Uranium, Junior Resource Stocks Investor Success Follows Management Success

Commodities / Uranium May 05, 2010 - 09:29 AM GMTBy: Richard_Mills

One of the soundest strategies for investing in junior resource stocks is investing in management with a proven track record in creating value for their shareholders.

One of the soundest strategies for investing in junior resource stocks is investing in management with a proven track record in creating value for their shareholders.

Investors follow these successful mine builders from company to company, year after year, as they build and sell off their success stories to larger companies.

I've been watching one such company for a while. It's run by a management team that has multiple successes behind them - and they just reported their highest grade drill results ever causing the stock to trade multiple times its normal volume.

This junior is headed up by Greg Sedun - a former mining and securities lawyer. He was a founding director of Diamond Fields Resources which was sold to Inco for $4.3 billion in 1996. He was then a founding director of Adastra Minerals which sold to First Quantum Minerals for $300 million in 2006. Mr. Sedun was also a founding shareholder of Peru Copper which sold to Chinalco for $840 million in 2007.

At some point, a string of "wins" becomes a proven track record in creating value for shareholders.

Mr. Sedun is currently the CEO of Uracan (URC-TSX) - a little known Canadian exploration company which is developing one of the largest uranium resources in Canada.

Sedun is partnered with Clive Johnson and Tom Garagan - the two driving forces behind Bema Gold. Bema Gold was sold to Kinross in 2008 for over $3 billion. Also involved in Uracan are Frank Giustra and Gordon Keep - the brain trust behind the single most successful buyout of the uranium mania - they sold Urasia Energy to Uranium One for $3 billion in 2007. That deal went from a 40 cent seed financing to an $8 a share buyout in under two years!

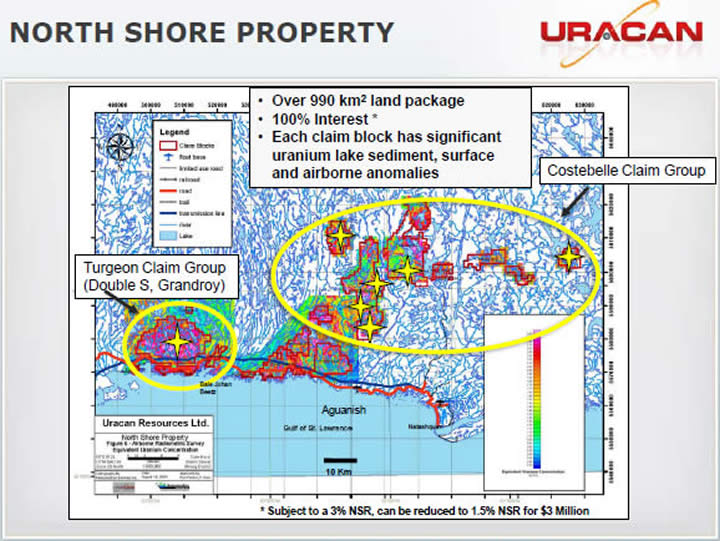

Success follows these guys. And although Uracan has explored only 4% of its 1000 sq km stake, it has already discovered 40 million pounds of compliant inferred U3O8. The average market valuation, according to Canadian brokerage firm Canaccord Capital, is $3 per pound in the ground, giving URC a theoretical valuation of $120 million, or roughly $1 share. Given that URC is trading at 19 cents and has a market cap of $25 million, this suggests a promising value play.

Initial drill results were released this week from a new zone at Uracan's North Shore Property in Quebec, the Costebelle, showing grades of almost one pound per tonne. At a long term price of $58 per pound of uranium, Uracan's Costebelle claims are showing an initial gross metal value of $45-$50 per tonne.

The drill results returned grades of 480 parts per million (ppm 0.048% or 0.96 lbs/t) U3O8.

That's 50% higher grade than Forsys Metals and Bannerman Resources have with their African uranium deposits - Forsys has a $320 million market cap and Bannerman has an $80 million market cap. Uracan's uranium is in Quebec, Canada, which has been named the top mining jurisdiction in the world by the Fraser Institute, an independent think tank - North American mining assets often trade at a premium, not a discount.

It appears that Mr. Sedun has brought his Midas Touch to Uracan.

One thing we know for sure is that Sedun has a knack for getting in ahead of the big story, and staying with it until the end. His companies seek to add resources in an environment of surging spot prices. Diamonds, copper and cobalt - he sold them all at the end of extended runs.

Is Uranium due for a run?

Haywood Securities reported last week that uranium production was down at both the Olympic Dam and Rossing mines, two of the largest producers in the world - but the market did not pick up on this. Continued shortfalls are expected in the near to mid-term.

China has quietly approved the construction of 28 new nuclear power reactors by 2020. They are under pressure to convert to cleaner energy sources. Each reactor will require 300 tonnes of uranium a year.

In a recent financial report, Octagon Capital Corporation forecasts a 65% increase in the price of uranium by the year 2013.

These initial 12 URC drill holes into Costebelle represent a 350 m strike length and the system is open to depth and along strike. There are eight holes left to report on from the 20 hole winter program.

Greg Sedun is running a company with a large land package in a politically stable, geologically proven area and is reporting stellar drill results. His partners have also realized big gains for their shareholders in the last decade. Keep your eye on the coming drill results this summer.

Many can talk the talk, few can walk the walk, Sedun has proven, more than once, he is capable of walking the walk. For this reason alone Uracan should be on every energy investors radar screen.

Is it on yours?

By Richard (Rick) Mills

Copyright © 2010 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.