Gold Surges To New Record Highs in Swiss Francs, Euros and Pounds

Commodities / Gold and Silver 2010 May 04, 2010 - 10:20 AM GMTBy: GoldCore

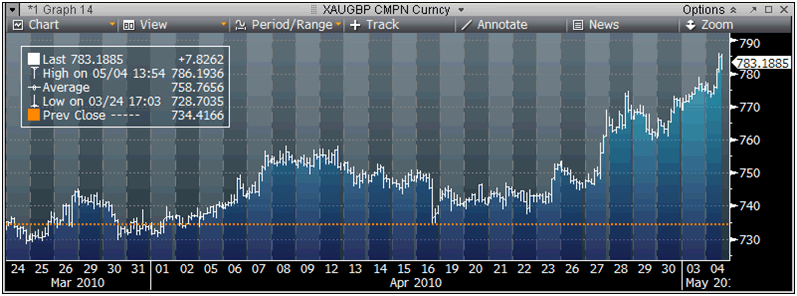

Gold rose to new five month highs in New York on signs of increased investment demand for the metal as an alternative to the euro and other currencies. Bullion surged to new nominal record highs in euros, Swiss francs and British pounds (see charts), extending gains this year as concern about sovereign debts in Europe encouraged investors into the safe haven of gold. Despite the yen being higher against all other major currencies, gold rose to 112,669 Japanese yen an ounce, the highest price in yen since February 1983.

Gold rose to new five month highs in New York on signs of increased investment demand for the metal as an alternative to the euro and other currencies. Bullion surged to new nominal record highs in euros, Swiss francs and British pounds (see charts), extending gains this year as concern about sovereign debts in Europe encouraged investors into the safe haven of gold. Despite the yen being higher against all other major currencies, gold rose to 112,669 Japanese yen an ounce, the highest price in yen since February 1983.

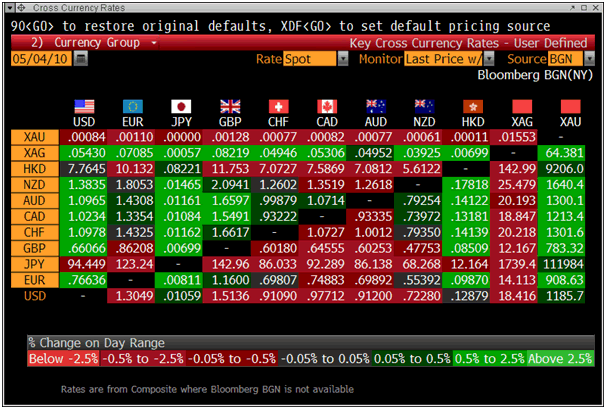

Intraday Cross Currency Rates at 1500 - Showing Gold as Strongest Currency with USD and JPY also strong

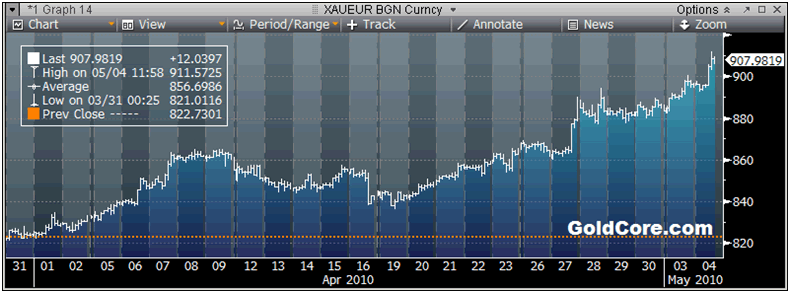

Gold rose to as high as $1,192.15/oz early in New York before profit taking and strong selling sat gold give up some of its earlier sharp gains. Gold is currently trading at $1,186/oz and in euro and GBP terms, at €907/oz and £783/oz respectively.

Gold in Euros - 30 Day (Tick)

Gold was up 5.3 percent in April, its biggest one-month rise since November 2009, as credit ratings downgrades of Greece, Spain and Portugal unleashed a wave of risk aversion, which led to diversification into gold. This diversification looks set to continue as allocations to gold by investors internationally remain very small vis-à-vis allocations to equities, bonds and cash.

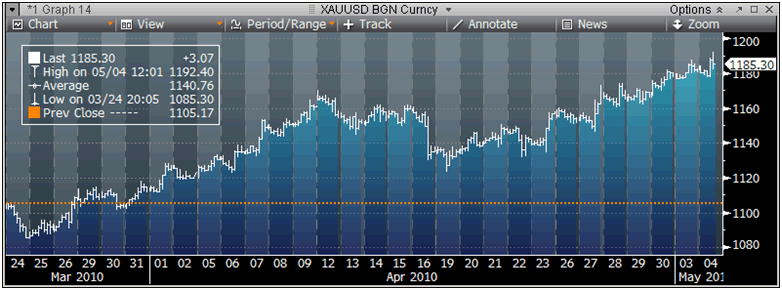

Gold in USD - 30 Day (Tick)

Last week's and last month's higher closes will not have gone unnoticed by technically minded traders who will likely choose to make the “trend their friend” which should see prices reach new record highs in dollars - as have already been seen in sterling, euros and Swiss francs. Therefore, gold looks good to move back toward the December high, a record high of $1,226.10 an ounce.

Gold in GBP - 30 Day (Tick)

The International Monetary Fund's gold reserves declined by 18.5 metric tons (about 595,000 ounces) in March, according to figures from the World Gold Council. Reserves of gold at the Washington-based lender were 981.2 tons at the end of March compared with 2,999.7 tons at the end of February, World Gold Council Managing Director George Milling-Stanley said by e-mail. IMF spokesman Alistair Thomson declined to comment. IMF gold reserves are denominated in special drawing rights, set at 35 SDRs an ounce. A change in the reserves is therefore not a reflection of price moves. The IMF plans to sell a total of 403.3 tons of gold. India, Mauritius and Sri Lanka bought 212 tons last year and the remainder is being sold on the open market. February sales were 6 tons, which combined with the March sales would leave 167.2 tons as of the beginning of last month.

The Chinese, Indians and others including some western financial institutions such as Sprott Asset Management are all on record as being interested in buying the IMF gold. The IMF's gold reserves are quite small considering the huge dollar reserves of many large creditor nations and huge pools of liquidity internationally.

Silver

Silver has dipped from $18.70/oz to $18.37/oz this morning in US trading - succumbing to very aggressive selling, likely from investment banks. News that the US Department of Justice is considering investigation of manipulation of the silver market will be welcomed by those who believe silver has been artificially suppressed in recent years.

Platinum Group Metals

PGMs are under pressure today as are most commodities. Platinum is trading at $1,700/oz down 1.7% and palladium is currently trading at $524/oz down 3.7%. Rhodium is at $2,850/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.