Sovereign Debt Crisis Fails to Deliver Knock Out Punch to Stock Markets

News_Letter / Financial Markets 2010 Jun 06, 2010 - 09:28 PM GMTBy: NewsLetter

The Market Oracle Newsletter

The Market Oracle Newsletter

May 31st, 2010 Issue #33 Vol. 4

Sovereign Debt Crisis Fails to Deliver Knock Out Punch to Stock MarketsInflation Mega-Trend Ebook Direct Download Link (PDF 3.2m/b) Dear Reader The stock market ended last week little changed at Dow 10,136 (10,193), which belied the drama seen during the week that included a Tuesday nose dive into the forecast target zone for a low of between 9,800 and 9,850 before bouncing back all the way into Thursdays closing peak of 10,264. Fridays session sought to correct this 450 point rally with a sharp drop in the last 15 minutes of trading from 10,200, which suggests follow through to the downside early week.

The overall trend remains in line with the last in-depth analysis and forecast - (16 May 2010 - Stocks Bull Market Hits Eurozone Debt Crisis Brick Wall, Forecast Into July 2010) Stock Market Conclusion Despite the flash in the pan crash and prevailing Eurozone sovereign debt default gloom and doom, the bottom line is that this is still a stocks bull market with the Dow ONLY down less than 6% from its bull market peak. Therefore the sum of the above analysis concludes towards the stocks bull market under going its most significant and a highly volatile correction since its birth in March 2009 (15 Mar 2009 - Stealth Bull Market Follows Stocks Bear Market Bottom at Dow 6,470 ). This correction could last for several months and may extend all the way into early October, which suggests that the next 2 months are going to see an ABC correction to be followed by a sideways price action between the extremes of 10,900 to 9,800 and so despite continuing wild gyrations I would not be surprised if the Dow is little changed from its last closing price of 10,620 in 2 months time (16th July 2010). Expectations remain for the bull market to resume its trend towards a target of between 12k to 12.5k by late 2010 after the tumultuous trading period over the next few weeks. I have tried to illustrate a more precise Dow forecast projection in the below graph, reality will probably end up being far more volatile.

The volatile price action looks set to continue as the market attempts to put in a bottom in the target zone of 9,800 to 9,850, whilst price wise this has been achieved, however time wise the market is still in its down phase, therefore I expect the Dow to trade back below 10k this week in an attempt to put in a higher short-term bottom before the market targets a move through the balancing point of the trading range at 10,350, before it AGAIN turns to break back below 10k during late June as part of its large sideways trading range as illustrated in the original forecast graph above. So far the market has not done anything for me to contemplate an alternative big picture, which despite the loud noises emanating out of the perma-bear camp as a consequence of the near daily crisis news about default this, that and the other, which when the dust settles has actually left the Dow little changed on the week. In summary - We remain in a sideways corrective pattern that continues to target a higher bottom late June, in advance of a trend towards the upper end of the range by Mid July. The immediate trend targets a break back below 10k as a continuation of Fridays end of day selling. UK Politics Could Hit FTSE Early Week As if the brewing Korean Crisis and European Sovereign debt crisis were not enough, the weekend has seen the first internal crisis to hit the Con-Dem coalition government with the shock surprise resignation of David Laws, Chief Secretary to the Treasury after he was allegedly caught out fiddling his parliamentary expenses by funneling £40,000 to his gay lover in contravention of the expenses rules (Con-Dem Government Starts to Crumble, David Laws Resigns, Liberal Democrats Betray Voters). Deficit Cutting Emergency David Laws has the responsibility of implementing huge public sector spending cuts starting with the £6.2 billion announced last week and to culminate in at least another £20 billion of cuts to be announced in the emergency June 22nd budget as part of a multi-year programme. John Laws was seen as ideal for the job as a Liberal Conservative he fit perfectly well within the Con-Dem government and as a former investment banker was seen to have the requisite skills to perform the task at hand. However now he is gone, and his replacement Danny Alexander to be frank is clueless on the economy, and will probably be spending his Bank Holiday reading up on economics texts and Treasury official documents so that he can construct a speech that contains a few buzz words to give the illusion that he has some idea as to what he is doing. The markets will not be forgiving for any indecision in terms of cutting the huge budget deficit that according to most recent data stands at £156 billion or about 11% of GDP, against which £6.2 billion of announced cuts is clearly too little with definitely more cuts to be announced to prevent the bond markets dump UK debt Spain style.

The above Government spending graph illustrates the amount Labour had plowed into the public sector annually over the past 13 years over and beyond inflation. For instance when Labour came to power government spending was at £318 billion which allowing for inflation would today stand at £408 billion. However Labour is spending an extra £270 billion over this as Labour continued to run a budget deficit even during the boom years which has today left the country with an annual budget hole of £156 billion. To say that the public sector had become bloated under Labour is an understatement as it is probably 25% larger than it should be i.e. government spending should be in the region of £508 billion instead of the current £677 billion. Out of control public spending by the Labour government is illustrated by Britains sacred cow, the NHS. Con-Dem Crisis The new governments crisis goes far beyond David Laws or Danny Alexander as now we face the question of how many more Lib Dem's who have never been under proper public scrutiny will be knocked out of the Con-Dem government as their dirty little secrets come out one by one. Already there are murmurings within hours that Danny Alexander has avoided paying capital gains tax by flipping the designation of his main home so as to claim expenses and not pay capital gains tax on profits. The same tax that is expected to more than double in the forthcoming emergency budget. The whole affair greatly weakens the government that has yet to complete its 3rd week in office and could result in major market turmoil early this week, which means the FTSE should significantly under perform other stock indices, which given that I expect the Dow to be weak early week implies a sharply lower FTSE. Meanwhile the British Pound continues to undergo its corrective bounce after hitting a new 2010 low against the dollar of £/$1.42, presently trading at £1.4480. The correction is expected to revert towards the long-standing target for a decline to below £/$1.40 as illustrated by the below graph. (26 Dec 2009 - British Pound GBP Forecast 2010 Targets Drop to Below £/$1.40)

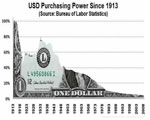

1. That sterling is targeting immediate support at £/$1.57 which implies it may temporarily bounce from there back through £/$1.60 before the eventual break. 2. That a break below £/$1.57 would target a trend to below £/$1.40. On a longer term view, the chart is indicative of trading range between £/$1.57 and £/$1.37, on anticipation of the eventual break of £/$1.57. On average this implies a 10% sterling deprecation against the trend of the preceding 6 months or so. UK Capital Gains Tax Hike to Hit Housing Market The FTSE is already suffering under the implications of the proposed Capital Gains Tax changes of expectations that the tax will rise from 18% to 40% which has resulted in gains being banked by private investors ahead of the tax hike on 22nd June. However the real hit from the tax hike will be felt not in the stock market but the property market, which hits the large number of buy to let sector investors who rely up on capital gains as an important element in generating total returns. Therefore expectations are for a surge in buy to let investors rushing to sell ahead of the tax hike, for which they have a very short window of opportunity of 22 days remaining. Another major contributing factor is scrapping of the costly Home Information Packs (HIPS), that has kept supply limited and hence supported house prices. HIPs have now gone and so home owners have no extra cost to bare by putting their homes on the markets which is as illustrated by the property website Rightmove that is seeing a 34% rise in listings. Of greatest concern is that a tax hike without reintroducing indexation for inflation would destroy the incentive for long-term investing. Therefore the government would be using inflation as a stealth tax to DOUBLE tax long-term investments, especially in the property market into oblivion, where it will become near impossible for an investor to make a gain in real terms. The same applies to stock market investments outside of tax free wrappers such as ISA's and SIPs, as there would be NO INCENTIVE to invest for the long-run. On top of this there is mounting evidence that raising capital gains tax may actually result in less tax revenue as people are less willing to realise gains i.e. to delay action, whereas a lower tax rate makes investors more likely to realise gains resulting in greater market turnover. Gold Bull Market Last weekends view that Gold falling $1,175 was clearly another buying opportunity has been reinforced by subsequent price action that has seen Gold close the week at $1,210. Gold Buying Opportunity! Notice no question mark, Gold's tumble to about $1,175 is healthy as my immediate take on the event concluded on Thursday (20 May 2010 - Gold Plunge to $1,175 a Buying Opportunity? ). Gold falling towards $1,150 is not even making me blink, its a non event, normal, expected even if I had not written about it before hand, its much better for Gold to be at $1,175 then to have risen to $1,300 BEFORE correcting, the bull is shaking the loose clingers on off of its back. I don't trade gold, but I am a long-term holder with a small investment position that I aim to increase. All these price movements are tiny when one considers the inflation mega-trend, that concludes towards much higher long-run gold prices, this years target is $1,333. However as I pointed out in the inflation mega-trend ebook, I would not be surprised if Gold reached $2k (though I would be if it happened this year). Gold is in a long-term bull market, the strategy remains to accumulate on corrections, and leave others to short the corrections and then to panic cover on short squeezes on subsequent rallies to new highs. Eurozone Sovereign Debt Downgrading Fitch's downgrade of Spain on Friday to AA+ was not really news as the market had already marked Spanish debt lower anyway with Spanish debt trading as if it were BB, 10 year notes yielding 4.27% against German bund's at 2.66% compared against UK 10yr gilts at 3.58%. The Rating agencies clearly are many months behind they curve as they are tugged by politics and income streams so they are NOT able to accurately rate sovereign debt, and hence FOLLOW the market. The ratings agencies have NO CREDIBILITTY, hence downgrades are no longer big market events. Though the problem is that many financial institutions behave like sheep which are fixed by rules that say they cannot invest in anything other than Triple AAA. I would imagine that many of the funds will shortly be revising these rules. Protect Yourself from Debt Slavery and Government Inflation The politicians as evidenced during the sovereign debt crisis bailouts continue to show that they are firmly in the back pockets of the bankster elite. Instead of countries such as Greece defaulting on their debts, they are being forced to become debt slaves to finance their debt masters (the bond market) in perpetuity, as power continue to drift from the debt slave sovereign states to the their debt masters i.e. the debt providers, the IMF and now the German Government which through its bailout holds countries such as Greece by the balls, and is fully willing to squeeze governments that show dissent and disobedience to the New German European Order. Off course looking at the bigger picture, the German state itself is enslaved to the banking elite. Even though I am a capitalist, I can clearly see that this is heading to some sort of socialist revolt against blatant debt slavery because the bankster's are their own worst enemy, they only know how to do one thing which is to systemically turn everyone and everything into perpetual debt slaves with the aim of squeezing every ounce of interest out of their slaves. We don't have real democracy, we have bankster elites dictating to politicians what they should do with the aim of centralising more power into their hands. In the UK taxes are set to soar, inflation has already soared, all is as a consequence of the crooks that call themselves Members of Parliament that funnel unlimited tax payer cash to their bankster masters pockets, in this regard so called socialist Labour MP's are NO different than their Tory elitist opponents. The financial terrorists continue to target country after country with a view to maximising profits as the risks of default soars. It is only the likes of Germany and France that have relatively small financial sectors that are COMPETEING AGAINST London and New York that can implement REAL financial reform such as a ban on Naked Short Selling. Whilst I am not religious, I can see that ALL of the worlds major religions have at their core that it is BAD, VERY BAD to borrow and lend money, that is for a reason because that IS the mechanism for turning people into SLAVES. Off course the bankster elite have over the centuries been busy corrupting even absolutist religious doctrine to the point where it becomes a farce, where those that subscribe to being religious as part of religions such as Christianity, Islam or Judaism use farcical mechanisms and frankly a load of B.S. to give the illusion that they are in obedience of their religious doctrine when in actual fact the complete opposite is true! Any religious person that borrows and lends money has been corrupted by the Bankster elite and is in fact default of their religion. The high priests of religions tooing and froing in prayer have been corrupted, I would not be surprised if there are even some places of worships that are handing out their own branded credit cards. In the modern world we have the rule of law as issued by our parliamentary representatives, unfortunately they have long since been corrupted and have done NOTHING, NOT ONE THING to offer an alternative to the debt slave model economy that perpetually channels peoples wealth and earnings into the pockets of the bankster elite, that leaves everyone with unsustainable debt burdens that ultimately seeks to destroy their lives. The credit crisis has made it crystal clear to what degree the bankster elite are in COMPLETE CONTROL, in that the politicians are willing to sacrifice the countries future to ensure that the bankster elite bond holders do not lose a single penny! Tiny pinprick countries such as Greece cannot stand a hope in hells chance against the bankster elite and their fund cohorts that seek to pick off countries one by one as candidates for default in swift panic fashion, against this we have the bankster elite forcing countries such as Germany to also bankrupt themselves to bailout countries that have TOO MUCH DEBT, they cannot service the current debt level so how will countries such as Greece be better able to service a debt mountain that will be 33% larger in 3 years time ? In the 16th century there was revolution in England against the absolutist Monarch, what we need is a NEW Cromwell for revolution against the system of debt slavery. The ONLY way YOU can Save yourself form the bankster vulture elite is to NOT BORROW MONEY !!! You need to know that those letters coming through your letter box offering you £10k at 3% are just as dangerous as if the envelope contained a sample of crack cocaine! Both will seek to enslave and destroy your life! Fools in the mainstream media are producing reams of garbage to state that the banks should lend more so that the trend towards absolute debt slavery may resume. Instead what should be happening is to break the cycle towards debt enslavement and bankruptcy towards a new financial system of capital investment rather than debt and interest, where there is no longer lending for consumption. More on how to protect yourself form the bankster elites in the Inflation Mega-Trend ebook, as the Bankster of England uses inflation as a stealth tax to steal your wealth. Do the Europeans Understand the Markets? Given the behaviour of Germany in the unilateral banning of Naked short-selling without telling anyone it would, suggests not. The markets are primarily driven by sentiment. Sentiment is impacted negatively by uncertainty, and positively impacted by reassurances, the German ban on Naked Short Selling whilst probably the right thing to do i.e. to prevent the bankster elite from manipulating the debt crisis to their own advantage, but implemented the wrong way as it is causing the markets to act even more chaotically then is usually the case. I think Angela Merkel and the rest of the E.U. Brady Bunch Politicians need to go on an intensive course so as to learn exactly what the markets are and what tends to drive them between the two extremes of fear and greed, because these clueless politicians tend to react in a manner which unnecessary pushes markets towards the edge. They need to understand that there IS a battle taking place and that it is between governments and the bankster elite that want to turn the governments into debt slaves to maximise profits. The markets are a mechanism for them to achieve this through market manipulations that enable the profits to be created during highly volatile market moves, usually as a consequence of panic such as that over the debt crisis as manifesting in the unregulated credit default swaps derivatives market. Merkel should have implemented the naked short-selling ban in an coordinated manner with at least other E.U. members if not the whole G20. What happens next ? Well the ONLY solution to the debt crisis remains as I voiced over a year ago, no 2 years ago now, that the ONLY answer is for the governments to keep PRINTING MONEY, there IS NO OTHER ANSWER, as the alternative as we are repeatedly reminded by the Perma-bear Deflationists IS DEFLATION. Which is an OBVIOUS outcome of Debt Deleveraging WITHOUT MONEY PRINTING. However money printing once started cannot stop until its ultimate conclusion which is very high inflation, as illustrated at length in the 100 page Inflation Mega-trend Ebook (FREE DOWNLOAD). The E.U. Bailout has bought the euro zone some time as they prepare to attempt to print their way out of the debt crisis, with possibly two currencies eventually emerging one for those that cannot compete against Germany and one for those that can. Off course two currencies, one for North Europe and one for the South Europe means that over time we will see divergence in standards of livings between the north and the south as the two currencies follow different paths and thus the South becoming significantly poorer in terms of purchasing power than the North, but that is how it should be because frankly the South has shown itself to not work as hard as the North when it comes to generating wealth, too many siesta's in the Sun. In conclusion Individual investors need to protect themselves from a. debt slavery and b. from the governments stealth tax - inflation as detailed at length in the Inflation Mega-Trend Ebook. OECD UK Interest Rates Should Rise to 3.5% During 2011 To Combat Inflation The OECD academic economics institution says that UK interest rates should rise to 3.5% by the end of 2011 to combat inflation. The OECD inline with other academic economics institutions remains as much as 6 months behind the curve by stating the obvious that inflation is too high AFTER inflation has risen to a 19 year high with RPI hitting 5.3% and CPI at 3.7%, by warning of higher UK interest rates AFTER market interest rates have already risen. The OECD, much as the other academic institutions exists purely to consume government funding ( Tax payers cash totaling Euros 328million per annum) by stating the obvious and constantly revising what amount to near worthless rear view mirror forecasts AFTER the fact on virtually a monthly basis that is diligently regurgitated by the gold fishesk memory mainstream press as though it amounts to news. The OECD states the obvious some 6 months after the fact: "The reversal of the December 2008 VAT cut and higher fuel prices have contributed to the recent jump in inflation. Notwithstanding the temporary nature of these price developments, the gradual drift up of some measures of inflation expectations implies a need to increase interest rates earlier than previously thought and no later than the last quarter of 2010, The projected increase of core inflation to the Bank of England target warrants policy rate to 3.5pc by the end of 2011." The same academic economists have sleep walked governments to the edge of bankruptcy, much as those that populate the bankrupt bailed out banks had succeeded in doing so during 2008. Interest Rate Rise Around the Corner The base rate is at 0.5%, whilst CPI is at 3.7%, the base rate should be at least 4.5%. This is as a direct consequence of bailing out the banking sector where money is being effectively stolen from savers and dumped onto the balance sheets of banks, who then recycle it out as bonuses for fictitious profits that only exist because of the forced tax payer and savers bailout. Still the OECD whilst 6 months behind the curve is still ahead of the The Bank of England and the mainstream press who have continued with the mantra of NO change in UK interest rates this year, this is illustrated by Roger Bootle of the Daily Telegraph's repetitive assertions that he expects UK interest rates to stay below 1% for the next 5 years! Meanwhile market interest rates have already risen as the bond markets price in higher inflation and interest rates, with the bond market targeting a year end interest rate of between 4.5% and 5% for UK government bonds which will have severe implications for the financing of Britians huge and growing £1 trillion debt mountain (PSND) with total liabilities extending to more than £3.7 trillion. My in depth analysis of 13th January (UK Interest Rate Forecast 2010 and 2011 ) concluded with the following forecast, that takes into account that despite the Bank of England wanting to keep interest rates at 0.5%, the market will force the BOE to start raising rates. UK Interest Rates Forecast 2010-11: UK interest Rates to Start Rising From Mid 2010 and Continue into end of 2010 to Target 1.75% / 2%, Continue Higher into Mid 2011 to Target 3%.

UK Inflation Forecast 2010 My analysis since November has been warning of a spike in UK inflation as part of an anticipated inflation mega-trend (18 Nov 2009 - Deflationists Are WRONG, Prepare for the INFLATION Mega-Trend ) that culminated in the forecast of 27th December 2009 (UK CPI Inflation Forecast 2010, Imminent and Sustained Spike Above 3%) as illustrated by the below graph.

Inflation Is a Government Stealth Tax On / Theft From Savers and Workers Whilst Mervyn King writes letter after letter full of repetitive worthless excuses as to why the Bank of England cannot do its job. The price is being paid for by ordinary savers and workers who are in effect being robbed by the banks and the government as inflation is a stealth tax on savers and earners that seeks to stealthily destroy the real value of accumulated life time savings and erode the real purchasing power of earnings. Add to this that savings are TAXED at 20% then savers should be enraged and demonstrating in the streets as to why they are receiving a pittance of interest rates at just 2.5% on even the top ranked savings accounts when inflation as measured by RPI is at 5.3%, and when tax is taken into account savings interest rates would need to be at 6.4% JUST to break even against inflation. So basically the Government, Bank of England in collusion with the bankster's are STEALING more than 50% of the earnings capacity of savings and therefore theft of the real capital value. Inflation Protection for Ordinary Savers With RPI at 5.3% the only real effective protection that ordinary savers can seek is in National Savings Index Linked Certificates which pay RPI +1% TAX FREE as mentioned in the Inflation Mega-trend Ebook (Free Download). However protection here is limited to a maximum of £15k per issue per individual. VAT 20% Inflation Time Bomb Temporary Inflation ? So called temporary Inflation is into its 6th month, will it still be temporary when it soars above 4% CPI and 6% RPI as a consequence of the VAT hike to be announced in the ConDem emergency budget on 22nd of June, as I wrote recently (05 May 2010 - Greece Economic Depression Resulting in INFLATION NOT DEFLATION Surge ) A post UK election VAT hike to 20% from 17.5% is near certain to bring in extra revenue of about £13 billion per year. This will have the effect of both spiking inflation sharply higher and maintaining the ongoing longer-term inflationary mega-trend, therefore I would not be surprised that following the implementation of a VAT tax hike that CPI spikes above 4% and RPI as high as 6%! Which would further discredit the Bank of England's mantra of "Don't Worry Folks its Only Temporary". BP Killed by Top Kill Failure BP is expected to take a battering when the markets open Tuesday, this is a catastrophe for the Gulf and BP, top kill was supposed to have an expectation of success of between 60% to 70%, instead its turning out it was more like 30% chance of success. This crisis is going to trundle on for several months, BP's share price is going to take a battering for the duration, at some point it will be cheap, but not whilst the gusher keeps blowing. The total spill cost looks set to be well north of $10 billion and may even run to over $20 billion, against which BP has insurance of an estimated $600 million, the only winners are going to be the lawyers who will rake in hundreds of millions in fees. Politically the Oil leak has damaged Obama, especially as the republicans relentlessly pounce on Obama as though the oil leak crisis in the Gulf was directly his fault. Though conveniently forgetting that not so long ago the Republican high command such as Palin were coming out with statements such as "Drill Baby Drill" with a view to extensive expansion of drilling in Alaska and other coastal areas of the United States, republicans are and always will remain two faced hypocrites! Apple Passes Microsoft in Market Cap Apple has overtaken Microsoft for the first time since the late 80's when Microsoft watched Apple and IBM batter each other into desktop PC oblivion in the O/S wars as Microsoft proceeded to take over the planet with Windows. In fact Apple was on the verge of going bust in the mid 1990's and was bailed out by Microsoft with a small investment and pledge to develop their office suite for the Apple O/S. In terms of valuations, Microsoft is cheaper on 11.6X earnings against Apple on 17.6X, and Microsoft profits are $17n against $10 billion for Apple, plus Apple does not pay a dividend, so I think over the next 12months Microsoft 'should' outperform an overbid Apple. Artificial Life to Spark the Next Industrial Revolution? To end on a bright note, as the computer age morphs into the internet age, we appear to be witnessing the birth pains of the next industrial revolution in artificial life and living computers. The oil companies are already queuing up to invest in the development of micro-organisms to enable them to manufacture fuels from water. Lets hope that one of these new micro-organisms does not one day mutate and start turning humans into gooey mush! In the meantime the question is how to monetize on this soon to be unfolding industrial revolution? Your Fight the Power by NOT BORROWING Money Analyst Source and Comments : http://www.marketoracle.co.uk/Article19936.html By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Jim_Willie_CB Let me start the article with a personal note. For the last six years, my pen has put forth a public article almost every week. Since the end of 2009, a change has come from that pattern, for four reasons. First, articles take time and serve as free volleys sent into cyberspace. They are attempts to raise awareness of a broken corrupt system, to encourage increased investment protection by the investment community, and to make repetitive messages that can sink in. Second, many of the warnings have come true of a monetary system in tatters, an insolvent banking system, a failed central bank franchise system, and a discredited amalgam of sovereign bond markets.

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.