Adapting to Systemic Dysfunction, Every Investment is a Pure Gamble -PERIOD

Stock-Markets / Financial Markets 2010 Jun 02, 2010 - 01:49 AM GMTBy: Joseph_Russo

Same As It Ever Was With the possible exception of Black Swan events, and beyond the amplification and speed with which share prices can persistently collapse following negative episodes of such, there is no difference in navigating markets now (amidst a heightened state of systemic dysfunction) relative to doing so at any other point in market history.

Same As It Ever Was With the possible exception of Black Swan events, and beyond the amplification and speed with which share prices can persistently collapse following negative episodes of such, there is no difference in navigating markets now (amidst a heightened state of systemic dysfunction) relative to doing so at any other point in market history.

Having sad that, we suppose a better title for this article might have been "Why it is essential to maintain sound risk management and if possible, to systematically automate proven technical disciplines regardless of how good or bad prevailing market conditions appear", but it just seemed too darned long.

Every Investment is a Pure Gamble -PERIOD

Specifically relative to ones clearly defined objectives and tolerance for risk, (another way mainstream answers the question of how much of a gambler one may or may not be), it is in our view, far better to be continuously prepared rather than finding oneself in the awkward situation of enduring excessive levels of discomfort while adapting to changing market conditions.

Specifically relative to ones clearly defined objectives and tolerance for risk, (another way mainstream answers the question of how much of a gambler one may or may not be), it is in our view, far better to be continuously prepared rather than finding oneself in the awkward situation of enduring excessive levels of discomfort while adapting to changing market conditions.

Be it a Day or a Lifetime

By their very nature and throughout all timeframes, financial markets have always been and shall continue to be notorious for their sudden and dramatic mood swings.

Whether over the course of a single trading session or that of an entire lifetime, sudden and repetitive swings from optimism to pessimism are the core elements upon which share markets thrive.

The House must thrive or there is No Game

Unfortunately, most fail to recognize the nature of the terrain, which suggests that the very core elements upon which markets thrive are those typically responsible for the inevitable deterioration of participants (gamblers) account balances (bankrolls).

Maintaining Tactical Context

Relative to all levels of engagement, the inevitable and never-ending succession of cyclical shifts from optimism to pessimism, and the near-impossible timing of such, makes it extremely difficult for lone participants to position themselves on the right side of trend, not to mention reversing positions when trends inevitably change direction.

The all too common quandary described above provides testament to the necessity of maintaining strategic disciplines relative to the context in which one has sought to engage in trade (Gamble, Risk, or Speculate) for his or her own benefit.

America

The land of innovation and entrepreneurial spirit could not exist without risk and high stakes gambles. Simply put, innovation is born of extreme risk and intense speculation. Nothing ventured, nothing gained - and to that we shall add, nothing lost - except earned freedom and limitless opportunity.

One Big Casino

(always has been - always will be) Be it the long-haul investor hoping to cash out with a big retirement bounty after buying and holding for 20-years, or the day trader looking to scalp a day's wage by the end of a trading session, each are gambling on a future outcome to their benefit.

Tipping the Odds

Despite the greater odds of coming out ahead over a 20-year period vs. a single trading session, there is NO GUARANTEE that such odds will deliver. Just ask those who in 1989 bought and continue to hold large portions of their retirement nest eggs in the Japanese Nikkei Index. After 21-years, the Japanese stock market is still down some 70% from its all-time highs.

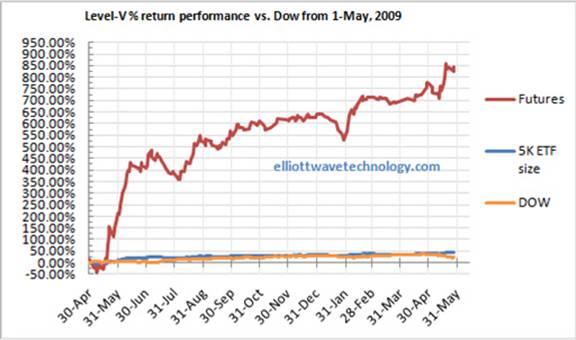

Find a Reliable Compass

Accurate charting and forecasting provides traders and investors with one of the most essential tools of navigation, a compass. A professional chartist should be able to forewarn his or her readers of any potential obstacles ahead, and then quickly reorient them upon moving through such waters with specific contingency for their preferred method of travel and comfort.

No Surprises

Market shocks, sudden shifts in trend, temporary panics, or true Black Swan events, should never come as a surprise for those who employ the services of a chartist who is worth his or her weight.

In part-II, we explore how this chartist plots a course in real time, and we shall reveal precisely where this chartist believes we stand (in Elliott terms) in the grand scheme of things.

Until then, Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2010 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.