Europe's Shock and Awe Bailout Impact on Bonds, Stocks, Gold and Currencies

Stock-Markets / Financial Markets 2010 May 11, 2010 - 04:28 AM GMTBy: Bill_Downey

Brother Can You Spare a Trillion? - In what has now become the normal in expectations, European policy makers have announced a 750 BILLION EURO bailout policy late Sunday evening in defense of the Euro currency and a show of force between the USA FED, the European Central bank, the Bank of Japan, the Bank of Canada and the Bank of England.

Brother Can You Spare a Trillion? - In what has now become the normal in expectations, European policy makers have announced a 750 BILLION EURO bailout policy late Sunday evening in defense of the Euro currency and a show of force between the USA FED, the European Central bank, the Bank of Japan, the Bank of Canada and the Bank of England.

In a nutshell they will buy bonds and will intervene in markets and "do what they have to" in order to avoid a meltdown. This is akin to the USA bailout of 1 Trillion dollars. This will only buy time, but it is all that can be done right now. For the moment the term being touted this Monday morning is "putting a floor on risk assets”. This time they mean stocks and bonds and not commodities.

In the same manner as the USA announcements, this move is being looked upon as "SHOCK AND AWE." What happened to cause such a turn in policy? While I am not certain, the plunge in liquidity of the world stock markets last week certainly must have played a role. The plan will buy private and sovereign debt. Virtually unlimited funds will be provided.

It is becoming more and more undeniable that the system of things and the mass underpinnings of debt have reached a point where there are structural cracks in the dam. That dam is not a mountain of water but a mountain of debt. The threat is ready to go global. It is not whether or not we have a problem but when a "watershed" event takes place and which direction it leads us in. There is no use rehashing what most of you have already read. So let’s go look at the charts.

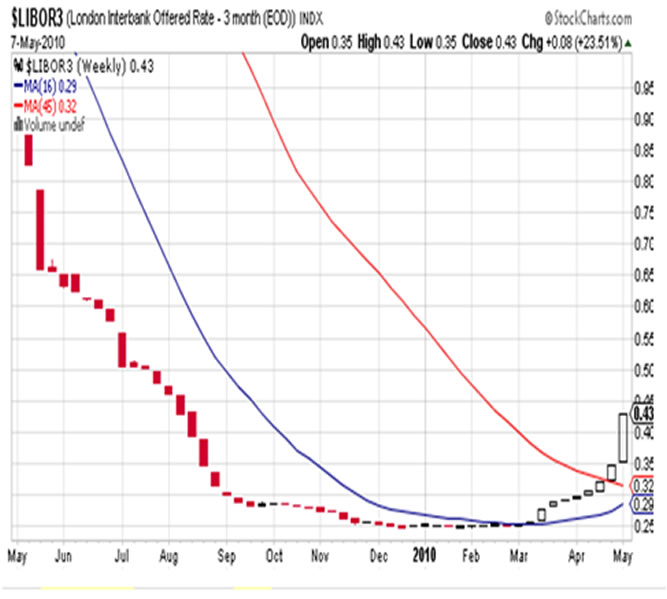

Our first chart today is the LIBOR and we use this extract from Bloomberg to make our point.

http://www.businessweek.com/..l

The rate banks say they pay for three-month loans in dollars rose the most in almost 16 months as lending sputtered amid concern financial institutions are holding too many assets of Europe’s most indebted nations.

The London interbank offered rate, or Libor, for three- month loans climbed 5.5 basis points to 0.428 percent today, the highest level since Aug. 17, according to data from the British Bankers’ Association. It was the biggest increase since Jan. 16, 2009, and the 13th straight daily gain.

“There is clearly a fear trade starting to stalk the market,” said Marc Ostwald, a fixed-income strategist at Monument Securities Ltd. in London. “Questions are being asked about certain counterparties. It’s a question of what people have on their books and whether they are vulnerable to big losses.”

Banks are holding back from offering loans to counterparties amid concern European leaders aren’t doing enough to keep the most indebted nations from defaulting after a 110 billion-euro ($140 billion) rescue package for Greece failed to halt a rise in government borrowing costs. Three-month Libor is a benchmark for about $360 trillion of financial products worldwide, ranging from mortgages to student loans.

Dollar Libor is set by 16 banks in a daily survey by the BBA before 11 a.m. in London. Member banks provide estimates on how much it would cost to borrow in 10 currencies for periods ranging from a day to a year. WestLB AG and Royal Bank of Scotland Group Plc contributed the highest rates today, of 0.50 percent. Rabobank International gave the lowest, at 0.37 percent. The BBA strips out the four highest and lowest rates quoted, calculating the average of the middle eight.

The spread between three-month Libor and the overnight indexed swap rate, a gauge of banks’ reluctance to lend, rose more than 6 basis points to 18.5 basis points, the most since Aug. 26. The Libor-OIS spread ballooned to 364 basis points, or 3.64 percentage points, after the collapse of Lehman Brothers Holdings Inc. in 2008.

“Banks simply don’t trust each other, just like in the aftermath of Lehman Brothers,” said Jens-Oliver Niklasch, a fixed-income strategist at Landesbank Baden-Wuerttemberg in Stuttgart.

Here is a key chart to watch this week to see if the action taken on Sunday evening quells down the panic that is arising.

One look at the chart below shows a 23.5% RISE in one week and a cause for concern.

The Dollar Peak of 2001

There was a time when the US Dollar and its bond markets were always the ‘go-to’ panic instruments where one could park money during a crisis. It is interesting to note that from 1992 to 1996 the United States dollar traded near the levels we see today. As we have seen in the past a crisis like this begins with one entity but spreads in contagion.

The Asian currency crisis began with Thailand. (The following 3 paragraphs below are excerpts from Wikipedia)

At the time, Thailand had acquired a burden of foreign debt that made the country effectively bankrupt even before the collapse of its currency. As the crisis spread, most of Southeast Asia and Japan saw slumping currencies, devalued stock markets and other asset prices, and a precipitous rise in private debt.

Though there has been general agreement on the existence of a crisis and its consequences, what is less clear is the causes of the crisis, as well as its scope and resolution. Indonesia, South Korea and Thailand were the countries most affected by the crisis. Hong Kong, Malaysia, Laos and the Philippines were also hurt by the slump. The People's Republic of China, India, Taiwan, Singapore, Brunei and Vietnam were less affected, although all suffered from a loss of demand and confidence throughout the region.

Foreign debt-to-GDP ratios rose from 100% to 167% in the four large ASEAN economies in 1993–96, and then shot up beyond 180% during the worst of the crisis. In South Korea, the ratios rose from 13 to 21% and then as high as 40%, while the other northern Newly Industrialized Countries (NIC) fared much better. Only in Thailand and South Korea did debt service-to-exports ratios rise.

The Asian currency crisis of 1997 coincided with the last rally in the US dollar. At the beginning of 1997 the dollar index stood just above the 84 level and in another coincidence just happens to be the level that the US Dollar closed out last week. So are we to witness another dollar rally proportional to what we saw in 1997 and what are the implications for gold that would make this time different?

The Interest Rate Peak of 2001

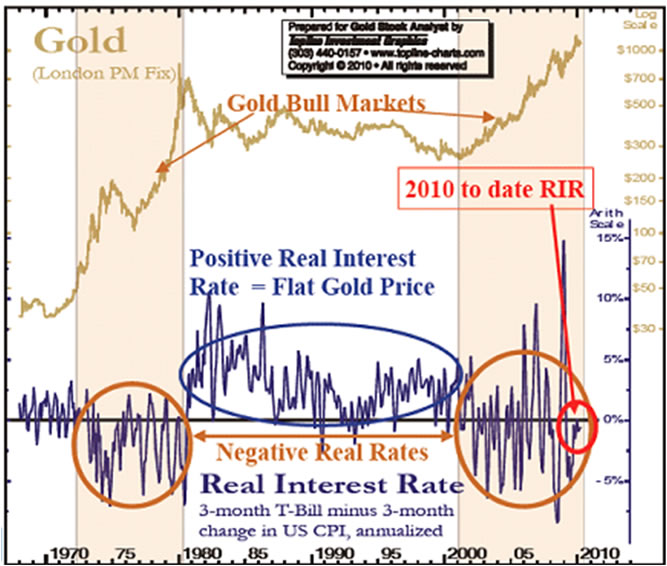

The biggest difference this time around is in the chart below. The most important tool of the FED’s to restart the economy and thus to increase tax revenues has, in effect, been neutralized. There is nowhere else to go now but to outright print money in a effort to sustain a broken system.

To watch debt spiral upwards while interest rates collapse is all we need to know to realize that the markets are no longer free or that they being priced on fundamentals. The argument that interest rates are at 1% because of the confidence behind the US dollar and the United States is laughable.

The last straw was the collapse of the dot com bubble.

If the FED’s can and do control interest rates to this extent, we should conclude that they will do as much as they can to contain the gold market from realizing its true net worth. The problem they face is the physical market is so tiny that there is more money tied up in the stock of one company, Microsoft, or say Wal-Mart. than the entire gold market.

When the real interest rate is negative – when inflation is higher than risk-free interest, cash loses purchasing power and buys fewer goods than it bought earlier in the year. When that happens, for protection, investors buy gold and drive its price higher.

The Gold Market Bottom of 2001

The long term chart of gold took a major step forward again last week by climbing to a momentum level that has only been witnessed on one other occasion (December 2009). Gold's close last Friday was the highest weekly close in the history of the gold market in US dollars and a handful of other major currencies.

The weekly chart is in a position where the market clearly has poked above "the" major resistance of the entire market. Now comes the test of whether it can be sustained. The true test is not exceeding trend lines but in maintaining price above these lines.

Just like we see this development on the chart you can rest assured that the Federal Reserve, the ECB, the BOJ and BOC also are watching this chart very carefully. None of these governments want to see the price of gold escalate out of control. Indeed this is for "all the marbles."

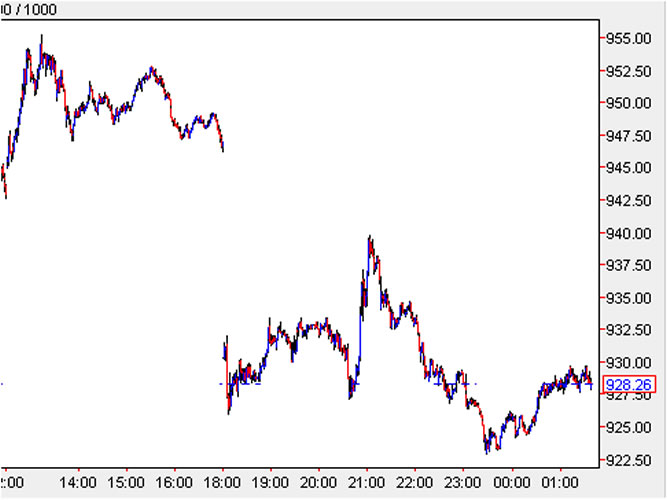

A close up look of the chart on a daily basis below shows a market that is now breaking above the red and white trend lines for the second time in five months. In between those five months we can see that the gold price has built a solid four month price base in an inverted head and shoulder chart pattern. The red and white lines were touched in January and April but each probe was met with a subsequent pullback.

The short positions have once again increased to a level of over 300,000 and it’s no wonder. Look at the price chart since the last week of March. It is rare to find anytime where there is a three day correction. The only correction we have really seen was a two day pullback in April and the pullback we saw from 1192 to the last Wednesday morning reached a low of 1156. The 50 dollar rally from that low in the last three days of the week was impressive.

But will selling come into the gold market via intervention?

The package is providing a bounce in the Euro initially and the next few days will determine the sentiment. One has to wonder if part of the intervention will include the gold market. If I was in charge of managing this crisis and I was just guaranteed 750 billion Euro's I would certainly consider keeping the gold market at bay here.

What Next?

What it really comes down to this week is whether gold explodes higher or some sort of controlled selloff occurs. The important thing to remember is that there certainly could be a temporary pullback if there is intervention in the gold market.

Initial support for the week comes in at the 1163-1176 area and on a daily basis at 1147-1154. On a weekly basis the 1115-1125 area is key support. Resistance is the 1209-1224 area and the all time highs.

Is it different yet?

The charts below show that the Dow and gold have gone through three pullbacks since 2009. The timeframes are similar but not exact. The recent selloff in the Dow last week was in contrast to the gold rally. Is this further evidence that the tide is turning and gold is forging its own road?

Look at the plunge in the Dow last week. From 11,200 to an intra-day low under 9,900. Does the Euro announcement once again come to the rescue of the global markets?

Initially we have to say yes, but it’s not what the markets do on Monday that will count but what they will do going forward AFTER Monday.

In summary, the gold market rally still has to be respected. While the potential for a short term pullback could develop, the printing of currency and the plunging into further debt of sovereign nations is certainly not a recipe saying SELL GOLD.

The CRB Commodity index below shows that GOLD WAS NOT rallying due to rising commodity prices. Indeed one can only conclude that gold is rallying due to PANIC and a loss of confidence of the global situation. This is nothing more than another delay in the day of reckoning for the world debt situation and it adds to the long term bull market in gold.

The chart below is the reaction of the Gold/Euro price. We can see the initial drop in price. The question now becomes, does this continue? The CRB chart above suggests to me that the current rise in gold is more panic based than inflation based. In many ways this possibility may make future price appreciation more powerful. Inflation is one thing......................FEAR IS MUCH MORE POWERFUL.

Again I would, who is more confident from this action?

Who is selling gold today? My take is the interventionists are and not rational investors.

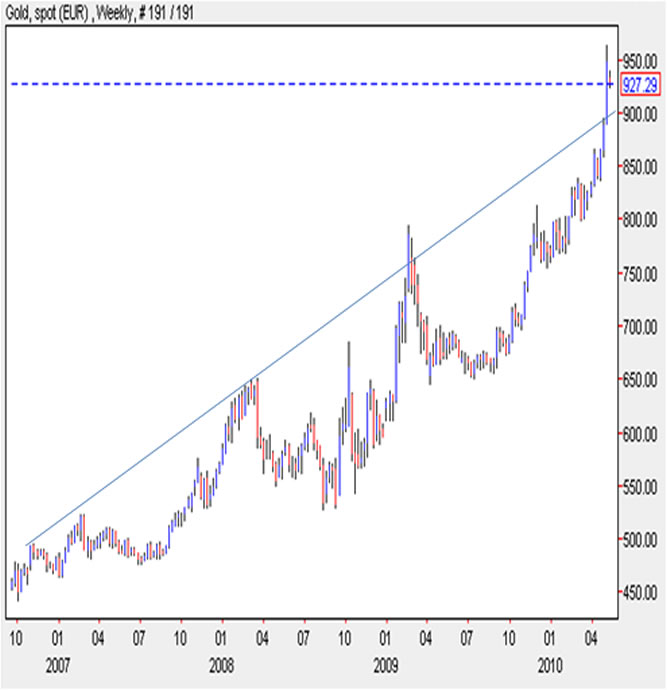

What is the Euro really being defended from? Since July of 2007 (below), the price of gold has almost doubled against the Euro. Look at the last two weeks on the chart below. Will the defending of the Euro include intervention here or is gold poised to really explode from here?

Bottom line:

These first few days following this major announcement should somehow get spun into a gold pullback. Indeed, should gold rally hard from here it will be a major signal that the government has failed.

Will this action be enough to end the spring rally in gold and cause a seasonal pullback into the July timeframe? We just don't know yet. Support in the Euro is right near the 900 area. On the downside watch the 875-900 area for support.

The spring rally in gold is still intact on the chart. But let's not just shake off a 750 billion dollar infusion and such a coordinated effort over the short term.

Initial support for the week comes in US DOLLARS at the 1185-1188 and 1163-1176 area. On a daily basis it's 1147-1154. On a weekly basis the 1115-1125 area is key Spring rally support.

Resistance is the 1209-1224 area and the all time highs.

Look for an early week pullback to support and the potential for gold to hit one of these major support areas listed above. From there price should try and recover back up. Investors should stay the course until there is a WEEKLY reversal on the charts.

Should gold move above 1220 the odds for a panic move to new highs in the 1250-1350 area will be in play. Otherwise, we look for a pullback to support.

We are now at a critical juncture in gold’s bull market. At www.GoldTrends.net we monitor the price pattern on an hourly, daily, weekly and monthly chart basis. And we offer extensive commentary on what it all means, along with support and resistance levels in advance of each day’s trade. If you would like to join us for the month of May and follow along with a free pass, send us an email.

We’d like for you to join us.

May you all prosper,

Bill

Bill Downey is an independent investor/ trader who has been involved with the study of the Gold and Silver markets since the mid 1980’s. He writes articles for public distribution for other newsletters and websites as well as his own free site at: http://www.goldtrends.net/Email: Goldtrends@gmail.com

© Copyright Bill Downey 2010

Disclaimer - The opinion expressed in this report is the opinion of the author. The information provided was researched carefully, but we cannot guarantee its total accuracy. The report is published for general information and does not address or have purpose or regard to advise specific investments to anyone in the general public. It does not recommend any specific investment advice to anyone.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.