Australia Holds Rates at 4.5%; Canada is First G-7 Country to Hike

Interest-Rates / Financial Markets 2010 Jun 01, 2010 - 11:46 AM GMTBy: Mike_Shedlock

Australia may have seen its last rate hike for quite some time. Today the Reserve Bank of Australia Holds Rate at 4.5% to Gauge Market Turmoil.

Australia may have seen its last rate hike for quite some time. Today the Reserve Bank of Australia Holds Rate at 4.5% to Gauge Market Turmoil.

Australia’s central bank left its benchmark interest rate unchanged and signaled it may keep borrowing costs steady in coming months as it assesses the impact of the most aggressive rate increases in the Group of 20.

Governor Glenn Stevens and his policy-setting board kept the overnight cash rate target at 4.5 percent, the Reserve Bank of Australia said in a statement in Sydney today. The decision was predicted by all 22 economists surveyed by Bloomberg News.

“They’re not going to be looking to hike interest rates for the next couple of months,” said Ben Dinte, an economist at Macquarie Group Ltd. in Sydney. “But at the same time they’re still commenting on the terms of trade and inflation. While they’re on hold, they’re not ruling out further increases later this year or early 2011.”

Stevens increased rates from a half-century low of 3 percent in early October, citing surging Asian demand for Australian commodities and a jobs boom that has pushed down unemployment to around half that of the U.S. and Europe.

The interest-rate moves helped stoke a 27 percent gain in Australia’s dollar in the 12 months through April 30, making it the second-best performer among the world’s 16 most-traded currencies. The currency has since pared around half of those gains as European Union policy makers moved to prevent a potential Greek debt default.

Canada is First G-7 Country to Hike

In what is likely a symbolic measure more than anything else, Canada Hikes Interest Rate to 0.5%

Canada on Tuesday became the first Group of Seven nation to raise interest rates since the global financial crisis, but said any further hikes would depend on global economic conditions.

The Bank of Canada increased its key interest rate by a quarter point to .50 percent from a record-low rate of .25 percent. It said the decision to raise rates still leaves considerable monetary stimulus in place.

Economists widely expected the central bank to raise rates after the country's economy grew 6.1 percent in the first three months of this year, emerging from the global downturn faster than the U.S.

"While Canada joined with other countries in taking interest rates down to virtually zero the sense of crisis was never as great here," said Avery Shenfeld, senior economist at CIBC World Markets.

Shenfeld pointed out that the central bank didn't include the usual statement about further rate hikes being required.

"They've left themselves an out to stop after one trivial move if financial markets and commodity markets continue to tell them that the global economy is going in the other direction," Shenfeld said.

With GDP growing at 6.1% the central bank sure seems tepid with this policy decision.

Could it be the Canadian Central bank does not believe the recovery? Or is is the Canadian Central Bank fears the busting of Canada's housing bubble.

My bet is both. Regardless, it's far too late to do anything about Canada's property bubble. It's a case of Hosed in Canada; Housing Crash is a Given.

Canadian Dollar Weekly

The Canadian dollar did not approach the 1.10 area it hit in October, 2007. The factors in play now are energy and metal prices, Canada's interest rate at .5%, and Canada's housing bubble.

Falling crude prices , tepid rate hikes, and a bursting of the property bubble all weigh against a strengthening Loonie.

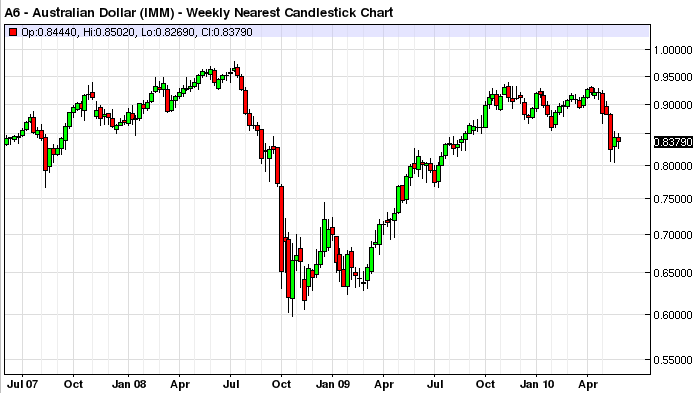

Australian Dollar Weekly

The same factors are in play in Australia as with Canada in regards to the strength of the Australian dollar. One difference is Australia has plenty of room to cut, Canada does not.

The next set of moves by the Reserve Bank of Australia will likely be lower along with a weakening housing market. Expect to see the Australia dollar weaken as well if the reserve bank aggressively cuts rates hoping to keep the property bubble alive.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.