Stock Market Bears Should Beware

Stock-Markets / Stock Markets 2010 Jul 02, 2010 - 10:15 AM GMTBy: Toby_Connor

I'm going to go through some signs that rabid bears might do well to pay attention to because I think the market is very close to a major bottom. (That doesn't mean we are guaranteed to make new highs, although we might. Just that we can probably expect an explosive rally soon, even if it ultimately turns out to be a counter trend rally in an ongoing bear market).

I'm going to go through some signs that rabid bears might do well to pay attention to because I think the market is very close to a major bottom. (That doesn't mean we are guaranteed to make new highs, although we might. Just that we can probably expect an explosive rally soon, even if it ultimately turns out to be a counter trend rally in an ongoing bear market).

First off, way too many people are counting on the head and shoulders pattern taking the market directly down to 850. Folks, historically these head and shoulder patterns have a success rate of about 50%. A coin toss, in other words. Didn't we learn that lesson last July?

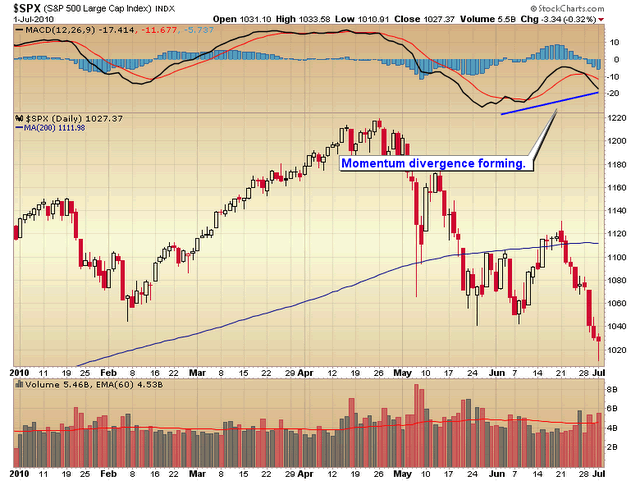

Let’s go now to the charts. We have a large momentum divergence that has developed on the daily charts.

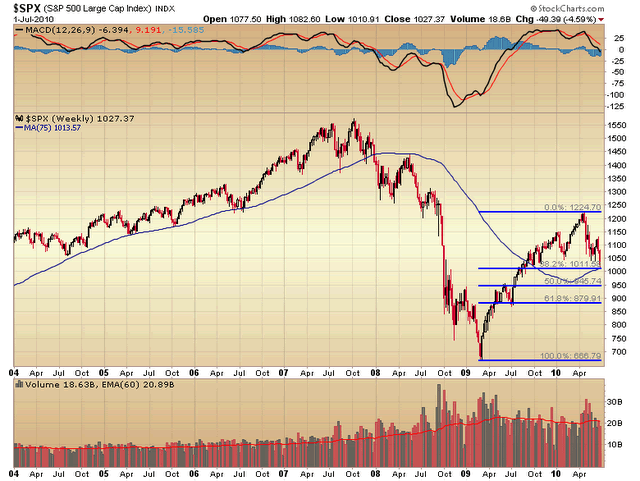

Also, notice that the market dropped down to the 75 week moving average yesterday and bounced strongly. You can see this same support during the prior bull. The 75 week moving average acted as final support during the entire bull market. That level also happens to be the 38.2% Fibonacci retracement of the entire cyclical bull move. Not an unusual correction in an ongoing bull, on both counts.

Next, we are now right in the timing band for a major intermediate cycle low.

At 21 weeks it's just way too late to press the short side. You risk getting caught as the intermediate cycle bottoms initiating a violent short covering rally.

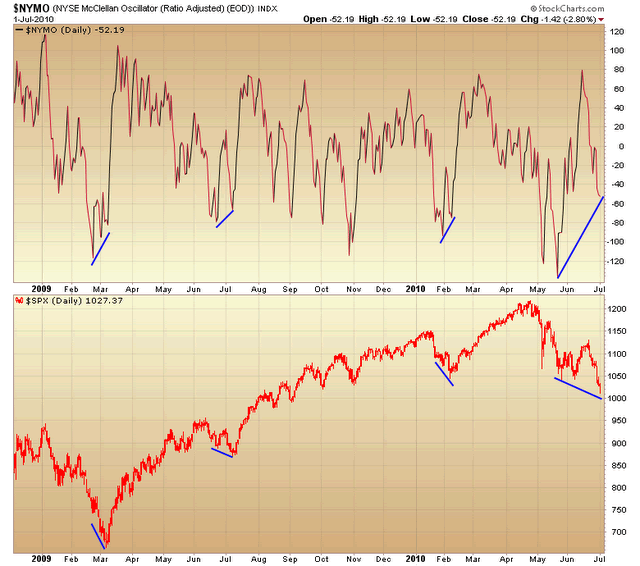

And finally, breadth is diverging massively during this final move down. As you can see the NYMO often diverges at these intermediate cycle bottoms. The divergence at this point is the largest in years.

Finally, I'll point out that the February cycle bottomed on a reversal off the jobs report. I think it's safe to say the market has already discounted a bad number so we could see shorts begin covering in a buy the news type trade, even if the number is bad. And if the number is good, we will see the market gap higher huge, trapping shorts and throwing gasoline on the fire of a short covering rally.

It's just too dangerous to continue pressing the short side at this point. Better to just step aside and not risk getting caught in the intermediate bottom that WILL happen sometime soon, maybe even on today's employment report.

Toby ConnorGold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.