When It Comes to Increasing Aggregate Demand, What's Fiscal Policy without Monetary Policy?

Interest-Rates / US Interest Rates Jun 25, 2010 - 01:26 AM GMTBy: Paul_L_Kasriel

Not much. Suppose the central government decides to increase spending without increasing taxes. Where do the funds come from? From entities who are willing to lend. If those lending entities are the nonbank public, for the most part, all this does is transfer spending power to the central government from these entities. Net, net, total spending in the economy does not increase. Rather, there is just a change in the distribution of spending.

Suppose, instead, that central and commercial banks are the lending entities. In this case, credit or spending power is created, not just transferred. That is, when the central and commercial banking systems finance increased government spending, the government is able to spend more without any other entity having to cut back on its spending. Thus, in order for an increase in government spending to result in an increase in total aggregate demand, the government spending needs to be financed by the central bank and the commercial banking systems.

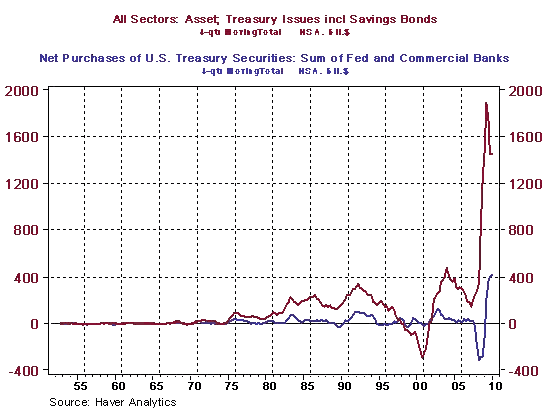

What's been the record on this in the past year? In the four quarters ended Q1:2010, the cumulative increase in Treasury borrowing was $1,455 billion. During the same time period, the cumulative increase in Treasury security purchases by the Fed and U.S commercial banks (including fore was $419 billion, or about 29% of the total Treasury issuance. How does this 29% compare with historical percentages?

From Q4:1952 through Q1:2010, the median percentage of combined Fed and commercial bank Treasury purchases to total Treasury issuance has been 15%; the average has been 213%. So, the recent "monetization" of Treasury debt has been above the median but well below the average. In sum, although the Fed and the banking system have helped fiscal policy to stimulate total aggregate demand, the help was not all that spectacular. No wonder the results of the recent fiscal stimulus program were something less than awe-inspiring with regard to increasing aggregate demand.

Chart 1

by Paul Kasriel

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2010 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.