Central Banks Diversifying into Gold

Commodities / Gold and Silver 2010 Jun 21, 2010 - 09:19 AM GMTBy: GoldCore

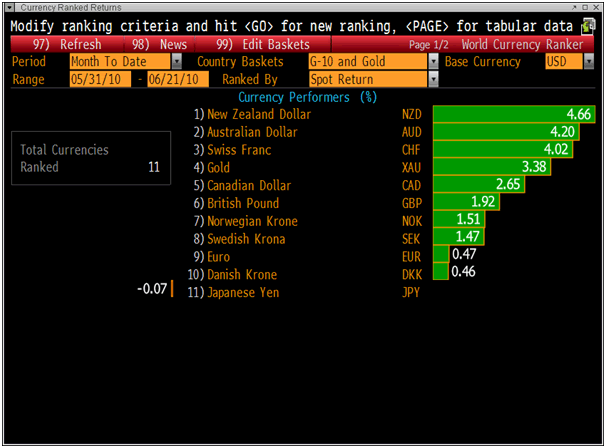

Gold rose to a new record (nominal) high in early European trading this morning at $1,265/oz. Gold finished last Friday up 2.3% and at a new weekly record high and is looking strong technically with rising moving averages and three consecutive higher weekly closes, and the higher monthly close in May. Given the strong technical and fundamental backdrop and the fact that the move up has been gradual (with gold only up 4% so far in June - see Currency Performance Table below) gold could make further gains and $1,300/oz looks like the next level of resistance.

Gold rose to a new record (nominal) high in early European trading this morning at $1,265/oz. Gold finished last Friday up 2.3% and at a new weekly record high and is looking strong technically with rising moving averages and three consecutive higher weekly closes, and the higher monthly close in May. Given the strong technical and fundamental backdrop and the fact that the move up has been gradual (with gold only up 4% so far in June - see Currency Performance Table below) gold could make further gains and $1,300/oz looks like the next level of resistance.

News of the Chinese allowing gradual appreciation in the yuan is expected to further bolster demand for gold in China as the Chinese consumers' and investors' purchasing power is increased. Chinese demand for gold has been growing at an average of 13% per annum over the past five years and it now has to import gold to meet national demand, despite being the largest producer of gold in the world.

Gold's latest record highs were aided by the news that Saudi Arabia, the world's fourth-largest holder of foreign exchange reserves, has twice as much gold reserves than was assumed. According to the WGC, the Saudi Arabian Monetary Agency, the central bank, has gold reserves of 322.9 tonnes, more than double the 143 tonnes it had previously reported. It seems likely that the Saudis, like the Chinese and other creditor nation central banks, have been quietly diversifying into gold.

The World Gold Council said on Friday that the central banks of Russia, the Philippines, Kazakhstan and Venezuela have been buying gold. Russia's central bank bought 26.6 metric tonnes of gold in the last quarter, taking its holdings to 668.6 tonnes. The Philippines increased holdings by 9.5 tonnes in March to 164.7 tonnes. That followed purchases in 2009 by Mauritius, Sri Lanka and India. India bought a massive 200 tonnes, or what amounts to about $8.8 billion at current prices, from the International Monetary Fund in November. The move, which multiplied India's reserves by 55%, was seen as a way for the country to diversify its reserves out of US dollars and euros and reinforced the perception among Indian consumers that the metal is a reliable and safe asset.

Recent revelations of large central bank purchases should lead to higher gold prices and mean that the inflation adjusted high of $2,300/oz remains a viable long term target.

Analysts believe that central banks could be net buyers of gold again this year. 2009 saw central banks become net buyers for the first time in nearly two decades. European central banks, after more than a decade of selling gold to diversify into other currencies (primarily euros), have stopped selling and the Bundesbank is on record as to not being disposed to gold sales.

Hedge funds, institutions, pension funds and central banks are now allocating funds to gold due to fears about currencies (especially the euro) and of coming inflation. Very importantly, central banks became net buyers of gold in Q2 09 for the first time since 1987. It seems possible that this is likely to be a continuing trend for the foreseeable future.

Major central banks own gold as an important monetary asset and foreign currency reserve. Large and increasingly powerful countries in the world such as Russia and particularly China have been the largest buyers in recent months. The Chinese, like the Saudis, are too astute to broadcast their purchases to the markets thereby undermining confidence in their dollar and other currency reserves.

Central banks remain concerned about financial, economic and systemic contagion. The German Bundesbank stated as long ago as late 2008 how they view gold as an essential monetary asset. "National gold reserves have a confidence and stability-building function for the single currency in a monetary union," the Bundesbank said.

Recent central bank purchases have been high in tonnage terms but miniscule in currency or dollar terms showing the small size of the gold market versus international currency reserves - not to mention the huge equity, bond and derivative markets.

News

Saudi Arabia, the world's fourth-largest holder of foreign exchange reserves, is sitting on more than twice as much gold as previously thought, according to new estimates that point to the revival of bullion as part of emerging economies' official reserves.

The changes in Riyadh's reserves were revealed by the World Gold Council, the industry-backed body which regularly tracks official bullion holdings. According to the WGC, the Saudi Arabian Monetary Agency, the central bank, has gold reserves of 322.9 tonnes, more than double the 143 tonnes it had previously reported.

The central bank said in a footnote of its latest quarterly report that "gold data have been modified from first quarter 2008 as a result of the adjustment of the Sama's gold accounts".

Sama did not respond on Sunday to calls seeking further comment.

Analysts said the rise in official gold holdings probably represented an accounting shift rather than fresh purchases. One possibility is that a large fraction of the country's gold was not considered until now part of the official reserves.

But without an official explanation, analysts were keeping options open. At current prices, the extra gold in Saudi Arabia's official reserves amounts to $7bn (€5.6bn, £4.7bn).

The revelation could fuel gold's rally as it is a further sign that central banks are keen on gold, after two decades of selling their bullion. Gold prices hit a nominal record high above $1,260 a troy ounce on Friday. Adjusted for inflation, however, bullion is still a long way from its all-time high of more than $2,300 in 1980.

The WGC revelation about Riyadh's gold holdings comes just a year after China surprised the bullion market when it revealed its gold holdings were more than 1,000 tonnes, almost double what it had reported for years.

Analysts believe that central banks could be net buyers of gold this year for the first time in nearly two decades. India bought 200 tonnes of gold from the International Monetary Fund earlier this year, while Russia and others are purchasing bullion from domestic miners on a regular basis, official data show. European central banks, after more than a decade of hefty disposals, have all but stopped selling.

Riyadh is now the 16th largest gold holder, ahead of countries such as the UK and Spain. The US is the world's largest bullion holder with 8,133.5 tonnes (Financial Times).

Foreign governments have been getting in on the recent gold rush, driven by continued fears about Europe's debt crisis and the pace of the global economic recovery.

Those concerns have been propelling the precious metal to record highs over the past 18 months. In fact, gold posted a new intra-day high Friday, when it reached $1,260.90 an ounce. A day earlier, it reached a fresh record high closing price of $1,248.70 an ounce.

Last year, foreign central banks were net buyers of gold for the first time since 1997. India, China and Russia have been the biggest buyers. And more recently, the Philippines and Kazakhstan jumped into the fray with big purchases of the precious metal during the first quarter, according to data released by the World Gold Council Thursday.

What's behind the buying binge?

Each country has its own unique reasons, but there are a few broad trends that unite them all, said Natalie Dempster, director of government affairs for the World Gold Council.

Like many individual investors, foreign governments prefer to spread their wealth around to decrease their risk.

The U.S. dollar is typically the main reserve asset because it's considered to be more stable than other holdings, while the euro comes in as the second most popular reserve currency. But gold is not far behind. The precious metal plays an important role as a hedge against inflation, which could devalue paper currencies.

Unlike paper currencies, gold has a tangible value and that value is not dependent on any one country's economic policies.

When the financial crisis drove down the dollar's value in 2009, and Europe's debt woes pushed the euro to fresh four-year lows earlier this month, investors and foreign central banks flocked to safe-haven assets like gold.

Add rising deficits in both Europe and the United States to the mix, and currencies have become increasingly questionable assets, said Jeffrey Nichols, managing director of American Precious Metals Advisors and senior economic advisor to Rosland Capital. That's why it's no surprise that foreign central banks overall have turned from sellers into buyers of gold in the last year, he said.

Who's buying gold?

Russia and Kazakhstan: As far as public records show, Russia appears to be the largest buyer of gold among central banks so far this year. In the first quarter of 2010, Russia's central bank increased its gold reserves by 26.6 metric tonnes, or about $1.2 billion at today's price, according to World Gold Council data. That's in addition to the 117.63 tonnes that Russia added in 2009. Russia has been adding to its gold reserves steadily for more than three years, partly through buying its own domestic mine production. It considers gold both a symbol of prestige as well as a way to bolster the country's credit worthiness, Nichols said.

Kazakhstan, the third largest buyer so far in 2010, has a similar strategy, although at a much lesser level. The former Soviet-controlled country bought 3.1 tonnes, or $137 million, of the precious metal in the first quarter.

Philippines: After Russia, the Philippines falls a distant second as a buyer, after purchasing 9.6 tonnes, or about $424 million, of gold earlier this year. The Philippines also buys its domestic production as a way of supporting local industry and as an inflation hedge, but its reserves usually fluctuate more than Russia's because the country often sells it at a later date on the open market.

India: While India has yet to publicly announce any major gold buys this year, the country bought a massive 200 tonnes, or what amounts to about $8.8 billion at current prices, from the International Monetary Fund in November. The move, which multiplied India's reserves by 55%, was seen as a way for the country to diversify its reserves and reinforce the perception among Indian consumers that the metal is a reliable and safe asset, the World Gold Council said.

China: China is considered a stealth buyer of gold, said Boris Schlossberg, director of currency research at Global Forex Trading. As the world's largest producer of the metal, China often buys gold from its own mines and doesn't report those sales publicly. But in April 2009, China did admit to having added 454 tonnes, or a 76% increase, to its reserves since 2003.

Analysts suspect the country is continuing to buy gold and could in fact, be the world's largest buyer consistently. It simply doesn't reveal it's pro-gold stance proudly, however, because China is also the world's largest holder of U.S. Treasurys. Announcing an aggressive gold buying spree is not in China's best interest because, for one, it might push gold prices higher. Secondly, it could devalue the U.S. dollar, which would subsequently lessen the worth of the country's portfolio of U.S. government bonds, Schlossberg said (CNN Money).

Silver may continue trading higher this week on bullish momentum indicators and an expected downslide in the dollar index. The dollar may drop on declining new home sales and durable goods orders.

Technical analysis suggests that silver is expected to trade higher this week. Silver futures for July delivery on the New York Mercantile Exchange traded in the range of $18.20 to $19.28 an ounce and finally settled at $19.18 an ounce. The silver market breached crucial resistance at $18.68 and will likely trade higher this week. Silver prices are trading above 13, 22, and 45 EMA daily indicating a bullish view. The momentum indicator, RSI (14) daily, has ascended from 0.38 to 0.60 implying a potential northward momentum.

Data releases this week will likely lower the dollar Index to support higher silver prices. Despite the uptrend in existing home sales, new home sales and durable goods are lagging. The Federal Reserve's rate decision is due this week and is likely to remain unchanged at 0.25%, however, the Fed's statements regarding the overall economy may move silver prices.

Over the past week, silver July futures on Nymex gained 5.23% outperforming gold's 2.28% increase. The gold-silver ratio dropped to 65.59 from 67.48 as silver rose more than gold. Being a smaller market, the white metal tends to outperform the yellow metal on a percentage basis during the later stages of an economic slowdown. Gains in the euro over the past week indicate signs of easing debt concerns. Downgrade of Greece's debt rating to "junk" status did not have a negative impact as bonds were already trading at "junk" levels. Silver is anticipated to outperform gold this week as well (TheStreet).

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.