Gold 'Decouples' on International Debt Crisis, Forecast to Reach $3,000 Per Ounce

Commodities / Gold and Silver 2010 May 07, 2010 - 04:30 AM GMTBy: GoldCore

The sharp sell off on Wall Street and with equities internationally saw gold decouple and surge in all currencies yesterday. Oil, commodities and bonds also fell sharply in incredibly volatile trading.

The sharp sell off on Wall Street and with equities internationally saw gold decouple and surge in all currencies yesterday. Oil, commodities and bonds also fell sharply in incredibly volatile trading.

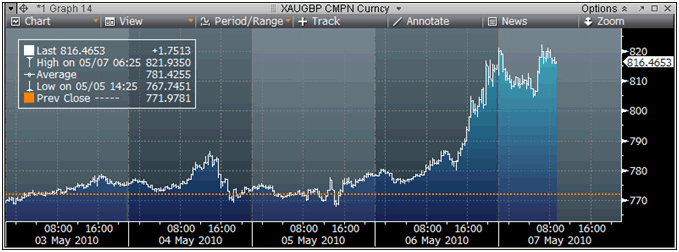

Gold was up by more than 2% in dollar terms and by more than 3.5% in euros and pounds as the euro and pound fell sharply on contagion fears, hung parliament and economic concerns respectively. Gold reached new record nominal highs in sterling, euros and Swiss francs and 27 year highs in Japanese yen, also reaching a five-month high in dollars. Given the scale of the international debt crisis, the December record (nominal) high of $1,226 per ounce (interday) could be reached in the coming days and respected analysts are now forecasting gold to rise to $3,000 per ounce (see News).

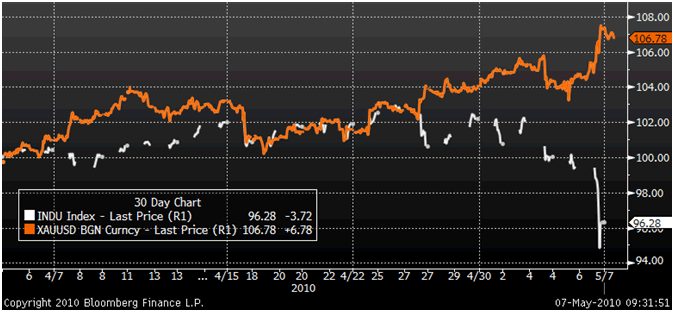

Gold Decouples - Gold and the Dow Jones - 30 Days

The massive intraday drop of nearly 1000 points in the Dow Jones also saw significant volatility in currency markets which may presage a euro currency crisis. There is the risk that the sovereign debt crisis could lead to an international monetary crisis as investors lose faith in fiat currencies most of which are saddled with very significant debt levels. Gold's debt free status and lack of counter party risk is making it an increasingly attractive diversification option - and this looks set to continue for the foreseeable future.

Gold in US Dollars Looks Set to Challenge the Record Nominal Daily High of $1,215 per ounce

The UK hung parliament or minority government will not help sentiment towards sterling. The incoming government will be faced with some of the most challenging economic challenges to be faced in modern history. The UK's public finances are in very poor shape and the UK's AAA credit rating is at risk. While the UK is no Greece, its fiscal challenges are extremely challenging and will involve considerable economic pain - possibly even austerity measures. Sterling may remain under pressure until the markets perceive that the incoming government means business about tacking the deficits.

Gold in GBP Surges 4% Yesterday on Political and Economic Concerns

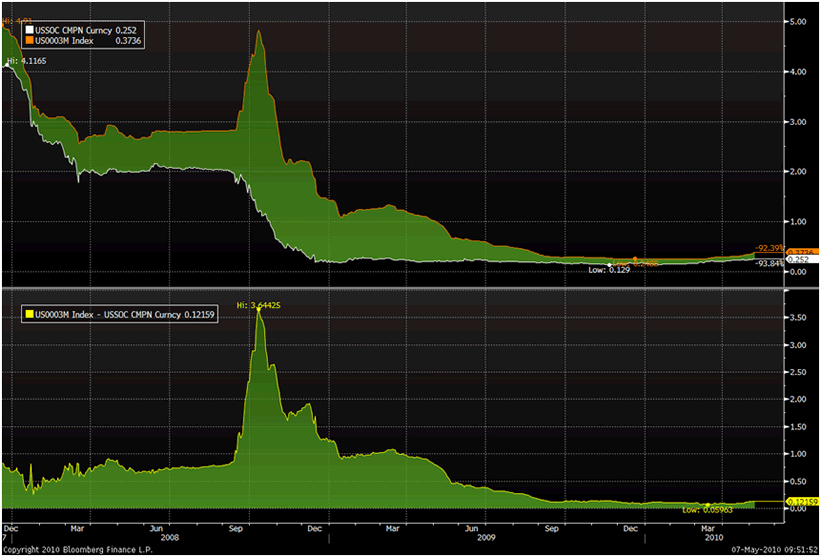

With all the focus on the Greek and European sovereign debt crisis, many have yet to notice the growing risks of another Lehman Brothers style interbank cash market seize up. Sovereign debt contagion fears are feeding into interbank contagion fears as concerns about the solvency of some banks saw Libor rates rising sharply. Moody's warned of risk of contagion in the banking sector yesterday.

Important benchmarks of the health of the global banking system are again flashing red signals. The spread between three-month Libor and the overnight indexed swap rate, a key gauge of banks' reluctance to lend, rose to the most in more than five months yesterday, as concern deepened that the financial crisis in Greece is spreading to other nations (see chart below).

3 Month Libor and the Overnight Indexed Swap Rate

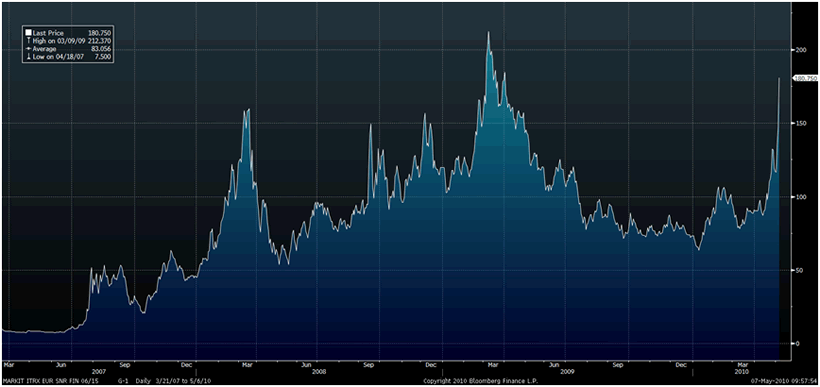

Another sign of 'Lehmanesque' problems recurring is that the Markit iTraxx Financial Index of credit-default swaps linked to the senior debt of 25 European banks and insurers soared as much as 40 basis points to an all-time high of 223. The cost of default protection on corporate debt in Europe rose to the highest since April 2009.

Markit iTraxx Financial Index of Credit-Default Swaps

Silver

Silver fell slightly in dollars yesterday to $17.47/oz but rose to new record highs in euros, British pounds and Swiss francs.

Silver remains less than half its nominal high of $50 per ounce 30 years ago and less than 20% of its inflation adjusted high of over $130 per ounce.

Platinum Group Metals

Platinum is trading at $1,660/oz marginally up and palladium is currently trading at $505/oz down another 1%. Rhodium is trading at $2,760/oz.

News

Respected analyst, David Rosenberg of Guskin-Sheff has forecast that gold will rise to $3,000 per ounce. Unlike Nouriel Roubini who has recently warned that the risk of deflation is abating and the growing risk was of inflation, Rosenberg remains a deflationist, but still thinks gold will continue to perform very well.

He argues that the breakdown of the euro is very bullish for gold. With the ECB being no Bundesbank and the Euro no D-Mark, gold is set to soar in euros and dollars.

Rosenberg warns that the Euro is less of a "hard currency" than its architects could have ever envisaged a decade ago. Now there is talk that the ECB is contemplating a quantitative easing plan. The case for gold heading to $3,000 an ounce is getting stronger by the day. The euro has already broken below 1.30 to the U.S. dollar and there is plenty of room for additional decline going forward. It's only at a one-year low - wait until it moves to a decade low.

Make no mistake - the problems in Greece are mirrored in places like Portugal and Spain - this is not about liquidity, like Bear Stearns and Lehman, it is a crisis in confidence (Banco Santander, widely seen as a barometer of financial health in Spain, cratered 7% yesterday). The FT reports today that there has been some market chatter that Spain has been "negotiating" with the IMF for assistance (€280bln) too. History shows that crises over confidence are tougher to repair over the near-term than liquidity crunches. The fact that Greek short- term bonds have collapsed in price even more - even though the country does not have to come to the market for the next few years so long as Germany comes through after the vote - is a case in point.

So contagion risks loom and there are simply not enough trees on the planet that can provide enough paper currency to backstop countries like Portugal and Spain. Moreover, what investors see is that if there is so much political foot- dragging in Germany and other EU countries to approve a bailout of tiny Greece, achieving a rescue plan for other large basket-cases will be even more arduous a task. Have a look at Martin Wolf's column on page 9 of the FT - A Bailout For Greece is Just the Beginning. What a tale of woe. And let's not forget about Italy - its public finances are less dire but still fragile (Business Insider).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.