Stock Market Top and Correction Trend Forecast to Follow January Pattern

Stock-Markets / Stock Markets 2010 May 02, 2010 - 12:09 PM GMTBy: Chris_Vermeulen

The past few weeks I have been talking about the SP500 forming a top similar to the January top we saw earlier this year. Well the charts below show exactly what I have been waiting for to unfold and I think the time has come for the market to take a healthy breather before continuing this strong bull market which could last another 12 -24 months before really topping out.

The past few weeks I have been talking about the SP500 forming a top similar to the January top we saw earlier this year. Well the charts below show exactly what I have been waiting for to unfold and I think the time has come for the market to take a healthy breather before continuing this strong bull market which could last another 12 -24 months before really topping out.

SPY – SP500 ETF Trading Chart

I am showing the SPY etf because that’s a fund most people know and trade, but this analysis is the same for trading futures like the ES M0 Mini SP500 contract.

You can see the similar price action which formed in January and what has happened recently. I feel we are about to see a correction which would last several weeks which is very exciting for us traders.

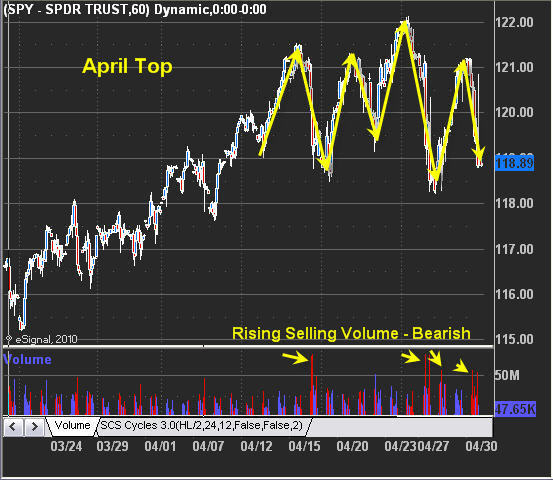

SPY April Top – SP500 ETF Trading 60 Minute Chart

This chart shows the past few weeks of price action with the market becoming more volatile with waves of selling and buying. This indicates exhaustion and generally leads to a market correction or at least some sideways movement to digest the recent rally before continuing higher.

SPY January Top – SP500 ETF Trading 60 Minute Chart

Take a look at this chart of January….

Very similar price and volume action.

SPY January Sell Off – SP500 ETF Trading 60 Minute Chart

This chart shows the sell off last January and the setups I had when the market reached extremes generating trades with the underlying down trend.

SP500 Day Trading & Swing Trading Opportunities:

I hope these charts help you to see how I read the market and what I am looking for in trade setups. While its easy to see these setups in hindsight it requires a lot of research and experience in-order to time these plays in real-time when emotions are flying high and with BNN, Bloomberg, CNBC and other newsletters all saying different things…

Some words from fellow traders:

"I just wanted to let you know how much I’ve learned from you already. Understanding that you don’t always have to be in the market because another Low Risk Setup is just around the corner tops my list. Keep up the good work.” Matt Brennan, CA, USA

“Hey, Chris!

I really like the way you think and I’m already learning some useful stuff. I tend to be too aggressive, that’s another reason I picked you – I think you have just the medicine I need to learn to be a bit more cautious and to manage risk better. My biggest weakness is jumping the gun. Pretty typical, I guess. Already I can see I will learn to improve from following your lead.” George Faison, VA, USA

If you would like stock market training, how to find low risk setups with great potential along with my trading signals then check out my websites below:

Gold and SP500 ETF Swing Trading Signals: www.TheGoldAndOilGuy.com

Intraday, Swing Trades and Trading Strategy: www.FuturesTradingSignals.com

Trade Explosive Stocks: www.ActiveTradingPartners.com

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.