PONZI Finance Recipe for Economic Catastrophe, Gold Not a Bubble

Economics / Global Debt Crisis Jun 11, 2010 - 04:26 AM GMTBy: Ty_Andros

The “When hope turns to Fear” moment (See 2010 Outlook “When hope turns to Fear” in Tedbits archives) is unfolding as we speak, as the tides of insolvency sweep over the social welfare states and financial systems of the developed world. It is the next leg down in the global financial crisis and what will come to be known as the greatest depression ever is commencing -- we are fascinated and astonished at what the main stream media is reporting and failing to report.

The “When hope turns to Fear” moment (See 2010 Outlook “When hope turns to Fear” in Tedbits archives) is unfolding as we speak, as the tides of insolvency sweep over the social welfare states and financial systems of the developed world. It is the next leg down in the global financial crisis and what will come to be known as the greatest depression ever is commencing -- we are fascinated and astonished at what the main stream media is reporting and failing to report.

No amount of PONZI finance or money printing will rescue the Western world from its immorality masquerading as morality. SOCIALISM is IMMORAL and that is why it always FALLS into BANKRUPTCY. As Margaret Thatcher once said:

“The problem with socialism is that eventually you run out of OTHER PEOPLE’S MONEY” - Margaret Thatcher

Of course they now have. The idea that asset values (malinvestments) or economies are going to resume growth or achieve pre-2008 levels is FALSE. Extend and pretend is DEAD, political lies are being exposed for what they are: Deception of the dumbest among us who swallow them hook, line and sinker and who then place their trust in government to solve problems they themselves should be solving. Let’s look back at a chart of the percentage of GDP the West’s social welfare states CONSUME and then MISALLOCATE to the unproductive and crony capitalist elites:

Simple math tells you that if budget deficits approach 10% of GDP these freeloaders, socialist redistributionists and misallocations of capital must cut government spending by 20% to restore ANY CHANCE for a private-sector recovery. FAT chance; but even a reduction of 1/3rd of that will bankrupt many of the crony capitalists and their LENDERS.

Instead they are implementing another power grab in the name of reform and believe that when it comes to spending they only know one word: MORE. The more public serpents and elites try to preserve the absurd in the name of JUSTICE and FAIRNESS, the farther recovery becomes the horizon.

Authors note: The world is AWASH on a sea of FIAT currency and credit creation. The only places where there is no cash are (1) welfare-state government coffers, as economic activity collapses tax receipts, and (2) on the balance sheet of the largest players in the financial system who are choking on the toxic assets they themselves created and borrowed money to buy.

At no time in history have assets -- stocks, bonds, real estate, etc. (malinvestments inflated by cheap credit) been more MISPRICED, and since the value of fiat currency as a unit of exchange is unknowable (not measured in GOLD or silver), prices are set to REPRICE and create VOLATILITY rarely seen in history -- other than previous “CURRENCY EXTINCTION” events such as Argentina, Weimar Germany and unfolding in VENEZUELA right now. Volatility is exploding and set to increase, creating HUGE opportunities as these markets zoom up and down. Learn how to fix your paper currencies and diversify into absolute return alternative investments with the potential to thrive in UP and down markets! This is what I do, contact me!

Keep the corner of your eye on Venezuela; this is where the developed world is headed! It is fascinating see Comrade Hugo torpedo his own economy to implement SOCIALISM, also known as MISERY spread WIDELY. He is following in the footsteps of Comrade Bob in Zimbabwe. Just look at the BOLIVAR currency, it says it all. You know, many in the BELTWAY are BIG supporters of Comrade Hugo.

Comrades Merkel and Sarkozy are now proposing BANNING short selling on stocks and sovereign debt throughout the Euro zone; obviously they do not like the opinions of the public and institutions that SEE the folly of current policy and who rationally want to vote against it, and so their solution is: OUTLAW anyone with whose opinions they DISAGREE and OUTLAW the mechanisms with which they do so. Not one short selling ban has halted a crash, as holders of the poor assets are just plain old sellers exercising RISK management.

Wealth creation (producing more than you consume and fostering rising incomes) is the only solution to preserving wealth in societies which practice credit-based FIAT currencies. FIAT currency based financial systems ALWAYS fall into insolvency, bond market collapses, serial quantitative easing and then hyperinflation, without exception throughout history. THIS TIME WILL BE NO DIFFERENT. I DEFY any analyst to show me one exception….

The destruction of the productive to feed the unproductive is cannibalism of the worst sort. In the name of social justice, public servants in something-for-nothing societies REFUSE to reform the welfare states of the west and implement polices of growth. Such REFORMS spell DOOM for their futures, economies and their constituents. IMPLEMENTING more wealth redistribution and taxes WILL FAIL to revive anything and sets the next deepening of the unfolding crisis and depression.

Over forty years of borrowing and spending to substitute for the policies of growth are now FAILING and the bills are now coming due. Only there is NO MONEY, and unfortunately, economic growth and wealth creation is something the Western world’s fathers and grandfathers knew about, but for current leaders they are but a footnote in the history books. Let me repeat: The IDIOTS at the wheel of economic and political power are implementing policies which have NO CHANCE of fostering economic and income growth.

The idea that a handful of brilliant minds can somehow steer an economy is fatal to economic growth and stability. The Soviet Union's economy failed because of its central economic planning, and the U.S. economy will suffer the same fate if we continue down the path toward more centralized control. We need to bring back sound money and free markets – yes, even in healthcare – if we hope to soften the economic blows coming our way. -Ron Paul

As interest rate spreads continue to BLOW OUT, private-sector -- and some public bond market issuance collapses -- and G-10 economies edge toward blowing up. Their political leaders, crony capitalists and banksters are all in a panic. Bond markets are shutting down, overnight markets are as well. Credit is collapsing again. Every measure of credit risk is below the worst levels of last month! As outlined in the May 6th edition of Tedbits, Black swans have taken flight and in their wake FAT tail events are emerging on the horizon.

In Amerika terrorists inside the Beltway have implemented the policies of an impending economic collapse. Health care reform (nothing of the sort, it’s a takeover, see video below), financial reform (before they even have the report from the financial crisis commission, once again this is not reform it is a politicization of the financial and banking industry), expiring Bush tax reforms and soon ENERGY legislation (collapsing US energy production in the name of saving you) are going to collapse the economy. All mostly ENSHRINED into law, set to unfold and be implemented in the next several years.

Reconciliation of the financial reform bill is going on, WHERE ELSE? Behind closed doors with four of the most incompetent corrupt public officials on the earth doing the DEALINGS:

Or should I say political STEALING and fleecing of the public. Let’s see, (1) a bagman for Government, … er Goldman Sachs, (2) a retiring senator who is retiring because he has no chance of reelection (so he has nothing to lose and can commit any crime) with (3) his gangster boss, and (4) the leader of the finance committee which fathered Fannie and Freddie’s insolvency. A more competent crew to REGULATE the financial system couldn’t be found anywhere. HA HA. Be afraid, be very afraid.

Keep in mind, the developed world’s banks and financial institutions have over $17 TRILLION of debt they have to ROLL in the next three years, and the assets they bought have lost up to 40% of their values. Do you think that money will rollover or demand payment? Or perhaps demand higher rates?

Next month some of the money (almost 500 billion Euros) the EU offered banks for during the financial crisis must roll, unfortunately it will be the seeds of the next down leg of the EU crisis, as European banks borrowed the money from the ECB at 1% and bought SOVEREIGN debt which is almost unsellable. Talk about a carry trade BLOWING UP. July will be a severe test of crisis management as these banks are increasingly SHUT out of the short-term lending markets or have to pay up to roll. Can you say another year of unlimited borrowing from the ECB?

In a recent Wall Street Journal entitled: Deutsch Bank Deserves Bite Bair Gave it, Peter Eavis reported:

“Was that Deutsche Bank that recently took a mauling from the Bair?

In a letter last month to an industry group called the Institute of International Bankers, Sheila Bair, chairman of the Federal Deposit Insurance Corp., went to considerable lengths to defend a part of the Senate's financial-overhaul bill that aims to strengthen capital regulations.

To support her case, Ms. Bair noted that the consolidated U.S. operations of an unnamed foreign bank have "negative Tier 1 capital." In other words, after regulatory adjustments, these banking operations have an actual capital deficit. Ms. Bair may have been talking about Deutsche, whose U.S. bank holding company, Taunus Corp., has a Tier 1 risk-based capital ratio of negative 7.58%, according to a regulatory filing. With $364 billion of assets, Taunus isn't a bit player.” - Peter Eavis

NEGATIVE tier-one capital? It is not isolated to these two; it is an epidemic amongst the biggest players.

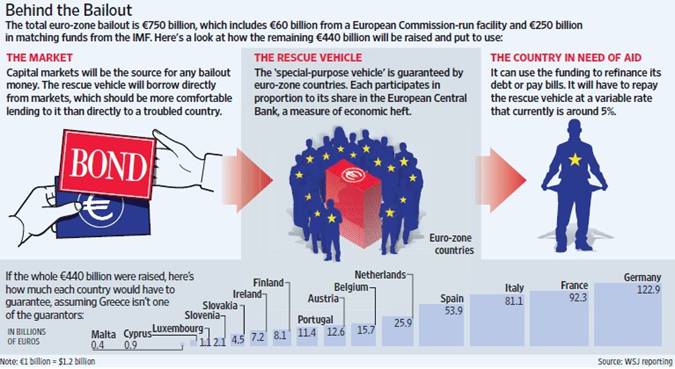

In the a previous Tedbits (May 20, 2010) I outlined the NEW special-purpose vehicle to RESCUE/bailout and how special-purpose vehicles are only used for DECEPTION; let’s look at a graphic of the deal from a recent wall street journal:

This is being done to keep the NEW debt off their individual balance sheets and circumvent the Euro zone rules which prohibit buying the debt of individual EU countries.

This is a picture of public-sector deception in the light of day. When will the markets call their bluff? When they try to issue the first tranche of that debt is my guess. Let’s see nothing from the respective EU governments except guarantees for the special-purpose vehicle (all the guarantees are from morally and fiscally bankrupt nations and public serpents), virtually none of the governments have budget deficits less than 6% of GDP (see graphic above) and their countries are not GROWING, so the debts are compounding at an inconceivable rate.

All have OTHER OFF BALANCE-SHEET obligations which are many multiples of GDP (which are unpayable as growth is ZERO), and of course, the ratings agencies will rate them AAA. Politicians will lean on them to do so, this is also known as creating “Fairy tales”. Anyone who buys these offerings will get what they deserve: NOTHING.

All of the countries are raising taxes, directly or indirectly on what few places in the private sector actually have profits or incomes and they are refusing to cut the public sectors in any meaningful manner. I will now take you back to a quote from Bill Gross of PIMCO, the world’s largest bond manager:

"If core sovereigns such as the U.S., Germany, U.K., and Japan 'absorb' more and more credit risk, then the credit spreads and yields of these sovereigns should look more and more like the markets that they guarantee. The Kings, in other words, in the process of increasingly shedding their clothes, begin to look more and more like their subjects. Kings and serfs begin to share the same castle."- Bill Gross

Bingo, and it actually is a SAND castle at this point. The waves of history are about to wash over them like the tides. Hanging like Damocles’ sword over these FRAUDSTER’s, they shall soon learn history’s lessons, as will investors who have placed their faith in banksters and Big wire houses (investment banks). Developed world governments and their financial systems are operating in BANKRUPTCY; I hope you are not on the other side of this trade as you are now a creditor, not an investor….. Although there is one thing you can count on them to do… PRINT the MONEY out of thin air and hand it back to you…

No entrepreneur or business owner in their right mind would hire an employee or plan an expansion without knowing the cost of their labor, new healthcare mandates, availability of credit or the cost of energy and unreported tax increases (VAT taxes, Medicare surcharges, the destruction of capital gains taxes, etc., the list is too long to cover, but be assured there are dozens of new taxes). When those issues are UNKNOWABLE uncertainty reigns SUPREME and the willingness to take risks vanishes, because there is no way to calculate the odds of success with those VARIABLES. There will be no jobs or small business growth until these things are dealt with.

Investors are in the same BOAT. They are confused and misled by banksters, main stream media and Investment banks; knowing past advice has failed and seeing that the prescriptions for future investing are no different than previously in a world of RELATIVE returns. This is the road to disaster and poverty for people trying to store capital and wealth in paper assets.

How many years will it be before they emerge again is the question? The answer is as long as it takes for these changes to be knowable. Take a look at this on- minute video of Glen Beck: www.youtube.com/watch?v=0PE4b0VFzYI It outlines FDR’s New Deal and its regulatory straightjackets, and then compares them to the current healthcare legislation; from the looks of it, the current lawmakers are dwarfing what took place then. THIS IS A MUST SEE VIDEO to gain perspective. Then think about FINANCIAL reform (2,000 pages of NEW LAWS) and energy legislation which will inevitably emerge from the accident in the gulf. Cloaks of complexity, regulatory buffoonery and corruption are descending on the social welfare states of the G10.

It will be years, if not a decade or more, to get over the destruction caused by this legislation. It took over 20 years for the destruction implemented by the Roosevelt administration’s NEW DEAL to be repealed and for growth to resume. These idiots are dwarfing those mistakes so you can expect it to take at least equally as long this time around.

The only businesses expanding are those on the GOVERNMENT GRAVY train. They are about to hit a brick wall just as Greece has done. Crony capitalists and public-sector unions are the only beneficiaries -- and the private sectors of the respective countries are on the menu, as the something-for-nothing societies eat the productive to FEED the welfare state. When they hit the BRICK wall then the fun really begins, political assumptions built up since 1971 are about to meet REALITY and it will BITE. Have you ever heard a politician ADMIT a MISTAKE and correct it? I know I haven’t.

The present leadership inside the Beltway and G10 capitals has engineered the perfect storm of destruction. In 1982, Margaret Thatcher and Ronald Reagan had reduced taxes and regulation and dismantled much of the Welfare State, thus setting the table for growth and wealth creation. Conversely, since 2008: socialists have implemented the largest intrusion into the private sector in history, they are politicizing the financial sector even more, radically expanding entitlements, taxes and the social safety net. One approach -- the road to recovery, the other -- road to RUIN. Public serpents and their special interest supporters have chosen the latter.

I am tired of hearing misinformation in the mainstream press. Is gold a bubble? No. I will provide a few graphs to illustrate the history of other bubbles in comparison and the fundamentals versus paper creation. First let’s look at a chart illustrating some recent bubbles (from Bruce Pile of www.goodstockinvesting.blog) and compare the present move in gold:

‘Now let’s look at them numerically, from Clusterstock:

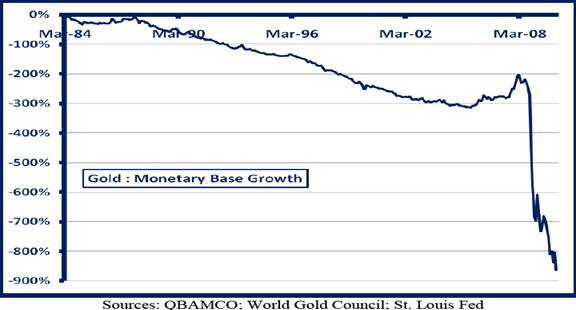

Now let’s take a look at gold prices in context to money supply creation (courtesy of www.qbamco.com) versus the real gold stock. This is the fundamental illustration of what is unfolding IN FRONT OF US:

This is a fabulous illustration, thanks again to www.qbamco.com . What is it saying? The fundamentals are in place to match any of the previous outlined bubbles!!! But also that we are in the infancy of the coming move. Remember, currencies don’t float they just SINK in purchasing power at different rates, take a look at the uniformity of the theft of purchasing power by MAJOR central banks and their public serpent partners in crime who are printing money OUT OF THIN AIR to fund their redistributionist schemes, stealing the purchasing power of your money while it sits in the bank:

Those gains are the reciprocal of how much purchasing power your money has lost while it sits in SAFE cash and US Treasuries. In other words: put negative signs in front of those numbers to see how you have been FLEECED in terms of purchasing power. The purchasing power of paper FIAT currencies is in FREEFALL.

Those gains are the reciprocal of how much purchasing power your money has lost while it sits in SAFE cash and US Treasuries. In other words: put negative signs in front of those numbers to see how you have been FLEECED in terms of purchasing power. The purchasing power of paper FIAT currencies is in FREEFALL.

Technically, the gold charts IN ALL CURRENCIES show ORDERLY long-term, secular bull markets commencing over 10 years ago. Take a look at this chart of gold since 2006:

This is the picture of an orderly advance, where gold spends long periods consolidating its gains and building corrective technical formations, then the pattern becomes active and the market goes higher in an orderly manner. Based upon the last two technical patterns (in this chart, the reverse head and shoulders), both of which are active, they project gold’s next price move to the $1,350 - $1,450 area. Question: Can gold back and fill and then go down before going higher? Of course it can. That is the very definition of an orderly market advance.

Let’s keep in mind another fundamental fact: Emerging-world central banks are sitting on 6.3 TRILLION (Dollars, Euros, British Pounds, and Swiss Francs etc.) of reserves in soon-to-be increasingly worthless developed world currencies, and less than $100 billion of it is in gold. Then, think of the $200 TRILLION sitting in financial assets around the world and the percentage of them in gold, (illustrated by this fabulous chart by www.agorafinancial.com):

Do you think they might increasingly want to exchange progressively-worthless FIAT paper money (IOU’s of bankrupt countries) for TIMELESS, real money sometime soon? I do! In addition to this fundamentally bullish picture, add the fact of the GARGANTUAN short positions held by the biggest banks in the world; they will soon face their waterloo, as they are overwhelmed by a tsunami of cash seeking safety and lighting a short covering bonfire to their balance sheets as well. That’s a mighty small door to safety, the sooner you arrive the better you will fare. At this point, GOLD IS NOT A BUBBLE. The bubble is in front of us, not in the rear view mirror. Remember:

The greatest transfer of wealth from those that hold it in paper to those that don’t is under way…Wait until the BIG money PANICS. When will they WAKE UP? A Crack- up boom looms…

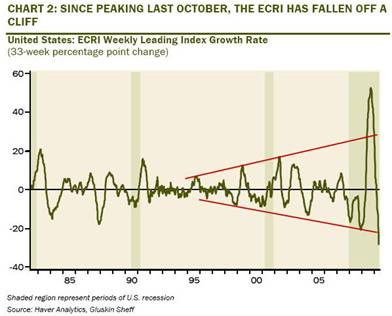

Look no further than these two charts of the ECRI economic index (from David Rosenberg www.Gluskinsheff.com), you can easily see the wolf waves (whipsawing megaphone formations) signifying the wild and EXPANDING oscillation in the economy caused by fiat currency and credit creation (either too hot or too cold):

Wolves eat people and these Wolves will eat economies. You can expect this to be coming true, heading into the last half of 2010; the economy of the US is heading into freefall right behind the EURO ZONE. An economic bloodbath approaches.

In conclusion: Black swans are firmly in flight and the FAT lady is singing. Catastrophe looms, courtesy of the chosen one and his minions in congress. The potential opportunities to profit from this unfolding maelstrom are infinite. This is not DOOM and Gloom, it is reality, learn to deal with it and prosper, fail too and learn the lessons of history in REAL time.

Everything is mispriced and will move UP and DOWN to price in unfolding REALITIES. Buy and hold is DEAD, and paper is poison. Applied Austrian economics is the recipe for success. Learn how to diversify your portfolio and create absolute return alternative investments and put gold behind your cash as it used to be. This is what I do. contact me if you wish…

Public servants in G10 capitals are destroying your futures and implementing the death of their economies ON PURPOSE to use the crisis to SEIZE power and what’s left of their respective private sectors. It is the something-for-nothings eating their own future. It’s going to be a HOT summer with lots of FIREWORKS.

Job and income growth? What job growth? Incentives matter as does the ability to take a calculated risk in hiring a new employee or starting a new business. Why take a risk when there is no reward for doing so?

There is no reward and there will be none; socialists never understand human behavior except at the lowest levels of society where people are desperate to escape POVERTY, thus becoming the mob which populous politicians prey upon, even though they are the culprits of the economic malaise. The consequence of their economic illiteracy and insatiable greed for power over others, along with their progressive policies.

The problem does not lie with your small-business-owner neighbors, aka the RICH, as your public serpents tell you. But don’t worry, they will just pull back their animal spirits and wait for better economic weather.

Battles loom between the public and private sectors to see who serves who. The policies of Insolvency are firmly in place in the social welfare states and are being added by the day, and it spells ECONOMIC doom. Global growth is falling off a cliff in the developed world and the structural reform REQUIRED will not be considered until the economic collapse is complete.

Thank you for reading Tedbits. If you enjoyed it...

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2010 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Jamie

15 Jun 10, 00:48 |

Dollar

Why has the dollar not crashed yet as you keep reminding us it should for the past several years ? |