Three Goals For This Week

Stock-Markets / Stock Index Trading May 31, 2010 - 10:00 AM GMTBy: David_Grandey

WHAT A MONTH! We took 24 trades in the month of May with 21, or 88% of them being profitable. Meanwhile here’s how the indexes performed:

WHAT A MONTH! We took 24 trades in the month of May with 21, or 88% of them being profitable. Meanwhile here’s how the indexes performed:

Dow — down 9%

Nasdaq — down 8%

S&P 500 — down 8%

For this week, we have 3 simple goals.

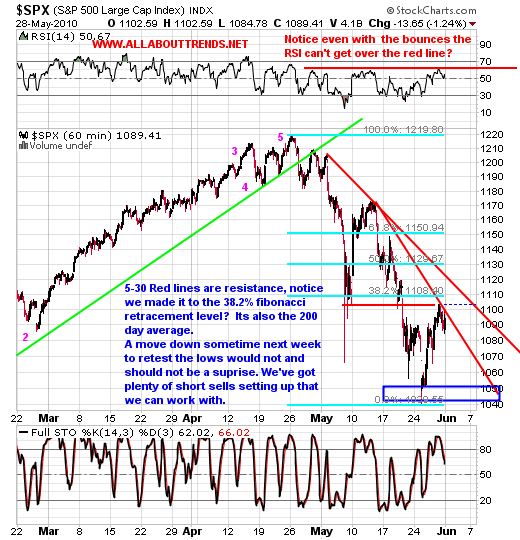

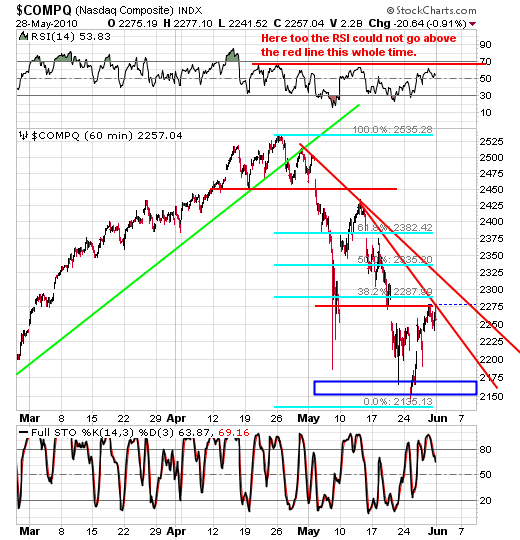

Friday’s sell off was to be expected as the market had come a long way in a short period of time. What we’ll want to see is the market either resume its advance early next week or if it stalls right here as we have multiple short term resistance levels that we are touching or near touching.

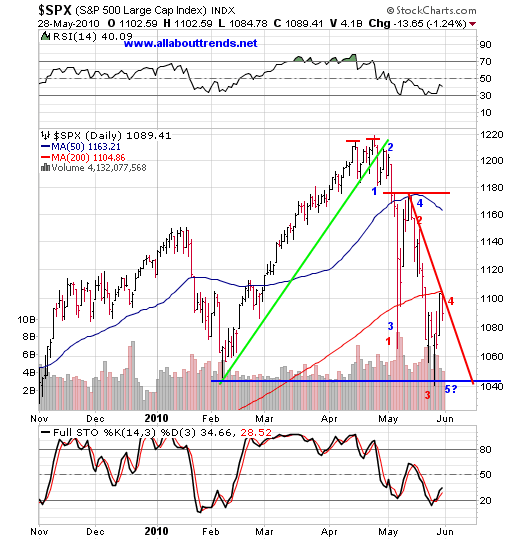

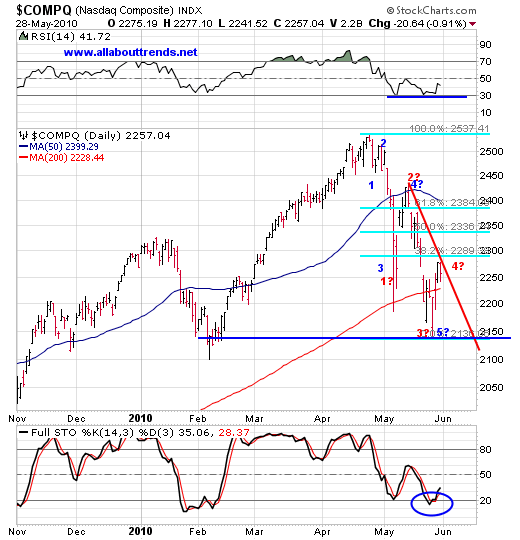

While the Nasdaq has been the top performer, the S&P 500 has found resistance at its 200-day the past two days. You can also see the RSI indicator at the top of each index chart shows the RSI having a hard time going over the 70 level ever since this correction started. Even with the big up days we’ve had it still can’t get over the red lines.

In addition to that we have the 38.2% Fibonacci level just above. And finally, you can see we are tagging, or are close to tagging multiple red resistance lines.

All of this puts us on the defensive as our number one goal this month is to extend our gains in a manner that is in tandem with the market.

A move back down to retest the recent lows would not surprise us. Should it occur we have a lot of names on the short sell watch list for just such an event. In fact there is a good possibility next week we lock down more gains on the long side and start allocating assets to the short side for trades as well as buying inverse ETFs.

Another item of concern is that the markets have not staged an accumulation day for all of May — yes, not one day this month did the markets close higher than the day before with volume heavier than the previous day. On the flip side, there were many days where the market closed lower than the previous day on volume heavier than the prior day.

Big Picture

For weeks we’ve been saying:

Make no mistake the damage done to stocks out there will not repair itself overnight and a lot of names are going to take months if at all to build all new bases. There is also a real good possibility that we will not see the April Highs again for a VERY VERY LONG TIME. Keep that in mind.

This all makes for a range bound trade and swing trading long and short being the order of the summer.

Going into next week we want to focus on a few things:

1. Lock down our gains on the long side

2. Focus upon opportunities as they present themselves long or short — Odds favor we retest the lows yet again in the coming days/weeks which sets up the short side and inverse ETFs for us.

3. Focus upon our monthly goal of “How Am I Going To Get My $500 per week ($2,000 per month) REGARDLESS OF WHAT THE MARKET THROWS OUR WAY

By David Grandeywww.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.