Gold To be Supported by Negative Real Interest Rates

Commodities / Gold and Silver 2010 Jul 08, 2010 - 09:19 AM GMTBy: GoldCore

Gold fell to an inter day six week low yesterday of $1,184.75/oz yesterday before a strong rebound which saw it close higher on the day at $1,197.80/oz. It rose above $1200/oz in Asian trade to $1,207.75/oz prior to giving up some of those gains in early European trade. Many traders and investors who have nee on the sideline in recent weeks see the present sell off as a buying opportunity.

Gold fell to an inter day six week low yesterday of $1,184.75/oz yesterday before a strong rebound which saw it close higher on the day at $1,197.80/oz. It rose above $1200/oz in Asian trade to $1,207.75/oz prior to giving up some of those gains in early European trade. Many traders and investors who have nee on the sideline in recent weeks see the present sell off as a buying opportunity.

Gold is currently trading at $1,200/oz and in euro, GBP, CHF, and JPY terms, at €948/oz, £792/oz, CHF 1,263/oz, JPY 105,665/oz respectively.

Risk appetite has returned with world stock markets up (except China) after yesterday's bounce in the Dow Jones and the IMF growth upgrade. How sustainable this bounce is remains to be seen as significant macroeconomic risks remain as warned of by the IMF.

With the European Central Bank and the Bank of England leaving interest rates unchanged at historic low levels, at 1 percent and 0.5 percent respectively, the opportunity cost of holding gold remains negligible. Especially as inflation has picked up in both the EU and especially in the UK where it remains stubbornly above the BoE's 3% target rate (see News below). Negative real interest rates remain positive for gold and until savers and bondholders are compensated for considerable risk with higher yields, gold is likely to remain in a secular bull market.

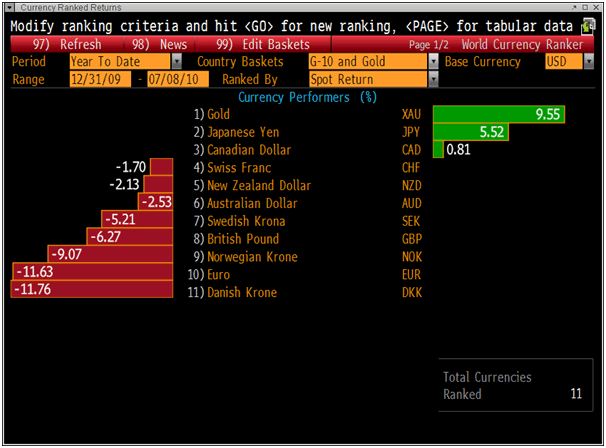

The dollar has fallen recently against most currencies and has reached 1.2650 against the euro. With no fundamental change in the outlook for the European economies, the bounce in the euro seems more a function of US dollar weakness rather than euro strength. Markets may be starting to examine the fiscal challenges facing many US states (some of which are akin to those faced in European economies) and the massive unfunded liabilities of the US.

Silver

Silver is currently trading at $17.99/oz, €14.22/oz and £11.88/oz.

Platinum Group Metals

Platinum is trading at $1,537/oz and palladium is currently trading at $453/oz. While rhodium is at $2,450/oz.

News

BIS gold swap confuses as price rebounds

(FT) - Gold prices dropped to a six-week low on Wednesday as traders puzzled over the news that the Bank for International Settlements had received 346 tonnes of gold in "swap operations". But prices rebounded in the afternoon as Asian consumers of the metal saw the correction as a long-awaited buying opportunity. According to a note in its latest annual report, in the financial year to March 31 the BIS took 346 tonnes of gold in exchange for foreign currency in gold swap operations - an action that surprised markets and left traders bemused about what the motives behind the swap might be. As the report circulated the gold market, the price of the yellow metal dropped to its lowest since May with some investors afraid that the gold mentioned in the BIS report might somehow find its way on to the market, depressing prices.

Trichet Faces Market Rate Threat as Debt Crisis Hurts Growth

(Bloomberg) - European Central Bank President Jean- Claude Trichet is facing higher interest rates sooner than he may have planned. Interbank borrowing costs have been climbing since financial institutions had to pay back a record 442 billion-euro ($557 billion) ECB loan on July 1, threatening to hurt the economy just as investors fret about the health of the banking system and the ongoing sovereign debt crisis. That may force the ECB to consider additional lending measures when policy makers convene in Frankfurt today, economists and analysts said.

BOE Wrestles Inflation 'Elephant' as Debate Heats Up

(Bloomberg) - Bank of England Governor Mervyn King's commitment to keep up stimulus for the economy during the deepest public spending cuts in half a century is under attack. King may today face renewed dissent by Andrew Sentance, who on June 10 sounded the alarm on inflation and made the first push in almost two years to raise the benchmark interest rate from a record low. The governor said a week later that the economy is still languishing in the aftermath of the recession and the bank can expand emergency bond purchases if needed. Sentance's vote provoked a public debate among officials on the dangers of inflation, which is still above the government's 3 percent upper limit as consumer-price expectations pick up. His colleagues argue Britain faces the risk of a renewed slump as Prime Minister David Cameron tackles the budget deficit. "There is an elephant in the room, and Sentance is pointing it out," said Neville Hill, an economist at Credit Suisse.

UK house prices fall for third month, Halifax

(Daily Telegraph) - UK house prices fell for the third month in a row in June, extending a slowdown that started at the beginning of the year as more homes came on the market. Despite the bigger-than-expected decline - analysts had forecast a rise of 0.2pc - prices are 7.5pc above a low hit in April last year, according Halifax's June house price survey.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.