How To Handle A Bad Day In The Stock Market

Stock-Markets / Stock Markets 2010 Jun 29, 2010 - 01:57 PM GMTBy: David_Grandey

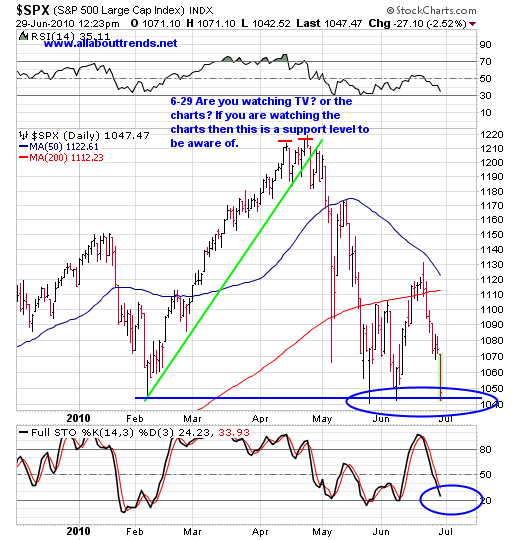

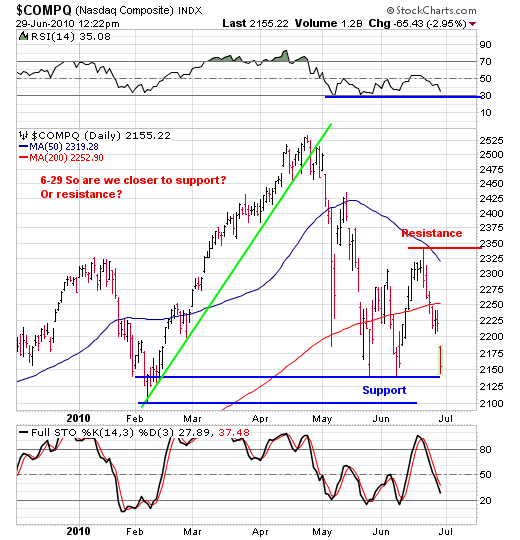

Look at the charts below, Are we closer to support or resistance? Given we are at a support level do you really want to stop out of everything here? Not us. We’ll let the dust settle, manage our positions (of which most all are still intact) and see what happens with support. Then we’ll make some decisions, but not here.

Look at the charts below, Are we closer to support or resistance? Given we are at a support level do you really want to stop out of everything here? Not us. We’ll let the dust settle, manage our positions (of which most all are still intact) and see what happens with support. Then we’ll make some decisions, but not here.

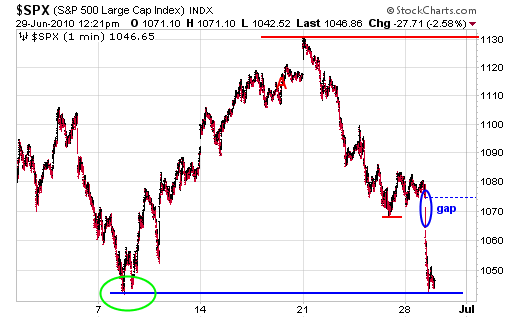

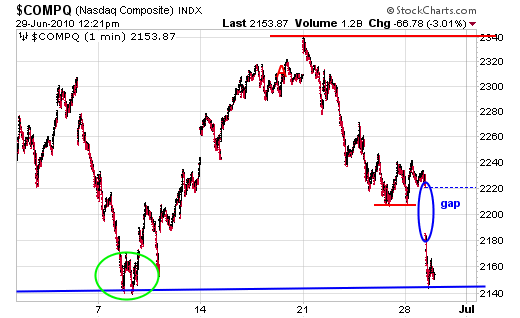

What we also want to make note of is the green circles in the one-minute charts. Notice how after we hit initial lows in early June the indexes chewed around for a day or two with a retest of the lows before it lifted? Expect that to occur here too and don’t be surprised at an undercut over the next day or two as well.

===========================================

The market is a two way street. Good days and bad days. Being successful is not just how you handle the good days, it’s how you manage the bad days.

Recently we’ve talked about letting our stocks tell us what to do by the action they exhibit so lets touch upon that a little more. The first thing we do every morning is see what the pre-market is looking like. So let’s walk through this morning’s routine.

Futures were down about 1-1.25% in all the indexes. So immediately we knew stocks are going to be down. We immediately switched into what are our stocks doing. Are any in threat of breaking down or are their uptrends still intact but pulling back. That’s the first thing we do.

The one thing we DO NOT DO is stage a mental UH OH CHICKEN LITTLE STANCE as more often than not the damage has already occurred otherwise we wouldn’t be chicken littling it. In other words we don’t get emotional and neither should you. If you do get emotional then that is something YOU need to work on mentally. If you’ve got monster size positions and are part of the hot money crowd and are not employing proper trade size position risk management then on bad days in the market you are going to have a bad day and you know what? You should be getting it handed to you! Why? Because you are not paying attention to risk management.

We take a lot of pride in educating our subscribers in the mechanics of reality and in so doing managing their mental state of mind. We are firm believers here that your state of mind is your most precious asset, not your portfolio. In other words it all starts with you and your internal make up. In all of our trade trigger alerts we talk about the mechanics of reality and we talk about being willing to take the risk. This is all by design, all in an effort to keep your emotions in check and you grounded in reality. When a bad day hits the market it doesn’t destroy you and you are better prepared mentally for days like this.

A HUGE PART of being successful in the stock market is knowing what you have control over and what you don’t. One thing you don’t have control over is openings like we’ve seen today. You have no control over gaps. As you saw in the 1st hour today it didn’t matter who you were, you could run but you couldn’t hide. That’s what gaps do.

Remember though, they work for you and against you. If you are long and they gap em higher you are all for that. If you are short you are having a bad day. The flip side is if you are long and they gap you down you are having a bad day, if you are short you are having a good day. It’s always the same and always will be so one would do themselves well to get used to it and have a plan

In a nutshell how do you manage the unknown. You do so by trading your plan and planing your trades all the while being mindful of risk management per position size and on a opening 1st hour like today now you know why we adhere to this.

What you do have control over is your mental state and what your positions are doing by the action they exhibit.

No matter where you go and what you do you WILL have to deal with days like this. So let’s use this as an opportunity to learn from so the next time you get a morning like this you know how to handle it. Remember knowledge is power when used effectively as we say.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.