Financial Market Turmoil Poses Risks For the Housing Market

Housing-Market / UK Housing Sep 03, 2007 - 11:20 PM GMTBy: Nationwide

- House prices are unlikely to be significantly hit by market turmoil in the short term

- But dependence of UK economy on financial services poses a longer term risk

- Unexpectedly low inflation and financial market unrest has reduced the risk of a Bank Rate rise to 6%

| Headlines | August 2007 | July 2007 |

|---|---|---|

| Monthly index * Q1 '93 = 100 | 365.7 | 363.5 |

| Monthly change* | 0.6% | 0.1% |

| Annual change | 9.6% | 9.9% |

| Average price | £183,898 | £184,270 |

* seasonally adjusted

Commenting on the figures Fionnuala Earley, Nationwide's Chief Economist, said:

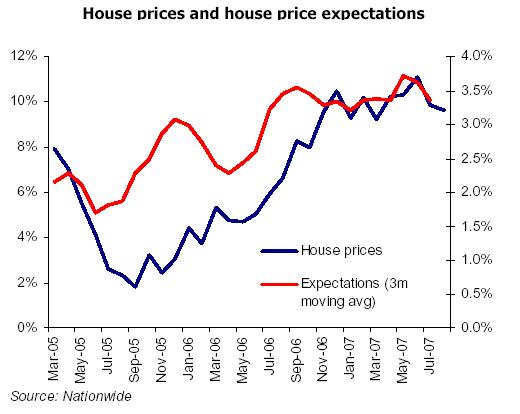

"The rate of house price growth lifted a little during August, but the annual rate continues to moderate. Prices increased by 0.6% during the month, but the annual rate fell to 9.6% down from 9.9% in July. A typical UK property cost an average of £183,898 in August, £16,177 more than one year ago."

Financial market volatility unlikely to affect UK house prices in the short term…

“The US sub-prime crisis has created turmoil in international financial markets, but this is unlikely to

have a significant additional effect on the rate of growth of house prices in the UK in the short term.

We still expect house price growth in 2007 to come in close to the middle of our forecast range of

between 5% and 8%. The expected slowing results from three main factors, each of which have been

around for some time. First, weaker affordability, as house prices continue to grow more quickly than

earnings; second the effect of higher interest rates and inflation on consumers’ pockets; and third

lower house price expectations.

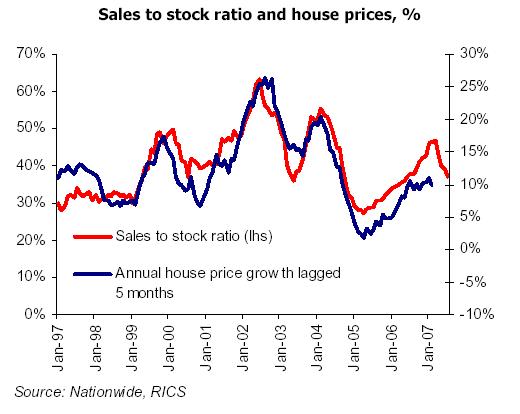

“While it has taken some time for these factors to bite, there are now clearer signs of slower demand in the market reflected in the collapse in new buyer enquiries. In addition, the stock-to-sales ratio, which leads house price inflation by five to seven months, predicts a continued slowing in the annual rate of house price inflation.

…but there are risks

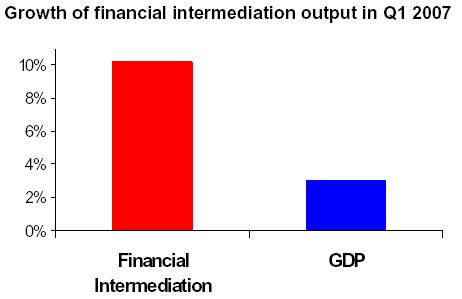

“Whether the fall out from the US sub-prime crisis will

have a more severe impact on the housing market

longer term will depend on how long it takes for

market jitters to settle. A prolonged financial market

downturn would be uncomfortable for the overall

economy given the importance of this sector to

economic growth over several years. Such a downturn

would not only affect investment bankers, but would

also have negative knock-on effects for legal,

accountancy and other professional services that have

benefited from the structured credit boom. On top of

this, jobs in restaurants, cafes and other services

catering for city workers would also be affected. The

impact on London property prices can only be negative compared to the current situation, particularly

at the top end, but employment generated from Olympic and other infrastructure investment along

with supply issues will remain positive factors for the mainstream market.

“Whether the fall out from the US sub-prime crisis will

have a more severe impact on the housing market

longer term will depend on how long it takes for

market jitters to settle. A prolonged financial market

downturn would be uncomfortable for the overall

economy given the importance of this sector to

economic growth over several years. Such a downturn

would not only affect investment bankers, but would

also have negative knock-on effects for legal,

accountancy and other professional services that have

benefited from the structured credit boom. On top of

this, jobs in restaurants, cafes and other services

catering for city workers would also be affected. The

impact on London property prices can only be negative compared to the current situation, particularly

at the top end, but employment generated from Olympic and other infrastructure investment along

with supply issues will remain positive factors for the mainstream market.

After the floods, out come the doves

“The overall extent of any damage to economic growth and hence the housing market will depend on

the length of the credit crunch and the monetary policy response by the Bank of England. August’s

Inflation Report signalled that a rise in the Bank Rate to 6% was pretty much a certainty. But the

Bank’s forecast of inflation did not predict a dip below the 2% target at any point over the next two

years, even based on market rates rising to 6%. So, the fall in inflation to a sub-target 1.9% in July

will have come as a surprise. On top of this, news from Europe suggests that the economies of the

UK’s main trading partners are weakening, while the likelihood of a slowdown in the States is rising all

the time. The MPC has been highlighting the strength of global and Eurozone growth as a factor

supporting its tightening campaign. This, together with the softer tone of the last set of MPC minutes,

which revealed that most Committee members “had no firm views on whether rates would need to

rise further”, has led us to believe that rates will now remain at 5.75%.

“The turmoil in credit markets strengthens the case of the doves on the Committee as the MPC will be

reluctant to do anything to add uncertainty while the markets remain volatile. The Bank of England’s

reluctance to intervene in the markets in the same way as the Fed and the ECB suggests that at the

moment it is fairly sanguine about the lasting effects of the credit crunch. But the longer the squeeze

continues, the more likely it is to have a dampening effect on the wider economy and hence the

outlook for house price growth next year.”

| Fionnuala Earley Chief Economist Tel: 01793 656370 Mobile: 07985 928029 fionnuala.earley@nationwide.co.uk |

Katie Harper Media Relations Manager Tel: 01793 656215 Mobile: 07764 234893 katie.harper@nationwide.co.uk |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.