Gold and Silver Bullion in Euros, Pounds and Swiss Francs At New Record Highs as Contagion Spreads

Commodities / Gold and Silver 2010 May 06, 2010 - 06:36 AM GMTBy: GoldCore

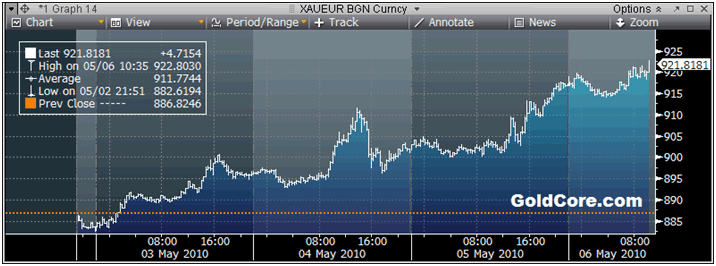

Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally.

Bullion denominated in euros and Swiss francs surged to new record highs this morning. The euro has again come under severe pressure as contagion risks increase. While all the focus is on Europe right now, similar risks face the UK and US economies and this is leading to significant safe haven demand for gold internationally.

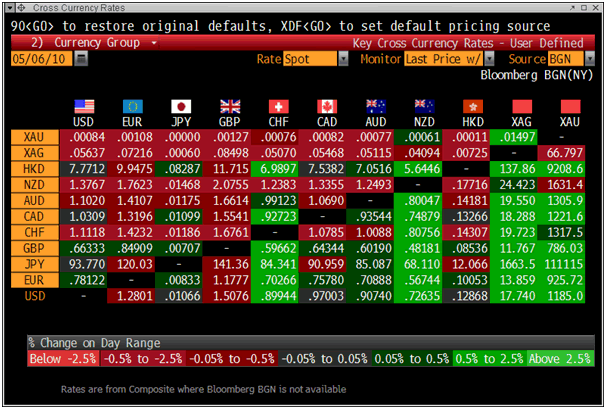

Prices have risen close to a new nominal record against the British pound and the highest level in yen since February 1983. Gold is slightly higher in most currencies this morning and significantly stronger in British pounds and euros - trading at $1,185.00, £786.03 and €925.72 per ounce this morning (see Cross Currency Table below). Markets await the ECB rate decision and UK general election with interest.

The real risk is that the massive debts in various OECD countries are simply too big to bail out and neither the German government, individual governments or even the IMF itself can afford to bail out Greece, Spain, Portugal, Italy, Ireland or other debt ridden countries. As the Greek debt crisis spreads to other European nations there is a real risk of the crisis creating an international monetary and financial crisis. The Asian monetary crisis of 1998 looks quite tame and management compared with the risks today.

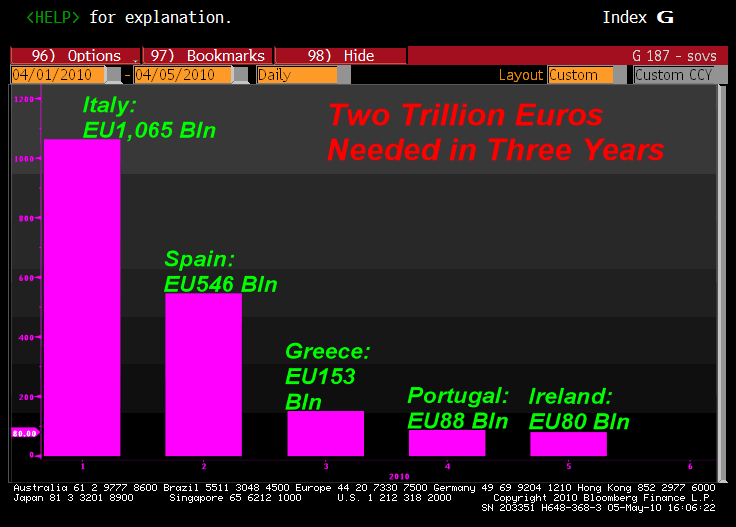

European nations will have to raise almost 2 trillion euros ($2.6 trillion) within the next three years to refinance maturing bonds and fund deficits as shown in the Bloomberg Chart of the Day.

Bundesbank President Axel Weber said the threat of contagion from Greece's fiscal crisis doesn't merit "using every means," rebuffing calls for the ECB to consider the 'nuclear option' of buying government bonds. The ECB's Governing Council meets today in Lisbon, the latest capital to be hit by the fiscal meltdown that's shaking the foundations of Europe's monetary union.

IMF International Monetary System Conference Next Week

This is why the International Monetary Fund (IMF) and the Swiss National Bank (SNB) are jointly hosting a High-Level Conference on the International Monetary System in Zurich on May 11, 2010. The conference is set to analyse the global financial crisis and will provide an opportunity to exchange ideas on a number of related topics, including sources of instability in the international monetary system, improving the supply of reserve assets, dealing with volatile capital flows, and possible alternatives to countries' accumulation of reserves as self-insurance against future crises. The conference will bring together a group of high-level participants, including central bank governors, other senior policymakers, leading academics, and commentators. The key objective of the conference is to examine weaknesses in the current international monetary system, and identify reforms that might be desirable over the medium to long run to build a more robust and stable world economy. The event will be concluded with a joint press conference by SNB Governor Philipp Hildebrand and IMF Managing Director Dominique Strauss-Kahn.

There is speculation that the conference may have favourable implications for gold with proposals that gold reserves may again have some form of role in bringing stability to the international monetary system.

Silver

Silver fell some 1.7% yesterday and is marginally higher today - trading at $17.53 per ounce.

Platinum Group Metals

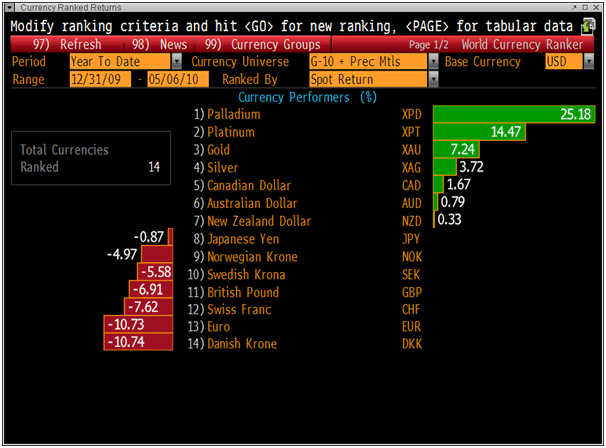

The PGMs were under pressure yesterday with both platinum and particularly palladium falling. Palladium fell the most in three months and platinum dropped to its lowest price in five weeks on speculation investors will favour gold as an alternative to currencies.

Both have recovered somewhat from their sharp falls this morning - platinum is trading at $1,670/oz marginally up and palladium is currently trading at $501/oz down another 1%. Rhodium is trading at $2,750/oz.

News

Increasing sovereign risk is lifting appetite for gold, Morgan Stanley said in a report today. "We like owning gold and expect further upside as sovereign risks intensify and real rates remain anchored," the bank said in the report. Gold may target its previous record as concern that financial turmoil will spread from Greece across Europe prompts investors to seek refuge in the metal, according to Morgan Stanley. "While contagion fears persist, gold should remain well supported and we expect gold to test its December 2009 high above $1,200 an ounce," analysts including New York-based Hussein Allidina wrote in a note to clients yesterday (Bloomberg).

H3 Global Advisors, a Sydney-based commodities and hedge-fund manager, is banking on gold's advance to $1,500 an ounce in the next year and reducing its exposure to industrial metals such as nickel (Bloomberg).

Petropavlovsk Plc said its first-quarter attributable gold output fell 37 percent to 65,600 ounces. Thereby continuing the trend seen in recent months of gold mining companies output falling primarily due to lower ore grades.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.