More Keynesian Clowns With Priming the Economic Pump Nonsense

Economics / Economic Theory Jun 28, 2010 - 11:29 AM GMTBy: Mike_Shedlock

Nearly every day, more Keynesian and Monetarist clowns show up trumpeting the benefits of more government spending and more financial debt.

Nearly every day, more Keynesian and Monetarist clowns show up trumpeting the benefits of more government spending and more financial debt.

For example, please consider the Telegraph article Ben Bernanke needs fresh monetary blitz as US recovery falters by Ambrose Evans-Pritchard.

Weekly Leading IndicatorsFed watchers say Mr Bernanke and his close allies at the Board in Washington are worried by signs that the US recovery is running out of steam. The ECRI leading indicator published by the Economic Cycle Research Institute has collapsed to a 45-week low of -5.7 in the most precipitous slide for half a century. Such a reading typically portends contraction within three months or so.

Key members of the five-man Board are quietly mulling a fresh burst of asset purchases, if necessary by pushing the Fed's balance sheet from $2.4 trillion (£1.6 trillion) to uncharted levels of $5 trillion. But they are certain to face intense scepticism from regional hardliners. The dispute has echoes of the early 1930s when the Chicago Fed stymied rescue efforts.

"We're heading towards a double-dip recession," said Chris Whalen, a former Fed official and now head of Institutional Risk Analystics. "The party is over from fiscal support. These hard-money men are fighting the last war: they don't recognise that money velocity has slowed and we are going into deflation. The only default option left is to crank up the printing presses again."

"The US recovery is in imminent danger of stalling," said Stephen Lewis, from Monument Securities. "Growth could be negative again as soon as the fourth quarter. There is no easy way out since fiscal stimulus has already been pushed as far as it can credibly go without endangering US credit-worthiness."

The ECRI weekly leading indicators were at -5.7 at the time Ambrose Evans-Pritchard wrote the above article. They are at -6.9 now.

Please see ECRI Weekly Leading Indicators at Negative 6.9; How Likely is a Double Dip? for details and a chart.

Here is an additional comment I would like to make. ...

The ECRI's much trumped up leading indicators are really not much more than coincident indicators heavily skewed to the performance of the stock market. Housing starts are one of the best leading indicators and the ECRI does not even factor in housing starts.

The ECRI claims to have called every recession in advance and that is a huge distortion of reality. It only seems they can predict recessions because the NBER is even later in calling recessions than they are. By the time the ECRI predicts a recession it is generally clear to everyone but dunderhead economists that we are already in one.

Part of the problem is the ECRI is in dreaded fear of calling a recession that does not happen. The other part of the problem is they are blinded by their own Keynesian claptrap.

Et Tu Whalen?

Chris Whalen, head of Institutional Risk Analystics, normally writes an excellent column.

Thus, I was quite disappointed with his comment "The only default option left is to crank up the printing presses again."

I never realized Whalen was a former Fed official, and that explains the sad state of affairs. It is very difficult to become a Fed official without being a Keynesian or Monetarist clown.

What more does it take to prove Keynesian stimulus is blatant stupidity? For Christ's sake, we threw $trillions of dollars at reflation and it has already failed. But no, Keynesian clowns want to throw another $2 trillion at it, and then another $5 trillion etc., until the bond market pukes as happened in Greece.

The simple fact of the matter is ... There is no recovery to save because there never was a recovery in the first place, only a mirage of reckless spending.

Whalen Borrows Krugman's Magic Mirror

It seems Whalen has borrowed Paul Krugman's Magic Keynesian Mirror.

Throwing money at problems never works in the long run.

Japan tried that and now has debt to GDP of 200%. Because of its aging demographics, Japan is in serious trouble as soon as interest rates rise. Japan will not be able to finance its monstrous debt nor will it be able to grow its way out of the problem. Such is the nature of compound interest and unsustainable levels of debt.

Likewise, the US tried to spend its way out of the 2000-2001 recession.

Greenspan's policies seemed to work, but it was nothing but an illusion. The real economy was taking a nosedive even as financial assets soared. It was a nice party, as all Keynesian parties are, but in the final analysis all Greenspan and Bernanke accomplished was to dig the deepest debt hole mankind has ever seen. The housing and debt implosion of 2007-2008 was the direct result.

Now Paul Krugman thinks it's too early to shut off stimulus.

Hello Paul!

It will always be too early for you. There is no recovery nor will there ever be a recovery until there is genuine demand for goods and services at prices set by the free market not the government.

When the problem is debt, going deeper in debt cannot possibly be the solution.

Yes, Paul, we lost a decade. Yes, Paul, we are going to lose another, not because we failed to follow your recommendations, but precisely because we did!

We had a chance to write off the debt and to let the insolvent banks go under. Instead we wasted over a trillion dollars bailing out banks that still are not lending (and wisely will not lend) because we never purged the debts that needed to be purged nor did we reduce rampant overcapacity.

We could have and should have forced the bondholders of Citigroup and Fannie Mae to take a hit. Instead, taxpayers who cannot possibly afford it, bailed out wealthy bondholders.

In addition, we tried all sorts of Keynesian nonsense like cash-for-clunkers and an$8,000 tax credits for houses. As soon as the tax credit expired housing went in the gutter. It is about to do so for the second time.

Bernanke will not know what hit him even though it is point blank foolish to stimulate housing when there is an ocean of housing oversupply already.

By the way, how many roads can you pave? We paved roads in our area that did not even need to be paved. Now fooking what?

This is exactly the mistake Japan made. Yet you want to repeat it with more absurd makeshift work.

The stimulus money is nearly out and you want more. You will always want more for the simple reason there is no real demand for goods and services, only an illusion of a recovery that comes from passing out "free money".

When you look in a mirror you see the illusion, what you should see is a Keynesian warthog. Substitute the words "Keynesian Economics" for "Real Economy" on that hag, and the picture is perfect.

As Europe found out, the will and the means to pass out "free money" is 100% guaranteed to end before a lasting recovery can take hold.

That dear Paul, whether you like it or not, is the mechanics of peak debt, compound interest, global wage arbitrage, and something you desperately need to learn: Austrian economics.

By the way, we are not going into deflation, we are in deflation, and a badly needed one at that. It is time to writeoff debt that cannot be paid back rather than pile on still more debt that cannot be paid back.

Here are a couple pertinent, common-sense comments from readers of my blog.

Comment from Black Swan (No Not Nassim Taleb)

Let us for example imagine a secluded island society. We shall call the island Maupiti. The Maupiti economy is based on the division of labour, and cowrie shells are the most marketable means of exchange – and there are exactly 1,000 units available.

One night a tropical thunderstorm destroys a majority of the means of production. However, not only did all cowrie shells remain intact – the storm also washed ashore 1,000 more shells. In the face of the doubled number of cowrie shells in Maupiti, John Maynard Keynes would shout “eureka!” and contend that now, magically, every citizen of Maupiti is twice as rich as before and that the storm was a blessing.

However, if you ask the citizens of Maupiti right after the catastrophe, they will hold a different point of view. As a result of the sudden loss of means of production, they will have to deal with a lower standard of living although the amount of monetary units has doubled. This example is supposed to illustrate that it is absurd to gauge the prosperity of a society in monetary units. We live in a society that is based on the division of labour and barter trade, and our prosperity depends exclusively on the number and quality of consumer and capital goods that we as society own.

Comment from LA-Girl

I think we have to see the bloated government payroll for union workers for what it is: a replacement for private sector jobs that are gone for good. Many of these public sector jobs serve no useful purpose, they are the equivalent of FDR paying one group of guys to dig a hole, and another to fill it in.

Only today, at least some of these workers are the foot soldiers carrying out the trend toward statism: teachers who brainwash children with political correctness, police who act as armed tax collectors, inspectors who shake down property owners for "permit fees", etc.Interest on Debt the Ultimate Limiting Factor

There will be no genuine recovery with personal, corporate, and governmental debt levels as they are. Moreover, it should be blatantly obvious that adding to government debt as the solution for falling personal consumption cannot possibly work. Eventually, interest on the debt will consume all revenues.

For what? For bridges to nowhere, for the same roads to be repaved a half dozen times, for the benefit of government bureaucrats and public workers who collect huge pensions that no one else gets.

US Citizens Understand Better than Economists

Europe seems to be ahead of the US in figuring out perpetual stimulus cannot possibly work. Us taxpayers seem to have figured that out as well.

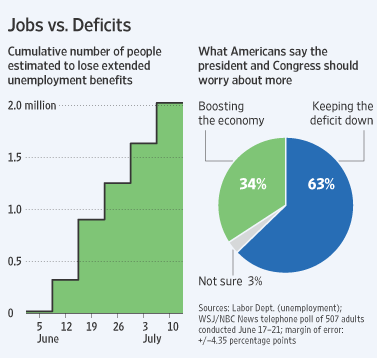

Please consider Consumers Get It, Keynesian Clowns Don't - 63% Believe Congress Should Worry More About Deficit than Boosting the Economy

Last Thursday Congress failed to pass legislation extending jobless benefits.

Is Congress finally listing to the US Public? Not quite. It took a GOP filibuster to "Just Say No" in spite of the fact that by a margin of 63% to 34% more citizens are worried about keeping down the deficit than boosting the economy.

Jobs vs. Deficits

Congratulations to the Republicans for doing the right thing. It is also what taxpayers want as the following Wall Street Journal chart shows.

Congratulations also go to US citizens who have had enough of Keynesian economist clowns as wall as Obama administration clowns."Priming the Pump" Nonsense

Keynesian clowns think the pump needs to be primed. Well $2 trillion did not "prime the pump", nor would $20 trillion. No amount of government spending (waste) can "prime the pump". The idea is ludicrous. As soon as stimulus stops, so does demand as recent housing starts proved and as Japan has proven over two decades of various nonsensical deflation fighting efforts.

Japan tried both Keynesian public work spending (building bridges to nowhere), and monetarist actions (Quantitative Easing) and neither worked.

Results, no matter how awful, are never bad enough to cause government bureaucrats or Keynesian clowns to abandon their religion. The results of Fannie Mae and Freddie Mac are proof enough.

Japan is in its mess because of Keynesian and Monetarist stimulus, we are in this mess because of Keynesian and Monetarist stimulus, and the UK is in its mess because of Keynesian and Monetarist stimulus. Yet the Keynesian clowns want more Keynesian stimulus and the Monetarist clowns want more Quantitative Easing.

No policy ever performs badly enough to cause its disciples to abandon it.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.