Russia cuts oil to Europe in response to Belarus syphoning off thousands barrels of oil

Commodities / Strategic News Jan 08, 2007 - 09:08 PM GMTBy: Nadeem_Walayat

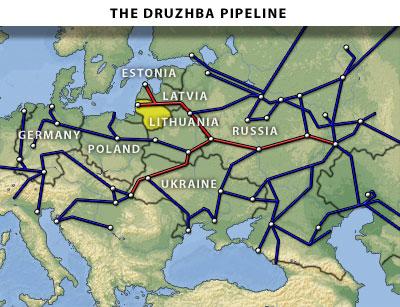

Belarus smarting from the doubling in the price of gas agreed just over a week ago, started to illegally syphon oil from the Druzhba pipeline,after the Russian pipeline operator Transneft refused to pay a retaliatory duty imposed by Belarus of $45 per metric ton of Russian oil shipped to Western Europe in pipelines that cross Belarus.

So far over Belarus has syphoned off an estimated 100,000 tons of oil from the Druzhba pipeline.

The current dispute started with the deal agreed between Belarus and Russia's gas giant Gazprom, for Belarus to buy Russian gas at $100 per 1,000 cubic meters in 2007. And Gazprom agreed to pay more for gas transit through Belarus to Europe. Whilst during 2006, Belarus had bought gas from Russia at just 46.7 dollars per 1,000 cubic meters. Against a market price of over $200 per 1,000 cubic meters.

Russia supplies about a 25% of the oil and gas consumed by the EU, with approximately 25% of which is piped through Belarus, mainly to Poland, Germany and Lithuania.

Earlier it was reported that Belarus had blocked Russian oil from flowing, but following statements from both Russia and Belarus it is now clear that the Russians are responsible for stopping the flow of oil.

"The responsibility for the stoppage (in oil pumping) lies on the Russian side. Belarus never stopped pumping. All questions _ to the Russians," Alexei Kostyuchenko, head of the pipeline operator Gomeltransneft-Druzhba told The Associated Press. The Belarusian Foreign Ministry also denied blocking the transit of Russian oil, saying that Belarus was not responsible for a decrease of pressure in the pipeline

Luckily for western countries such as Germany, the winter thus far has been mild so there is no immediate threat of shortages. Whilst Poland is expected to be hit the hardest as Poland relies on the pipeline for over 90% of its oil consumption.

Oil prices initially rose $2 per barrel on the news before subcoming to weakness and giving up all of the gains. As the oil market remains weak in the light of he recent sell off.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.