Non Farm Payrolls Disappoints Stock Market

Stock-Markets / Stock Markets 2010 Jun 04, 2010 - 08:43 AM GMTBy: PaddyPowerTrader

Even on a typical uber quiet pre-payrolls day, the on going tug-of-war between strong economic data in the US and European sovereign banking risks was clearly visible with the former triumphing by a short head giving the S&P 500 Index its first back-to-back gains since April. Microsoft and Cisco led advances in the Dow and Dell rose 4.9% helping lead technology shares to the biggest gain in the S&P 500, after its founder said he has considered taking the company private. The losers were basic resource / mining stocks like Freeport-McMoRan Copper & Gold which sank after saying China’s plans to crimp growth will hurt demand for copper.

Even on a typical uber quiet pre-payrolls day, the on going tug-of-war between strong economic data in the US and European sovereign banking risks was clearly visible with the former triumphing by a short head giving the S&P 500 Index its first back-to-back gains since April. Microsoft and Cisco led advances in the Dow and Dell rose 4.9% helping lead technology shares to the biggest gain in the S&P 500, after its founder said he has considered taking the company private. The losers were basic resource / mining stocks like Freeport-McMoRan Copper & Gold which sank after saying China’s plans to crimp growth will hurt demand for copper.

Today sentiment swung around into the red mid morning after a Greek sense of déjà vu moment from the Hungarian PM Vicktor Orban who said that the economy is in “a very grave situation” because of the previous government fiddled the books. Vague rumours that a large French bank was in trouble (allegedly Soc Gen on loses in derivatives) certainly didn’t help traders frayed nerves upon a Friday after a tough week. So where to now? Well my gut feel is that with even the old hardcore countries like the Netherlands, France, Belgium and Austria seeing the spread (cost of borrowing) move out viz a vis Germany in the last couple of sessions that the arm of Brussels is going to come on the ECB to embark on full blown QE (i.e. buying the bonds of Eurozone countries directly without sterilisation) or risk losing their independence much to the horror of Weber, Stark et al.

Stateside to add to the world’s woes, we’ve just had the key Non Farm Payrolls report and it proved to be a huge disappointment. Not just a miss on the headline number at +431k versus the consensus expectation for a +536k print but the fact that the report showed that the private sector was only responsible for +41k of these new jobs. The market will assume that the bulk of the remainder are temporary short term jobs enrolled for the ongoing US census. So the painfully slow and tepid recovery on the jobs market continues. The only good news is that this keeps the Fed on hold longer. Needless to say the equity markets have dumped on this as it looks like they were holding out for a number even larger than expected

G20 Talks Start Today

At the G20 talks in Busan (beginning today), a focal point is likely to be attempts to reach agreement on revised bank capital and liquidity regulations. Citing “people familiar with the discussions”, the WSJ today reported that rules to require banks to raise more capital were “likely to take effect later than expected”, with a consensus emerging for a gradual implementation that could stretch several years beyond the initial deadline of end-2012. Meanwhile, Bloomberg reported that the G20 was split on the scale and timing of increases in bank capital requirements, with the US pushing for higher holdings and mainland Europe concerned that too-high reserves would risk choking off growth, according to an official who will attend the weekend discussions. The WSJ mentioned Japan, Germany and France as having argued for a much slower pace of implementation, even up to ten years, “arguing that the current deadline could lead to multi-trillion-dollar funding shortfalls at a time when much of the banking sector will likely still be fragile”. The WSJ said that US and UK officials recently had indicated that they would support a gradual timeframe. One concern is that euro area banks need to rollover €800bn of maturing debt by 2012. As well, the WSJ said that other crucial details remain unresolved, including disputes over the types of funds that count towards the tougher capital and liquidity requirements.

The chairman of Seoul’s G20 presidential committee, Sakong Il, said that the Busan meeting would discuss a global bank tax (which is strongly resisted by Canada and Australia) while it would also discuss an IMF report that will be submitted to the G20 Toronto summit on June 26-27. He added that the summit would not separately discuss the euro or the yuan. A draft of the G20 communiqué, seen on Thursday by Dow Jones, reportedly expressed concern over the European crisis and financial market volatility, without referring to specific currencies.

Lots Of Fedspeak Overnight

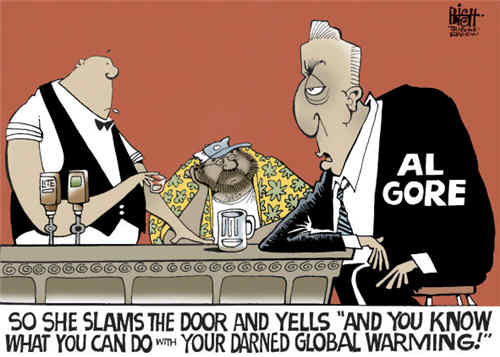

Kansas City Federal Reserve Bank President and hawk Thomas Hoenig said the US economic recovery has the momentum to sustain itself and called for an increase in the target federal funds rate to 1% by the end of the summer. “The first step toward a more normal policy is to move policy rates off zero, back toward neutral,” Hoenig said. Hoenig’s view hasn’t shifted since the European debt crisis last month posed a risk to the US recovery. He has voted against central bank statements, saying in April the “extended period” language limited the Fed’s “flexibility to begin raising rates modestly.”

And Federal Reserve Bank of Dallas President Richard Fisher said that while it’s not time for central bankers to tighten monetary policy, they may be “getting closer” as the economy further expands this year. “I’m not sure we’re there yet” Fisher said. “At the same time, I think we need to be ready and we need to be ready to move fairly quickly.”

Federal Reserve Bank of Atlanta President Dennis Lockhart said the central bank, to counter inflation, may eventually need to raise its target interest rate from near zero even with US unemployment still high. “The policy rate may have to begin to rise even while unemployment is considerably higher than before the recession,” Lockhart said. “Good policy, even in circumstances of unacceptable levels of unemployment, may incorporate higher interest rates.”

New Japanese PM

Naoto Kan was elected head of Japan’s ruling party, paving the way for the 63-year-old finance minister to become the fifth premier in less than four years. Democratic Party of Japan lawmakers voted 291 to 129 for Kan, who defeated Shinji Tarutoko, a five-term legislator. The DPJ is now set to use its majority in the lower house to appoint him prime minister. Kan’s role as finance minister may convince voters his government can improve the country’s finances without compromising promises to boost spending on social programs. Kan said today he will pursue the main policy goals of Prime Minister Yukio Hatoyama, who announced his resignation on June 2 citing a broken vow to relocate U.S. troops. The new PM is widely believed to favour a weaker Yen which is of course good news for the heavy exporter stocks in the Nikkei.

Company / Equity News

•Blackstone is in exclusive talks to sell most of the property behind its Centre Parcs holiday business in the UK to M&G, the Prudential-owned fund manager, in a deal to raise more than £1bn. In one of the largest property deals since 2007, the US buy-out firm is creating a fund to hold the holiday company’s £1.4bn of UK property assets. M&G and its client funds would then acquire the majority stake.

•Google, seeking more revenue outside its main search business, acquired a start-up called Invite Media that helps customers place ads on websites more effectively. Invite Media lets companies tailor their bids for advertising space using up-to-the-minute data, helping them better target customers, Google said.

•The incident commander for the BP subsea oil spill response said there was no indication as yet that the containment cap put in place over the ruptured pipe was successful. “The placement of the containment cap is another positive development in BP’s most recent attempt to contain the leak, however, it will be sometime before we can confirm that this method will work and to what extent it will mitigate the release of oil into the environment,” said Coast Guard Adm. Thad Allen.

•ArcelorMittal, the world’s largest steelmaker, Posco and five rivals may spend a combined $30.4 billion to build plants in southern India, after investments were stymied in other states. ArcelorMittal plans to invest 300 billion rupees in the state of Karnataka, Chairman Lakshmi Mittal said.

•Air France KLM now expects to lose between €300m and €400m in the year to March 2011 according to French media quoting the CEO. That compares with a consensus forecast loss of €260m. Last year the carrier lost €1.13bn at the operating line. easyJet will generate EBIT profit of about €200m this year while Ryanair’s operating profit will be over €400m. For 2009 the two combined produced an EBIT of €460m. This chasm in performance is further amplified by the relative balance sheet structures. While Ryanair triggers a special dividend, and easyJet contemplates one, Air France mulls over its gargantuan €7bn+ of debt. British Airways lost over €300m EBIT last year and net debt is over €3bn. Both LCCs have minimal balance sheet debt with combined shareholders equity of about €4.4bn. These figures heighten the risk differential that exists for equity investors between legacy and LCC (low cost carriers) camps. Legacy shareholders have numbers tumbling out that raise the probability of some form of call to manage losses and weakened balance sheets. LCC investors enjoy numbers (in a recession) that hold the promise of calls in the opposite direction (i.e. do you want special dividends or share buybacks?). Where do you want to be?

•easyJet grew pax volume by 7.9% in May (to 4.26m) while load factor rose from 83.5% to 85.8%. 215k passengers had flights cancelled due to ash. Ryanair lost 250k pax during May from ash and these are included in the headline 6.44m volume figure (v 5.51m in ’09). Load factor was unchanged at 81%. Both data points reflect the measureable but modest impact from ash. Of more importance is guidance from Ryanair and anecdotal feedback elsewhere that demand and yields firmed up quickly once the volcano settled. That will propel financials through the summer.

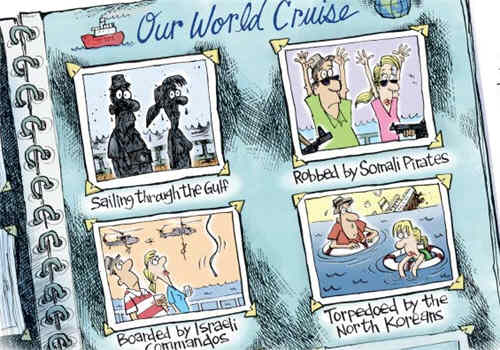

•For those planning their World Cup viewing.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.