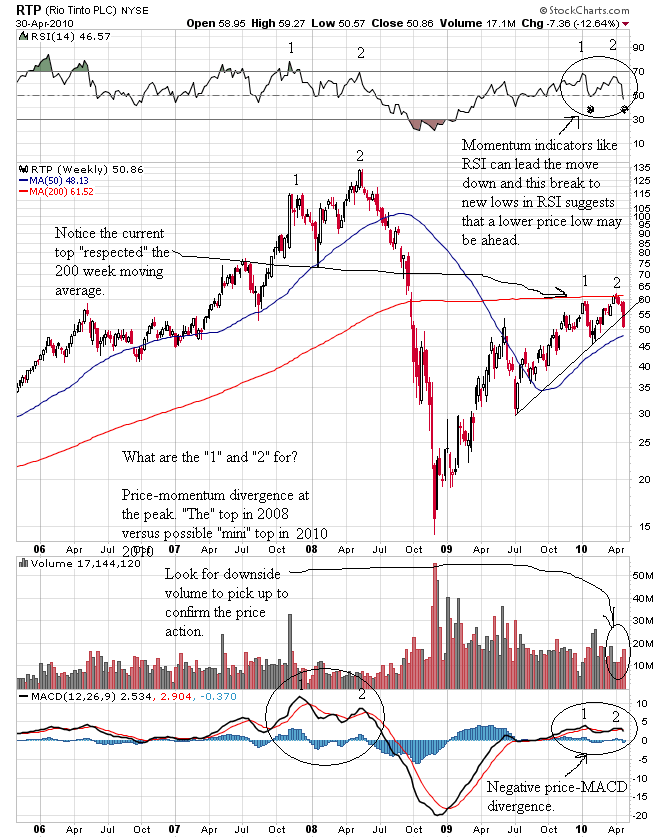

Not good when a bellwether breaks down. Rio Tinto (ticker: RTP), one of the world's biggest miners, also looks like it is getting ready to break down:

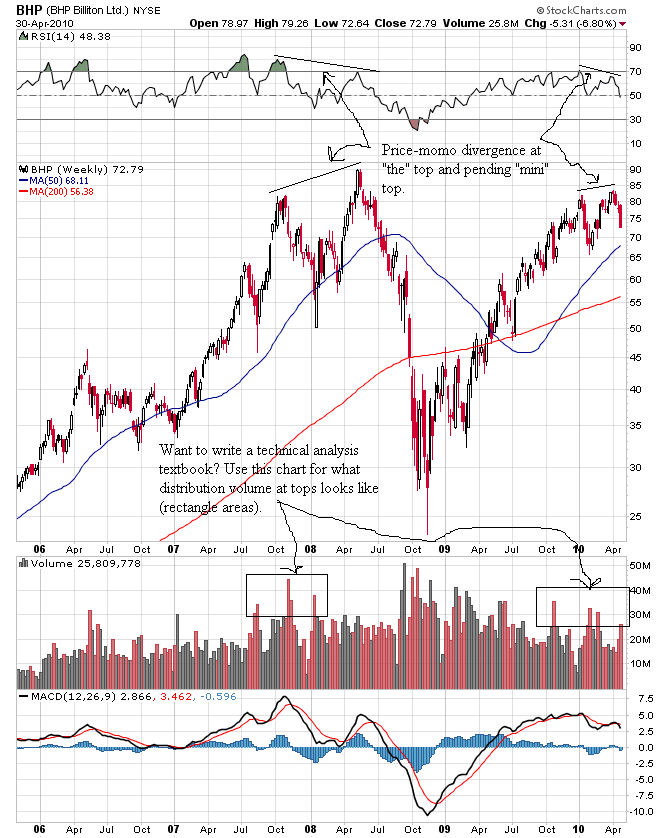

Speaking of base metal miners, which are an important sector to watch for the health of the global economy, the BHP Billiton (ticker: BHP) chart doesn't look so hot either:

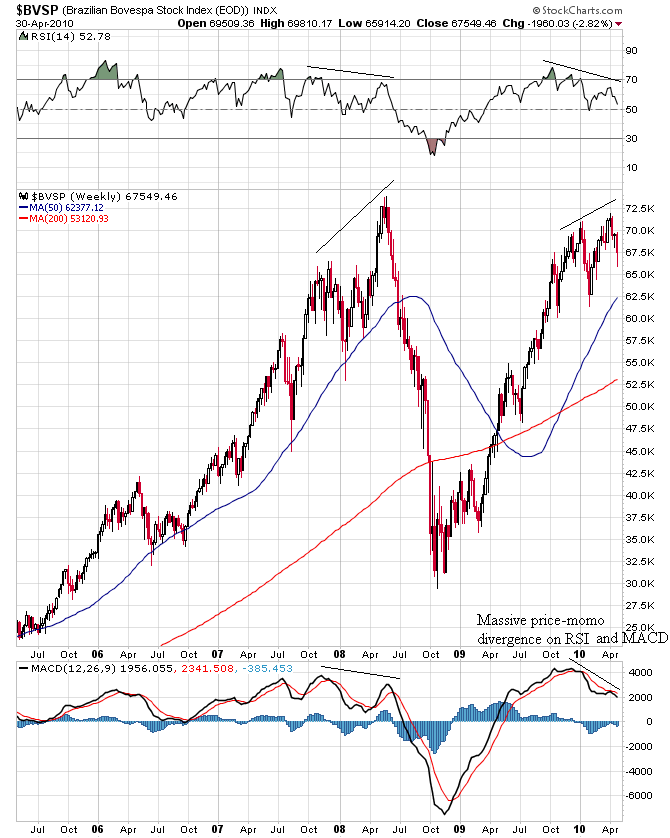

I also wonder if the Brazilian stock market ($BVSP) is working on a double top here:

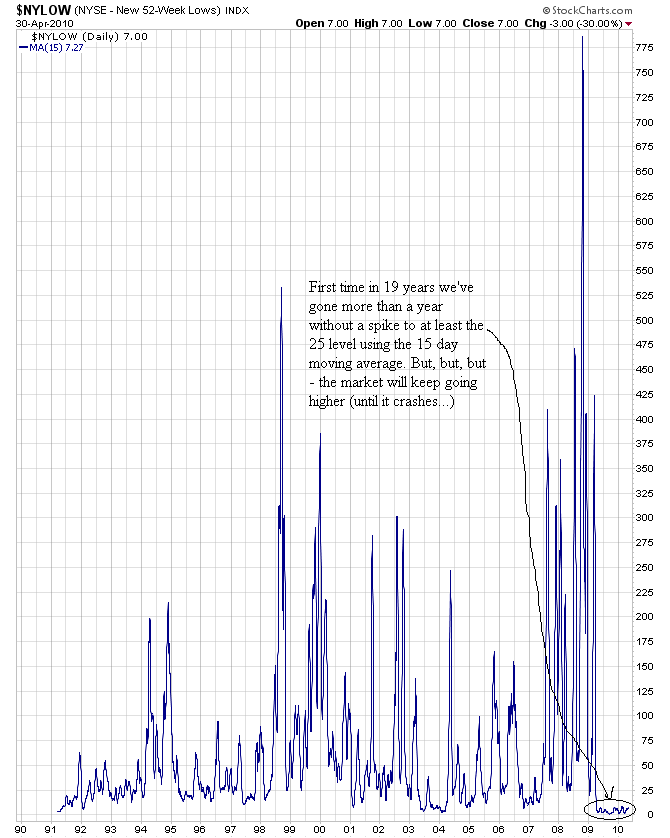

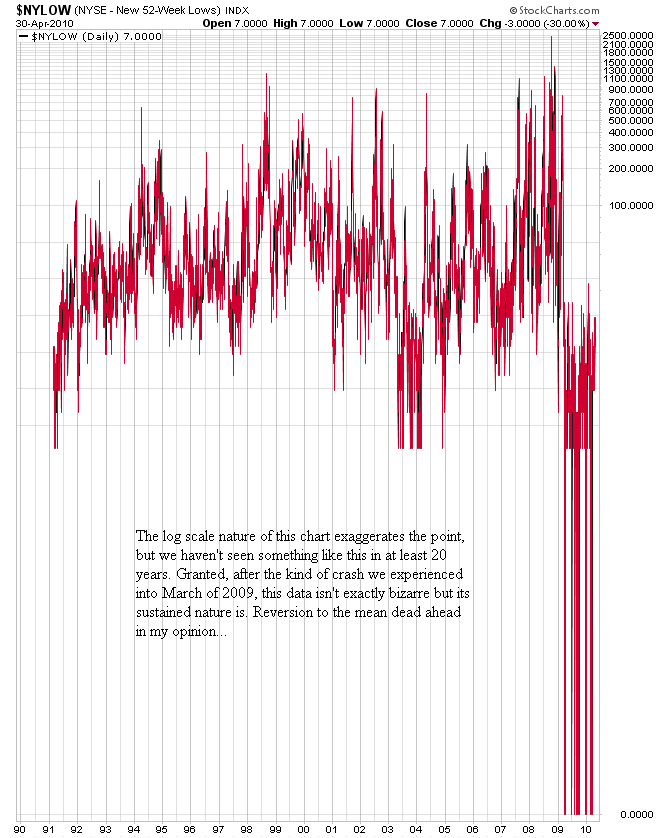

And to add to the technical data I posted when I asked if there were any stock market bears left the other day, the number of new 52 week lows in the New York Stock Exchange ($NYLOW) is showing a pattern unseen over the past 19 years (the data I have access to only goes back to 1991). I have heard many people speak about the number of new highs confirming the strength of this rally in general stocks. I would like to present the other side of the argument. To do so, I would like to show you the $NYLOW data using a 15 day moving average of this data over the past 19 years to smooth out the data using a linear scale chart. After that is a chart of the actual daily raw data on a log scale chart, which despite the noise gives a perspective on what we've been experiencing lately:

Those invested in Gold don't have to worry. While Gold stocks are volatile beasts, they have shrugged off many a cyclical bear market in the past. Of course, the Great Fall Panic of 2008 is still fresh in Gold stock investors' minds, but that doesn't mean a replay is in the cards. Gold is safer, but Gold stocks are due to outperform the metal even if there is a stock bear market about to begin. You can invest in the U.S. Dollar instead of Gold if you want, but I'll stick with real money for the next deflationary impulse, which is when the point of recognition that our international monetary system is going to fail reaches a critical mass of investors. Do you honestly believe the Portuguese, Irish, Italian, Greek and Spanish PIIGS-y investors (among other non-American global investors) are going to put their savings in the U.S. dollar rather than Gold? HAHAHAHAHAHAHAAAAAAAAAAAAAAAAAAA!

Until the Dow to Gold ratio gets back to 2 (and we may get to 1 or less this cycle), there is little reason to be invested in the general stock markets. This may become apparent again soon if technical analysis is to be trusted.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2010 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.