U.S. Negative 2% GDP Q3, Economy Return to Recession?

Economics / Economic Recovery Jun 05, 2010 - 07:37 AM GMTBy: John_Mauldin

There's a Slow Train Coming

There's a Slow Train Coming

A Negative 2% GDP in the Third Quarter?

Small Business Still Has Issues

The question before the jury is a simple one, but the answer is complex. Is the US in a "V"-shaped recovery? Are we returning to the old normal? A great deal hinges on the answer, and this week we look at some of the evidence before us.

But first, a follow-up thought to last week's letter. I wrote about why countries can reduce their private debt, reduce their public debt, or run a trade deficit, but not all three at the same time. If a country wants to see its government run a fiscal surplus (or small deficit) and at the same time its private citizens want to reduce their leverage (common desires throughout the developed world), it must run a trade surplus. That's a simple accounting statement. If you did not read last week's letter, you can get to it by going here.

That brings up the deepwater gusher in the Gulf. That it is an unmitigated disaster is an understatement. There is the possibility of the oil getting into the Gulf Stream and going around Florida and landing upon the Atlantic coast. We will be cleaning this up for years.

I am at the moment on a plane to Italy, but if memory serves me right, we run about a $300-billion-dollar trade deficit just in energy purchases. Our trade deficit has been coming down in most other categories but is fairly steady with respect to oil. And as noted above, if we want to get to a place where we are in control of our government deficit, we must reduce that trade deficit.

Bluntly, we cannot hope to balance the fiscal budget without getting a handle on our energy policy (unless consumers and business elect to go into more debt against the current trend – there must be an accounting balance!)

The reality is that we need more domestic drilling, and that means offshore drilling and drilling in ANWAR. I know this is anathema for many people, but not doing so threatens our national economic health. The oil industry has a great track record, up until this catastrophe, for safety. We need to figure out what went wrong, fix it, and get back to drilling. If it requires more regulations, then so be it. Even more, we should be converting out truck fleet to natural gas (as well as many cars as possible) until electric cars become a reality.

If we are serious about wanting to cut the federal deficit, and we should be, we need to get even more serious about a national energy policy that reduces our dependence on foreign oil. You can't solve one problem without solving the other. And now, on to today's topic.

There's a Slow Train Coming

The consensus for growth in the last half of the year is around 3%, with some forecasts even higher. That would be a good number, but the usual number coming out of a recession would be over 4% and approaching 5%, so even the optimists are forecasting a weaker than usual recovery.

But there are some positive signs. Withholding taxes at the state level are starting to show year-over-year growth, albeit from low levels; but let's take growth where we can find it.

New and existing home sales are up, but that appears to be largely related to the ending of the government buying subsidy. The tax break pulled forward people who were planning on buying within the next year or so, and without that stimulus...? Mortgage applications for new purchases are now at a 13-year low, and that is with mortgage rates below 5%!

"Chain store sales grew 2.6% in May, better than in April but consistent with the view that spending growth has moderated since the first quarter. Sales were limited by the shift in Memorial Day and adverse weather, particularly in the West. Fundamentals remain too weak to support consistent strong sales growth." ( www.dismal.com)

And that last sentence seems to sum up most of the positive data points: the fundamentals are too weak to support robust growth.

We had massive stimulus applied to the economy in 2009 and through the first half of this year. That stimulus is now beginning to fade. Besides keeping us out a major deflationary recession or even depression, it was supposed to get us to a place where consumer spending and GDP growth would become organic and not need further stimulus packages. The Congressional Budget Office just delivered a report on the effects of the stimulus. Let's review.

"... instead of losing 8.3 million jobs between the end of 2007 and the end of 2009, without [the stimulus package] the toll would have been 9.8 million—and instead of gaining 522,000 jobs since the end of last year, we'd have lost another 328,000. And instead of peaking at 10.0% at the end of 2009 and falling modestly since, without ARRA, the jobless rate would have continued to climb to 11.2%. ... taking the midpoint of the CBO's estimates, GDP would have been down 1.1% between 2008Q3 and 2010Q1 instead of up 1.8%." ( www.theliscioreport.com)

I know many of you, gentle readers, will take that finding with several grains of salt, but in general they do have a point. If you shove a stimulus of 4% of GDP into the system, you will get a rise in GDP. Let's set aside whether the stimulus was well-planned and properly targeted (it wasn't), and focus on the larger picture.

Without the stimulus, according to the CBO, we would still be barely out of recession. So the question becomes, what happens when the stimulus goes away in the latter half of the year? Have we gotten the economy to the point where it can grow on its own? To answer that let's take a look at some leading indicators.

First, let's take a peek at data from the Economic Cycle Research Institute (ECRI). The leading economic indicator, which led the recovery by about four months, fell in April and is now at a 47-week low. It is not signaling a recession (yet) but it does suggest that growth in the latter half of the year will be in the range of 1-1.5%. That is not enough to cut into the unemployment numbers in any meaningful fashion. (Economists generally think that GDP growth in the range of 3.5% is needed to really create job growth.)

A Negative 2% GDP in the Third Quarter?

And now let me introduce you to a new economic metric from the Consumer Metrics Institute. They track consumer discretionary spending on a daily basis. ( http://www.consumerindexes.com/index.html – hat tip Bill King.) From their web site:

"The Consumer Metrics Institute was founded on a simple observation: many 'leading' economic indicators are published, but few (if any) are sufficiently 'leading' to be meaningful to investors. In fact, many 'leading' indicators use the prior month's equity market results as a key component of their indexes. Investors may find their most recent month-end account statements more timely.

"To remedy this, the Consumer Metrics Institute has developed (and is continuing to develop) techniques for monitoring 'up-stream' economic activities on a daily basis. The daily consumer sampling process commenced in 2004, and several years of data were required to refine the process and statistically analyze how the timing of our indexes related to other 'leading' indicators, including the equity markets. The 2008-2009 recession provided a final validation of the methodologies and confirmed a multi-month lead relative to other commonly referenced indicators."

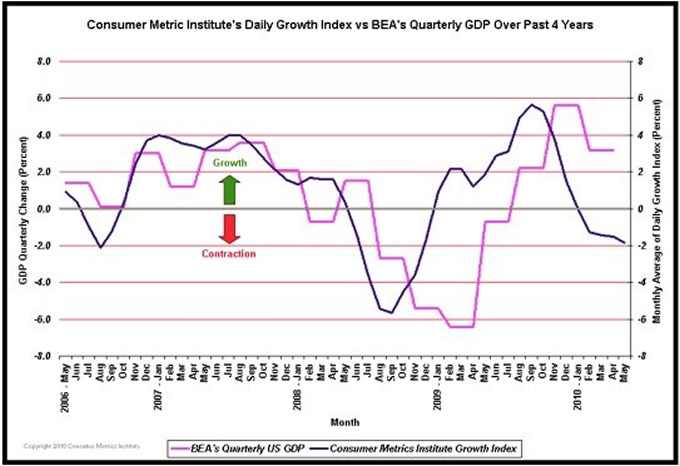

Their Consumer Metrics Institute Growth Index, which is the composite of a number of sub-indices, seems to lead GDP growth by about 4-5 months. Look at this chart showing the index and GDP growth for the past four years.

"On May 27th the BEA released its first revision to its 1st Quarter 2010 GDP growth rate measurement, lowering the number from a 3.2% annualized growth rate to 3.0% annualized growth. One day later the Consumer Metrics Institute's 'Daily Growth Index' was signaling what we should expect the BEA's measurement of the 3rd Quarter 2010 GDP growth rate to be contracting at about a 2.0% rate.

"The prior BEA estimate of 1st Quarter 2010 GDP growth trailed our 'Daily Growth Index' by 127 days, and because of the rapid rate that the economy was cooling when the measurements were being made the newly adjusted estimate is now trailing our 'Daily Growth Index' by 125 days. Since the 3rd Quarter of 2010 ends 125 days after May 28th (when our 'Daily Growth Index' was recording a 'growth' rate of -1.99%), if the BEA estimates continue to trail our 'Daily Growth Index' in a consistent manner we should expect that the 3rd Quarter's GDP 'growth' rate will be in the -2.0% neighborhood."

Wow. A negative 2% in the quarter starting next month? How can that be? Let's look at what caused the recent growth.

First-quarter GDP was revised down to 3% last week by the BEA (Bureau of Economic Analysis). But buried in that release was an upward revision to inventories, which accounted for over half of that 3%. At some point inventories become balanced and no longer grow.

And that may already be happening. We got the ISM number on Wednesday, and it came in somewhat above consensus at a quite robust 59.7. But when you look at the inventory sub-component, you find a different picture. It was slightly negative in April and dropped another 3.8 in May to be down to 45.6. This is a drop in that index of 9.7 points in just two months (anything north of 50 shows growth and below 50 suggests no growth or actual retreat).

Increases in inventory count as a plus when you are figuring GDP. If inventories are not growing, that figures to be a drag on second-quarter GDP.

And a significant part of the growth in the past three quarters came from transfer payments from the government (AKA stimulus), which are going away. The money received by state and local governments, which allowed them to keep employees on the job, is now being taken off the table; and the stories of state and local governments having to cut back are everywhere.

I have my doubts about negative GDP growth of 2% in the third quarter, but a much slower GDP than the consensus 3% seems quite possible.

Small Business Still Has Issues

Ben Bernanke said today that loans to small businesses are down across the nation. He did not know whether to attribute it to lack of demand or tight lending standards (or a need to build up balance sheets?). That is certainly borne out by the latest missive from my friend Bill Dunkelberg, chief economist for the National Federation of Small Business:

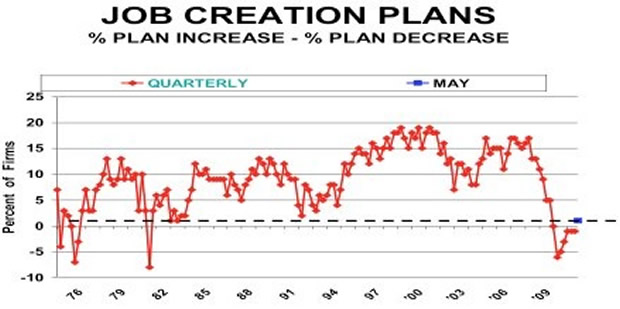

"Since January, 2008, the average employment per firm was negative in every month, including May, with a seasonally adjusted loss of 0.5 workers per firm. Most firms did not change employment, 8% increased average employment by 2.4 employees, but 20% reduced their workforces by an average of 4.0. Small business ‘job creation' still has not crossed the 0 line in over 2 years. Government (including health care and education) and manufacturing (a large-firm activity) are providing what few jobs are created, weak given the magnitude of employment loss during the recession (are we really out or are Greek-style subsidies masking the fundamental weakness?).

"The number of owners with unfilled (hard to fill) openings fell 2 points to 9% of all firms, historically a weak showing (chart below). A major determinant of the NFIB forecast of the unemployment rate, the May decline suggests the unemployment rate will not improve."

Over the next three months, 7 percent plan to reduce employment (unchanged), and 14 percent plan to create new jobs (unchanged), yielding a seasonally adjusted net 1 percent of owners planning to create new jobs, a gain of 2 points and the first positive reading in 19 months. But historically the May reading is very weak (see chart below).

And now I am in Rome. The above was written on the plane. I must confess that I was shocked by the weakness of the job report. I did expect it to be weaker than the consensus or even the 600,000 that Goldman Sachs predicted. Since my kids want to find a pizza place, I am going to give you the summary from my friends at The Liscio Report:

"While total employment grew by 431,000, 95% of the gain came from temporary Census workers. Private employment rose just 41,000, and aside from the Census workers, government employment was off by 21,000 (down 15,000 state and 7,000 local - federal employment ex-Census rose by 1,000). Construction employment fell by 35,000, with all subsectors clocking losses, including heavy/civil – where's the stimulus spending? Manufacturing rose by 29,000, the sector's fifth consecutive gain. Private services added just 37,000. Gainers included transportation, up 11,000; professional and business services, up 22,000 (though that was more than accounted for by the temp sector's 31,000 – most of its other subsectors fell); health care, up just 8,000 (less than half its recent average); and leisure and hospitality, barely positive at 2,000. A number of major sectors fell, with retail off 7,000 and finance off 12,000. Over the last five months, manufacturing has gained 126,000 and finance has lost 58,000; we haven't seen a gap in favor of manufacturing that wide between the two sectors since 1994."

Did you notice the weakness in some of the sectors connected to small business? Ugly. There is no other word. After April's rather stronger job report, I thought we might see some moderation, but this is not good.

I continue to be very worried about the large negative contribution to growth that will come from Federal, state, and local governments as they cut payrolls and increase taxes. I think the combined effect looks to be close to 2% of GDP. If we are flatlining by the end of the year, such an outrageous tax increase will shove us into another recession. Let there be no doubt what the cause will be.

Ok, Paul, I am going to call you out. (Paul McCulley of PIMCO, really a very good friend and all-around nicest guy in the world.) Paul said to me at my latest conference that tax increases on the rich will not have a negative multiplier effect on the economy. He thinks the Romers' research is on the total economy and thus the rich (read: lots of you) will not change their spending habits. I say it will. Many of those "rich" are small business owners. Look at the above data from Dunk (NFIB). That does not add up to no impact.

Let me say it for the (insert number) time. If we go back into recession, the market on average drops 40%. This is NOT a buy-and-hold market. It is a buy-and-trade or, for those with the skills, sell-and-short. (If you are not experienced at short selling, this is not the time to jump in "whole hog." Short selling is a craft. An art form. A dangerous thing for rookies. Tread gently, gentle reader.)

There is a slow train coming. Between December of 2007 and through April of this year disposable personal income would have been DOWN just over $900 billion without the stimulus money (Gary Shilling). It would have been a far more serious recession. And now we are getting ready to find out whether we can make it without the intravenous infusion of government (borrowed taxpayer) money. I fear the train is going to slow down.

Italy, Paris, Vancouver, and San Francisco And a Forbes Cruise to Mexico

Some time this month I go over 6 million AAdvantage miles. I am Executive Platinum. Even after spending a million miles to take my kids to Europe with me (twice!), I still have some 700,000 left. I bought a coach fare ticket five months in advance because I always get upgraded on international flights. And yet, this time I didn't. I am sitting back in fairly cramped quarters, and my seat has some device taking up half my foot room. I did not get an exit row. The travel gods, who for so long have smiled on me, have forsaken me. I have real trouble sleeping in coach, so let's hope that changes.

I will finish this letter in Rome, where I will wait for the unemployment report before hitting the send button. Then I will join the kids for pizza and wine. We are in Rome for 5 days, with a side trip to Pompeii, then Venice, Tuscany (Trequanda), a side trip to Paris as most of the kids return, then back to Tuscany, then Milan and home. I am really looking forward to this.

I will be at the Agora Conference in Vancouver July 20-23. There are a lot of good friends and great speakers. It will be a great time. You should consider joining me. http://agorafinancial.com/..

Then, after my regular fishing trip to Maine, I will be in San Francisco for The Money Show, San Francisco, August 19-21, at the Marriott Marquis. You'll have the opportunity to meet with 50+ leading experts, who will cover everything from the global economy and markets to biotech, greentech, nanotech, and much more. Register for free by calling 800/970-4355 and mentioning priority code 018914, or register online at The MoneyShow San Francisco!

Then I will be with Steve Forbes, good friend Rich Karlgaard, and Ken Fisher for a cruise through the Mexican Riviera, November 28 - December 5. I suspect there will be some friendly debate between perma-bull Fisher and myself. He's wrong. I'm right. And I'm sure he feels exactly the same way. It really will be fun, and Tiffani will be there (with Ryan and my granddaughter Lively!) Click on the link, and if you decide to go, let me know. We will set up some time for my closest friends, of which you are one, of course. It's right after Thanksgiving. My new book will be finished and out (yes, I am working on one, even on vacation!). http://www.moneyshow.com/frmx/?scode=018912

Your glad to be on the ground in Italy analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.