Four Factors to Consider Before Determining Your View on Stocks

Stock-Markets / Stock Markets 2010 Jun 21, 2010 - 05:31 AM GMTBy: Money_Morning

Jon D. Markman writes: Stocks rose worldwide over the past week -- ranging from +2% in U.S. big caps to +6% in gold -- as investors swelled with sudden courage in response to positive reports on Chinese economy and glimmers of hope that European governments can get their financial houses in order.

Jon D. Markman writes: Stocks rose worldwide over the past week -- ranging from +2% in U.S. big caps to +6% in gold -- as investors swelled with sudden courage in response to positive reports on Chinese economy and glimmers of hope that European governments can get their financial houses in order.

The week's results erased four weeks of losses, including the despairing session that ensued on June 7 after a disappointing report on U.S. employment. Meanwhile, the result of the past 35 trading days, or seven calendar weeks, are still largely negative, ranging from a loss of 5.5% for U.S. stocks and -8.5% for Europe. Only gold stocks have eluded the smoke monster, rising 7% in the span.

The variation in one-week and one-month results illustrate perfectly how investors are showing that they are hopeful but unconvinced that recent strength in gross domestic product (GDP) growth and corporate income advances are sustainable, and therefore won't buy stocks heavily until prices are so cheap that they discount worst-case scenarios. In other words, they want a high risk premium before buying -- sort of like demanding a 72-month warranty before buying an expensive car.

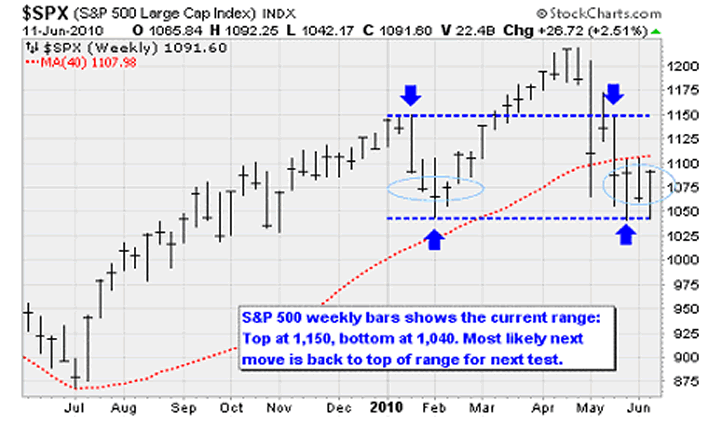

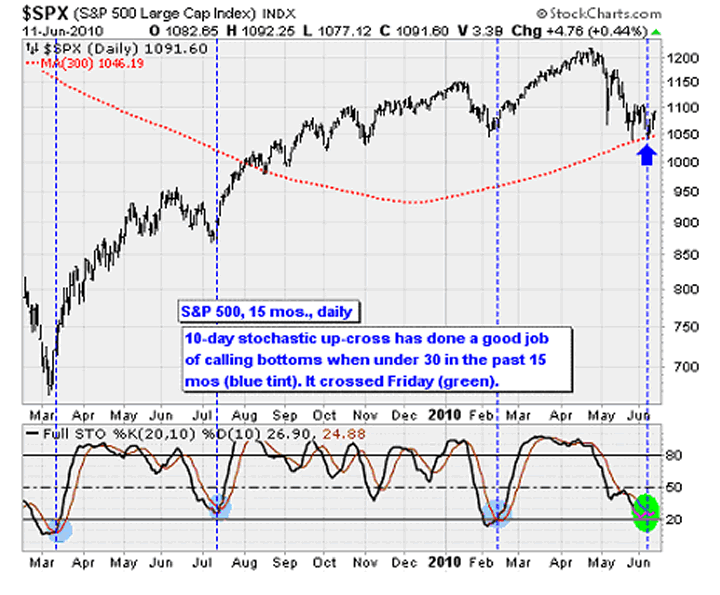

If it seems that we're sort of treading water lately after the big down moves in mid-May, you can see that is basically correct in the chart above. In fact what's setting up now is a classic duel between investors with a positive view of the future and investors with a pessimistic view of the future, which I sometimes call bulls and bears for the sake of brevity.

What very often occurs over prolonged stretch of time is a standoff between the two views until definitive evidence emerges that one view or the other is correct. This shows up as a "trading range," or a period in which stocks move up to a well-defined level of resistance (now 1,150 on the Standard & Poor's 500 Index) and then down to a well-defined level of support (now 1,140 on the benchmark index).

When prices reach each of those two levels, we have already seen that market participants are defending their world view. Sometimes I use military terms to describe the action, observing that bears are on the ridgeline shooting down from 1,150 or that bulls are defending their fort at 1,040. While these terms may seem glib, they're just a way of describing the clash of opinion.

How do we make money in an environment like this? It's most important that we each try to develop a personal long-term point of view first. And then recognize that it usually takes longer than anyone ever expects for our long-term views to play out, and in the meantime there may be a lot of variation in the market -- jiggling around the mean -- that can throw us off track.

While "in the box," or the trading range, it's very important not to get too bullish at the top or too bearish at the bottom. The high-probability expectation is that the range holds, which is why I urged you not to become too bearish two weeks ago as the market pounded 1,040 a couple of times.

Here are four major factors to consider before determining your long-range view of stocks:

-- European consumers are the first or second largest market in the world, depending on how you count. Germany is doing well with its strategy of machinery exports to China; most other countries are not. The British, Spanish, French, Italian, Belgian and Hungarian governments have all said they are going to cut back on government spending to get their deficits under control enough to prevent sovereign debt downgrades. GDP growth in the EU is on track to clock in at -1% to +0.5% over calendar 2010. This doesn't leave a lot of opportunity for most companies to grow earnings successfully even if they keep cutting employee and supplier costs. Negative.

-- U.S. economic growth has likely peaked for this cycle, but has an opportunity to settle into a cruising speed at around 3%. Even if corporate profits peak this quarter after absorbing fiscal stimulus for 14 months, they can still hit a cruising speed too, at around annual +10% growth. The United States has the most flexible economic system in the world, so it adapts quickly to change. More on this in a moment. Neutral.

-- Chinese economic growth is key to the success of basic materials suppliers worldwide, including individual companies like iron ore producer Cliff Natural Resources Inc. (NYSE: CLF) and whole countries, like Australia and Brazil. Although we know that China has tried to clamp down on bank lending to prevent a real-estate bubble from soaring out of control and leading to a big crash, there are signs now that officials have taken their feet off the brakes.

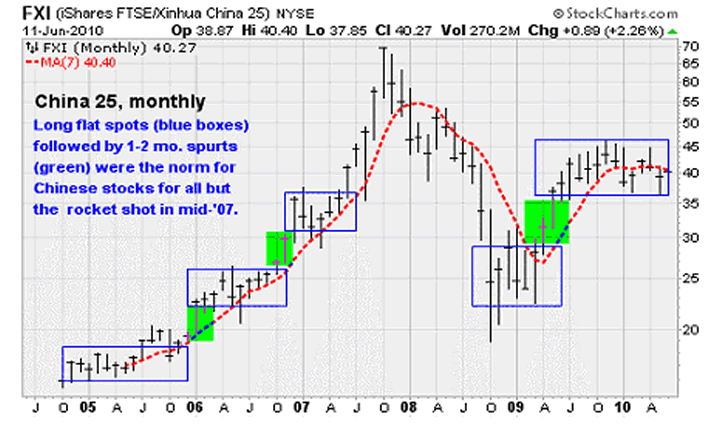

Investors in the West alternate between marveling at Chinese growth and being repulsed by it. But according to reports from my friends Robert Hsu and Keith Fitzgerald, who visit frequently, there's no doubt that it is occurring. So we may have to get used to ups and downs in its efforts to acquire basic materials. The last seven months have been negative for China, but it's possible to argue that the next seven months could be positive as credit starts to flow again, for better or worse. As you can see in the chart of the iShares FTSE/Xinhua China 25 Index (NYSE: FXI) above, long flat spots like the one seen since November 2009 have been common since 2005 except for the one big rocket shot in 2007. Long-term investors are buying at the bottom of these rectangles and holding for the next shot higher, whose timing cannot be easily forecast. Positive.

-- Government bonds are providing no competition for investors' funds. And that is terribly important, because big pension funds and individuals alike have long-term obligations for which they need to invest. If you're the defined benefit manager at a Lockheed, say, and are responsible for the pensions of 100,000 former employees, low interest rates are forcing you to buy stocks whether you like it or not. A 3.5% return on 10-year paper is just not going to cut it. All of your expectations are built on 6%-8% annual returns, and the longer you go without getting it the more desperate you become. You are virtually forced to put money at risk in the stock market, and this is one of the key reasons that the Federal Reserve and European Central Bank are keeping rates low. And it's one of the main reasons that Warren Buffett keeps buying stuff like railroads and utilities: because there's no competition from safer ways of making money, like investment-grade and government bonds. Positive.

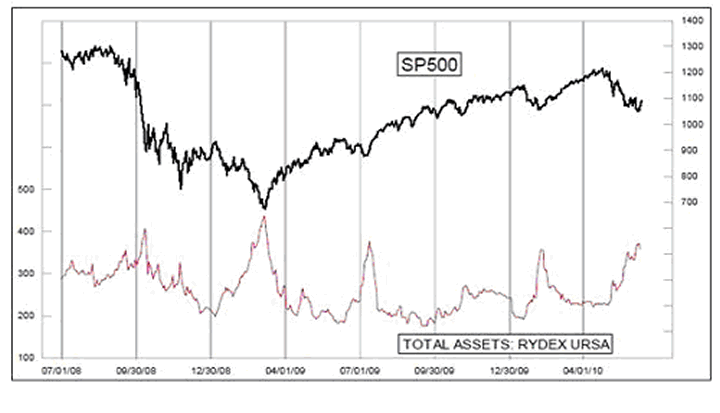

-- Sentiment continues to be heavily negative, with some measure of pessimism lately reaching epic proportions not seen since the end of the bear market in March 2009. The long scope of the stock market can be seen as a way of taking money from weak hands and transferring it to strong hands. That's a cliche comment but the practical manifestation of it occurs when pessimism gets so strong that "weak hands" give up their shares easily to "strong hands" who have seen this movie before. This happens in reverse too, of course, when the public becomes overly bullish, as in mid-April.

I've shown you a number of ways of measuring sentiment. Here's a new one, courtesy of Tom McClellan. The chart above in red plots total assets in the Rydex Ursa Fund (which tracks the inverse of the S&P 500), and in black plots the benchmark index. The level of assets (not the price) tends to top out at important bottoms. It went a little higher than now at the conclusion of the 2008-2009 bear market, but that was near the conclusion of the global financial crisis. If we're currently seeing a correction with in a bull market then the current peak will soon be followed by a decline just like we saw in July 2009 and February 2010. Sure, it could go higher -- but is that really the highest probability bet right now? Positive.

-- The BP oil spill has a hybrid effect: Negative for the economy of the Gulf of Mexico and possibly the Southeast coast; positive for oil prices; negative for the can-do sentiment of Americans who believe that technology can solve any problem; negative for investors' opinions of corporations, regulators and politicians who failed to prevent this preventable accident and have failed to communicate an effective and comprehensive plan for fixing it. Ultimately this can turn into a big positive when and if the public comes to believe the danger has been contained. Neutral.

-- Afghanistan war and Iraq occupation. The government has still not articulated a good reason for this contest, and it is a big drain of U.S. treasure and lives. If you ask 20 Americans why we have 100,000 men fighting there, you will get 20 different answers. Without trying to put a conservative or liberal spin on it, let me just say it's incredible that this battle is increasing in ferocity and death count at a time when there is no consensus on the goal. At the risk of sounding cynical, however, history shows that wars tend to be bullish on balance because they require the manufacturing of a lot of machinery, the purchase of a lot of energy, and the employment and training of a lot of public-minded men and women. The ends of wars have usually stifled the economy for at least a year, as manufacturing tapers off and ex-soldiers struggle to find jobs. Neutral.

Add all these up and you have on balance more positives and neutrals than negatives -- a condition permitting U.S. stocks to rebound to the top of their range at around 1,150. That's a 5.5% move.

So those are some big-picture concepts right now to think about. The summary is that Europe is under pressure, U.S. has an opportunity to muddle through and China may be down since November 2009 but it is now flat-lining with the potential to stage one of its patented surges at any time. The bottom line is that while we're still near the bottom of the range, and bears unable to press their advantage by plunging the S&P 500 under the 1,040 level, this is the wrong time to be bearish.

On the smaller picture -- corporate fundamentals, you remember them? -- companies are adapting to their environment, and that is what makes them compelling opportunities to help us meet our financial goals. In short, when you stop getting freaked out about geopolitics, you can look around and see a lot of well-run companies are getting the job done.

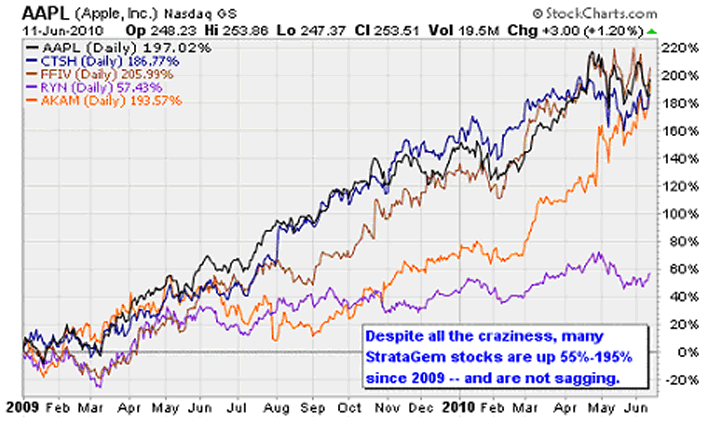

The idea of adaptation, creativity and leveraging a unique edge is key in adaptation. For the most visible signs among our past and present StrataGem picks, consider: Apple Inc. (Nasdaq: AAPL) created its new iPad and sold 2 million units far faster than anyone expected this year, and wowed the crowds with a new iPhone last week. Google Inc. (Nasdaq: GOOG) wireless partners have done great with its new Android mobile operating system. Akamai Technolgies Inc. (NYSE: AKAM) and F5 Networks Inc. (Nasdaq: FFIV) have risen to the challenge of efficiently and profitably providing hardware and software that permit stupefying amounts of video content to reach Internet media customers. Cognizant Technologies Solution Corp. (Nasdaq: CTSH) has helped customers arbitrage the relative costs of providing tech services to companies from either India or the United States as appropriate. Strayer Education (Nasdaq: STRA) has found ways to bring in more adult students at lower costs to help them achieve more success in a tightening job market.

The chart above lists some of the stocks that have appeared frequently in our monthly StrataGem lists over the past year and a half, including Apple (black), Cognizant (blue), F5 Networks(brown), Rayonier Inc. (NYSE: RYN) (purple) and Akamai Tech (orange). They advanced smartly through the easy months of 2009, but have also kept up the pace for the most part in 2010. They are creating value for their stakeholders the old fashioned way, through imagination and hard work, and it's important to recognize this when geopolitical fears threaten to get you down.

Final thought: The uptrend from 2009 is under pressure but recent lows have held fast. Overall economic and corporate growth are set to slow, but not to levels that are likely to imperil the equity market for now. Continue to fade the pessimism while it persists, but keep an eye out for an overabundance of optimism if we get to the top of the range at the 1,150 level of the S&P 500, or bears get the upper hand and manage to push the benchmark index under 1,040.

Week in review

Tuesday: The Empire State Manufacturing Survey came in slightly below expectations at 19.6 versus the consensus estimate of 21. Still, the result was an expansion on May's 19.1 result. New orders made a significant three point jump to 17.5 -- indicating month-over-month growth for this important leading indicator of manufacturing activity.

Wednesday: Housing starts came in weaker than expected, but the latest industrial production numbers didn't disappoint. Overall production increased 1.2% last month, building on a 0.7% increase in April. This was ahead of the consensus estimate of 1%. Motor vehicles were a big contributor, with production up 5.5%.

Thursday: Initial weekly jobless claims remain troublingly high at 472,000, up from 456,000 last week and well ahead of the 450,000 consensus estimate. We haven't seen a meaningful decline in this measure since last October -- not a good sign for the health of the labor market. Separately, the index of leading indicators increased 0.4% last month. Interest rates and the money supply continue to be the dominant factors, although a big increase in the factory workweek is a fantastic sign for the lukewarm labor recovery.

The week ahead

Monday: No major economic releases. Sonic Corp. (Nasdaq: SONC) and Steelcase Inc. (NYSE: SCS) announce Q2 earnings.

Tuesday: Existing home sales for May will be reported and provide insight into the stability of the housing market now that the homebuyer tax credit has expired. Purchase-only mortgage applications fell 27% for the month, which sets the stage for some disappointing sales numbers. Earnings reports: Carnival Corp. (NYSE: CCL), Jefferies Group Inc. (NYSE: JEF), Walgreen Co. (NYSE: WAG), Adobe (Nasdaq: ADBE).

Wednesday: New home sales will be reported. The Federal Reserve will also conclude its two-day policy meeting. Interest rates are broadly expected to remain unchanged. The team at Capital Economics believes the Fed will likely be on hold until 2012. Earnings: Bed Bath & Beyond (Nasdaq: BBBY), Darden Restaurants Inc. (NYSE: DRI), Nike Inc. (NKE), Paychex (NYSE: PAYX).

Thursday: Durable goods orders are expected to be pulled down due to a lean spell at Boeing. The consensus estimate is for a 0.5% decline. Earnings: ConAgra Foods Inc. (CAG), Discover Financial (NYSE: DFS), Lennar Corp. (NYSE: LEN), Oracle Corp. (Nasdaq: ORCL), Research in Motion (Nasdaq: RIMM).

Friday: The government will report its final numbers for Q1 GDP growth. Analysts expect the growth rate to remain unchanged at 3%. To review: Business spending drove activity in the first three months of the year, with investment in equipment and software up 12.7%. Earnings: KB Home (NYSE: KBH).

[Editor's Note: As this market analysis demonstrates, Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source: http://moneymorning.com/2010/06/21/u.s.-stocks-5/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.