Stock Market Retests H&S Neckline, Perfect Setup for Opening Gap Down

Stock-Markets / Stock Markets 2010 Jul 07, 2010 - 03:26 AM GMT U.S. stocks gained, with the Standard & Poor’s 500 Index rising from a 10-month low, amid

speculation earnings growth will help equities rebound from their lowest valuations since the

bull market began in 2009. (LOL!)

U.S. stocks gained, with the Standard & Poor’s 500 Index rising from a 10-month low, amid

speculation earnings growth will help equities rebound from their lowest valuations since the

bull market began in 2009. (LOL!)

The S&P 500 climbed 0.5 percent to 1,028.06 at 4 p.m. in New York after jumping 2 percent in the first hour of trading. The Dow Jones Industrial Average gained 57.14 points, or 0.6 percent, to 9,743.62 to snap a seven-day losing streak, its longest since the financial crisis in 2008.

Cleveland Fed on GDP - Dreary Outlook

(ZeroHedge) The Cleveland Fed issued a report that looked at the historical relationship between lagged GDP growth and the steepness of the yield curve. They compared the ten-year with the three-month bill yield. They used this information to make a probability estimate for a double did recession. Not surprisingly, they concluded that the probability is only 10%. I would take that bet. If anyone in Cleveland is interested, let me know.

99 Stocks Account For Half Of Day's Trading Volume As Liquidity Concentrates In Ever Fewer Stocks

(ZeroHedge) The attached liquidity analysis by Abel-Noser indicates that the US stock market has now become a concentrated pool in which just the top 99 stocks account for 50.09% of total domestic trading volume. In June, the top 20 stocks accounted for 28.94% of all domestic volume, an increase of 2.2% over May's 26.7% and a record. The HFT algos are increasingly trading less and less stocks in their attempt to corner just the most liquid stocks. Indicatively, the top 978 names represented 90.01% of total domestic volume, while the remaining 17,597 accounted for just 10% of all dollars traded.

VIX tested short-term Support, makes a right shoulder.

-- VIX tested short-term Trend

Support at 28.95 as I had speculated

last Thursday and completed a right

shoulder of an inverted Head &

Shoulders pattern. Today is

considered the last day of the

positive seasonal influences. What

follows is what is considered the four

worst months of the year in the stock

market.

The CBOE Put-Call Ratio for

equities ($CPCE) rose to .99, as

retail investors didn’t like what

they saw. The pros became more

bearish as $CPCI rose to 1.64 at

the end of the day. The 10-day

average remains bearish at 1.51.

The NYSE Hi-Lo index closed up 3

points today to -41. The Hi-Lo

index remains at a low ebb, but

could become extreme.

-- VIX tested short-term Trend

Support at 28.95 as I had speculated

last Thursday and completed a right

shoulder of an inverted Head &

Shoulders pattern. Today is

considered the last day of the

positive seasonal influences. What

follows is what is considered the four

worst months of the year in the stock

market.

The CBOE Put-Call Ratio for

equities ($CPCE) rose to .99, as

retail investors didn’t like what

they saw. The pros became more

bearish as $CPCI rose to 1.64 at

the end of the day. The 10-day

average remains bearish at 1.51.

The NYSE Hi-Lo index closed up 3

points today to -41. The Hi-Lo

index remains at a low ebb, but

could become extreme.

SPY attempted a retest of its Head & Shoulders Neckline.

Action: Sell/Short/Inverse

-- Today SPY attempted to retest the

H & S Neckline at 104.00. While it

temporarily overshot to 104.37, there

was too much selling pressure at

104.00. This constituted a 26.26%

retracement of the last two weeks’

decline. Tomorrow is a pivot day

and SPY (all equities, in fact) have a

perfect setup for a gap down at the

open tomorrow to kick off its third

wave.

I recall my trading activity in 2002,

where I was surprised by a 3.77%

rally on July 5th. It put me off my

game for a couple of days as I was

trying to figure out where it came

from. Probably end-of-quarter

retirement plan contributions.

Action: Sell/Short/Inverse

-- Today SPY attempted to retest the

H & S Neckline at 104.00. While it

temporarily overshot to 104.37, there

was too much selling pressure at

104.00. This constituted a 26.26%

retracement of the last two weeks’

decline. Tomorrow is a pivot day

and SPY (all equities, in fact) have a

perfect setup for a gap down at the

open tomorrow to kick off its third

wave.

I recall my trading activity in 2002,

where I was surprised by a 3.77%

rally on July 5th. It put me off my

game for a couple of days as I was

trying to figure out where it came

from. Probably end-of-quarter

retirement plan contributions.

QQQQ is heading for its own neckline.

Action: Sell/Short/Inverse

-- QQQQ completed a 27%

retracement today as it prepares to

challenge its Head & Shoulders

neckline at 41.00. It is also the lower

trendline of the Broadening Top. A

down-sloping neckline has higher

probabilities for success and portends

a larger decline, according to Thomas

Bulkowski’s Encyclopedia of Chart

Patterns (p. 290).

If the pattern is followed through, the

new target for this decline is 31.57.

By the way, the average decline once

the Broadening Top is violated is also

31.57. The NDX attempted but did

not succeed in retracing to its

neckline at 1775 today.

Action: Sell/Short/Inverse

-- QQQQ completed a 27%

retracement today as it prepares to

challenge its Head & Shoulders

neckline at 41.00. It is also the lower

trendline of the Broadening Top. A

down-sloping neckline has higher

probabilities for success and portends

a larger decline, according to Thomas

Bulkowski’s Encyclopedia of Chart

Patterns (p. 290).

If the pattern is followed through, the

new target for this decline is 31.57.

By the way, the average decline once

the Broadening Top is violated is also

31.57. The NDX attempted but did

not succeed in retracing to its

neckline at 1775 today.

XLF made a second retest of its neckline.

Action: Sell/Short/Inverse

-- XLF made a 32% retracement as it

retested its Head & Shoulders

neckline today. The next target is the

lower trendline of the Broadening

Top formation (in all likelihood)

tomorrow.

Action: Sell/Short/Inverse

-- XLF made a 32% retracement as it

retested its Head & Shoulders

neckline today. The next target is the

lower trendline of the Broadening

Top formation (in all likelihood)

tomorrow.

FXI retraced 52% to hit short-term Trend Support.

Action: Neutral

-- FXI retraced 52.65% of its two

week decline to its short-term Trend

Resistance at 40.28. This is the best

retracement of all the ETFs I follow.

Yesterday was its Trading Cycle low,

so if it can manage to overcome

short-term Trend Resistance, it is

bullish. Otherwise, I await a

breakdown below intermediate-term

Trend Support to become bearish.

$SSEC closed at 2409.42, nearly 100

points off its low. It also pivoted on

Monday, so I remain stuck on the

giant triangle that I have been

following for some time. It poses a

dilemma, since there is nothing but

bad news coming out of China.

Action: Neutral

-- FXI retraced 52.65% of its two

week decline to its short-term Trend

Resistance at 40.28. This is the best

retracement of all the ETFs I follow.

Yesterday was its Trading Cycle low,

so if it can manage to overcome

short-term Trend Resistance, it is

bullish. Otherwise, I await a

breakdown below intermediate-term

Trend Support to become bearish.

$SSEC closed at 2409.42, nearly 100

points off its low. It also pivoted on

Monday, so I remain stuck on the

giant triangle that I have been

following for some time. It poses a

dilemma, since there is nothing but

bad news coming out of China.

GLD may be ready for a brief retracement.

Action: Sell/Short/Inverse

-- GLD completed an impulse in the

daily chart and may be ready for a

brief retracement. Current overhead

resistance is at 117.40 and 118.86.

The 38.2% retracement is at 119.07.

I do not have any confidence in a

strong retracement, although it could

happen. What I do have confidence

in is that GLD has now joined

equities in what may also be a crash

pattern in GLD.

I do not envision a retest of the

Broadening Wedge trendline at this

time. The retest rate of a

Broadening Wedge is only 21%.

Action: Sell/Short/Inverse

-- GLD completed an impulse in the

daily chart and may be ready for a

brief retracement. Current overhead

resistance is at 117.40 and 118.86.

The 38.2% retracement is at 119.07.

I do not have any confidence in a

strong retracement, although it could

happen. What I do have confidence

in is that GLD has now joined

equities in what may also be a crash

pattern in GLD.

I do not envision a retest of the

Broadening Wedge trendline at this

time. The retest rate of a

Broadening Wedge is only 21%.

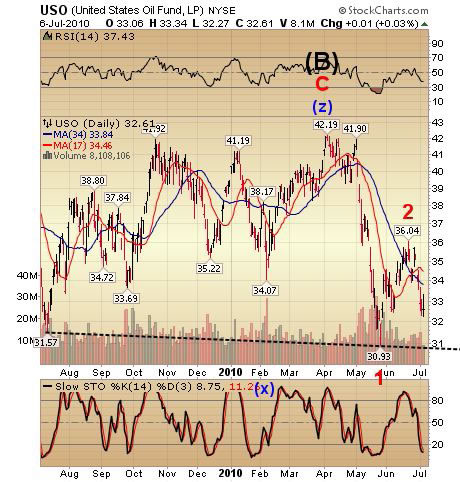

USO broke below intermediate-term Support.

Action: Sell/Short/Inverse

-- USO made a 27.8% retracement of

its decline from 36.04, then gave up

most of its gains. Although USO is

very oversold, it can remain in that

condition during the entire duration

of its third wave. That is why many

trading blogs are still looking for a

rally, since they follow

overbought/oversold indicators,

which currently suggest a reversal.

The cycles suggest otherwise.

I have drawn in the neckline for a

complex, triple-headed Head and

Shoulders pattern. Once below 30.93

the minimum downside target is

19.67, while another calculation

suggests as low as 17.80.

Action: Sell/Short/Inverse

-- USO made a 27.8% retracement of

its decline from 36.04, then gave up

most of its gains. Although USO is

very oversold, it can remain in that

condition during the entire duration

of its third wave. That is why many

trading blogs are still looking for a

rally, since they follow

overbought/oversold indicators,

which currently suggest a reversal.

The cycles suggest otherwise.

I have drawn in the neckline for a

complex, triple-headed Head and

Shoulders pattern. Once below 30.93

the minimum downside target is

19.67, while another calculation

suggests as low as 17.80.

The reversal pattern in TLT looks ominous.

Action: Sell/Short/Inverse

-- Last Thursday I reported a

reversal pattern in the hourly TLT

chart. Today the reversal pattern

appears in the daily chart. This

constitutes the best place for taking

profits in an ending pattern.

Friday’s pivot gave us the initial

decline. The follow-on decline may

take TLT as low as its intermediateterm

Trend Support at 97.77.

In addition, I am expecting a

Primary Cycle bottom by the end of

this week, which implies that all

cycle supports may be broken by

then. See ZeroHedge article.

Action: Sell/Short/Inverse

-- Last Thursday I reported a

reversal pattern in the hourly TLT

chart. Today the reversal pattern

appears in the daily chart. This

constitutes the best place for taking

profits in an ending pattern.

Friday’s pivot gave us the initial

decline. The follow-on decline may

take TLT as low as its intermediateterm

Trend Support at 97.77.

In addition, I am expecting a

Primary Cycle bottom by the end of

this week, which implies that all

cycle supports may be broken by

then. See ZeroHedge article.

UUP is ready to pivot.

Action: Buy/Long

-- Tomorrow is a pivot day for UUP

as it settled on its 38.2% Fibonacci

retracement today. Today’s action

may give us a new seasonal cycle,

since this one has lasted since

November 25, 2009. This has been

an unusually long cycle, but the

dollar seems to be the only asset left

in rally mode.

The pivot in UUP implies the

beginning of a third wave higher

while equities, bonds and

commodities go much lower.

Action: Buy/Long

-- Tomorrow is a pivot day for UUP

as it settled on its 38.2% Fibonacci

retracement today. Today’s action

may give us a new seasonal cycle,

since this one has lasted since

November 25, 2009. This has been

an unusually long cycle, but the

dollar seems to be the only asset left

in rally mode.

The pivot in UUP implies the

beginning of a third wave higher

while equities, bonds and

commodities go much lower.

Tony

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.