Euro Plunge, Stocks Bear, Gold Topping and China SSEC Reversal

Stock-Markets / Financial Markets 2010 May 15, 2010 - 09:41 AM GMT

Euro Drops, Stocks Trim Weekly Gain on European Debt Concern - The euro slid to the lowest since the aftermath of Lehman Brothers Holdings Inc.’s collapse and stocks tumbled, trimming a weekly rally, on concern the sovereign debt crisis will trigger a breakup of the European currency. Oil fell to a three-month low and U.S. and German bonds rallied.

Euro Drops, Stocks Trim Weekly Gain on European Debt Concern - The euro slid to the lowest since the aftermath of Lehman Brothers Holdings Inc.’s collapse and stocks tumbled, trimming a weekly rally, on concern the sovereign debt crisis will trigger a breakup of the European currency. Oil fell to a three-month low and U.S. and German bonds rallied.

The Standard & Poor’s 500 Index declined 1.9 percent at 4 p.m. in New York, paring its weekly gain to 2.3 percent. The Stoxx Europe 600 Index slumped 3.4 percent to finish a 4.8 percent weekly advance. The euro weakened below $1.24 to levels not seen since October 2008.

Geithner Says Europe Will Fix Sovereign-Debt Crisis

U.S. Treasury Secretary Timothy F. Geithner said he’s confident European policy makers will contain the continent’s sovereign-debt crisis without harming America’s economy or financial markets.

“Europe has the capacity to manage through this,” Geithner said in an interview on Bloomberg Television’s “Political Capital With Al Hunt” airing through the weekend. “They’ve committed to fix this problem. And again, I think they have the ability to do that, and I think they will.”

The euro has dropped 3 percent this week since European policy makers announced an almost $1 trillion emergency package to stem the region’s crisis. Former Federal Reserve Chairman Paul Volcker, an adviser to President Barack Obama, said yesterday he’s concerned about a potential “disintegration” of the euro.

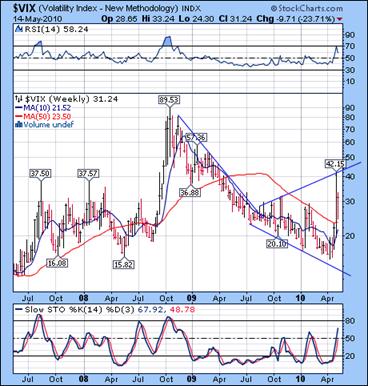

The VIX had an “inside week.”

--The VIX had an “inside week” within its Broadening Formation. It remained above its 10-week moving average, where it found support on Thursday. The majority of the rally to its close was accomplished on Friday.

--The VIX had an “inside week” within its Broadening Formation. It remained above its 10-week moving average, where it found support on Thursday. The majority of the rally to its close was accomplished on Friday.

The VIX has a slight lag in its performance to the market. As you may know, the SPX topped on Wednesday.

The NYSE (weekly) Hi-Lo index had a slight bounce from its low last week. The percentage of stocks selling above their 50-day moving average climbed from 14.8 to 30 this week.

The SPX had a triple play retest this week.

--The SPX was repelled by both its BroadeningTop Formation and its Bearish Wedge Formation this week. The 10-week moving average also played a part in providing resistance to the rally.

--The SPX was repelled by both its BroadeningTop Formation and its Bearish Wedge Formation this week. The 10-week moving average also played a part in providing resistance to the rally.

This week’s high marks the top of wave (ii) as the decline resumes through the first week of June. There may be some volatility through options week as wave i of (iii) finds a low early next week. We may see a brief rally near options expiration that only shows a fraction of the height and time that we saw in the last rally from the cycle low.

The NDX also retested its 10-week moving average.

--The NDX has now finished the retest of its 10-week moving average. The coming week should also be volatile for the NDX, as options week swings underway. It has not yet completed wave i of (iii), so we may get a bit of volatility as next week potentially opens on the downside. The original pivot schedule calls for a high on Wednesday, so that will be our primary view.

--The NDX has now finished the retest of its 10-week moving average. The coming week should also be volatile for the NDX, as options week swings underway. It has not yet completed wave i of (iii), so we may get a bit of volatility as next week potentially opens on the downside. The original pivot schedule calls for a high on Wednesday, so that will be our primary view.

Today’s cumulative tick was in far worse shape than the market appeared, so we may see some damage at the open on Monday.

Gold is nearing the end of its rally.

-- Gold is approaching multiple targets for its final push to new highs. I don’t know which will claim the prize, but it will be fascinating to see which one snags the top for gold. I have several advisors who disagree with me on this. So be it.

-- Gold is approaching multiple targets for its final push to new highs. I don’t know which will claim the prize, but it will be fascinating to see which one snags the top for gold. I have several advisors who disagree with me on this. So be it.

Weekly RSI and MACD are not confirming this new high. In addition, bullish sentiment for gold is over 97%. It means that virtually all those interested in gold are “all in.” I suggest we look at the next pivot on Wednesday for a possible reversal pattern.

Oil is diverging from its ETF.

While USO has a completed pattern to the downside, West Texas Light Crude has not yet finished its first wave down. It appears that $WTIC may finish its pattern on Monday before a potential bounce.

While USO has a completed pattern to the downside, West Texas Light Crude has not yet finished its first wave down. It appears that $WTIC may finish its pattern on Monday before a potential bounce.

I have no idea whether oil will follow the same pattern as equities next week, but that would be my top view. Once below that level, the next level of Model Support lies in the mid-20s.

The Bank Index loses intermediate-term support.

The $BKX rallied to trendline resistance, then dropped below its 10-week moving average. Options week also comes into play for $BKX, which may cause a higher than normal volatility. Once options week has passed, it may resume its decline with a vengeance.

The $BKX rallied to trendline resistance, then dropped below its 10-week moving average. Options week also comes into play for $BKX, which may cause a higher than normal volatility. Once options week has passed, it may resume its decline with a vengeance.

The Shanghai Index appears ready for a reversal.

--The Shanghai Index appears to be making a reversal on its daily chart. Based on the pivots, we may see a recognizable reversal as early as mid-week. The triangle pattern still appears to be valid, so we continue to monitor it for a reversal to the upside.

--The Shanghai Index appears to be making a reversal on its daily chart. Based on the pivots, we may see a recognizable reversal as early as mid-week. The triangle pattern still appears to be valid, so we continue to monitor it for a reversal to the upside.

My cycles model for the Shanghai Index suggests a rally may be possible that could range from a minimum of 3400 to a high of 4000, should one develop. An inversion of the Shanghai market to the U.S. equities poses an interesting question. Could it be that some event may trigger a flow of money from the U.S. to China?

$USB needs one more push higher.

-- $USB pulled back last week, but the retracement is now over. $USB needs one more push higher to complete its pattern.

-- $USB pulled back last week, but the retracement is now over. $USB needs one more push higher to complete its pattern.

An examination of the Head and Shoulders pattern suggests the rally may go to 124.44, its 38.2% retracement. However, this rally may go as high as the 61.8% retracement at 131.40. My weekly model is in close agreement, suggesting a top at 131.60. Don’t underestimate this rally.

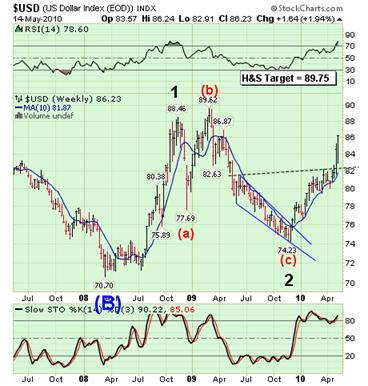

$USD is impulsing toward its target.

-- $USD appears to be advancing in wave (iii) of 3. This should be the strongest advance of the entire rally, so enjoy it.

-- $USD appears to be advancing in wave (iii) of 3. This should be the strongest advance of the entire rally, so enjoy it.

The top of wave iii may also be a Primary Cycle high for $USD, due in early June. The head and shoulders target shown on the chart is usually considered a minimum.

I hope you all have a wonderful weekend!

Regards,

Tony

Anthony M. Cherniawski

The PracticalTraders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.