Gold to be Supported by Massive Fiscal Challenges Facing the US and Western Economies

Commodities / Gold and Silver 2010 Jul 09, 2010 - 07:07 AM GMTBy: GoldCore

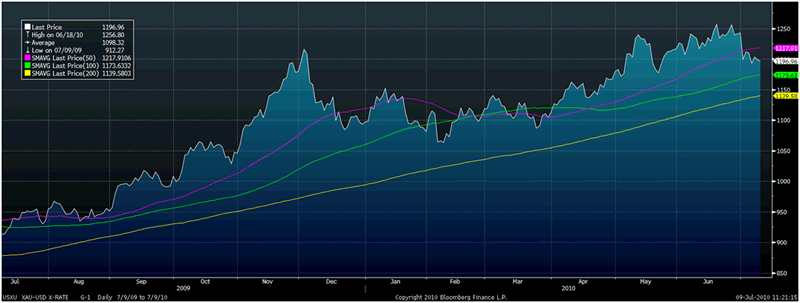

Gold fell $2.50 to $1195.30/oz yesterday and is now down 1% on the week. It traded sideways in Asia and down in early European trading. Another lower weekly close will again be bearish technically and would suggest that further retrenchment and consolidation may take place. A higher close today and on the week would help reverse the technical damage done recently.

Gold fell $2.50 to $1195.30/oz yesterday and is now down 1% on the week. It traded sideways in Asia and down in early European trading. Another lower weekly close will again be bearish technically and would suggest that further retrenchment and consolidation may take place. A higher close today and on the week would help reverse the technical damage done recently.

Gold is currently trading at $1,197/oz and in euro, GBP, CHF, and JPY terms, at €944/oz, £788/oz, CHF 1,261/oz, JPY 105,998/oz respectively.

BIS Swaps $12.6 Billion for Gold with Banks - (see News)

The recent weakness in the dollar and recovery of the euro has seen gold fall in dollars but also in sterling, euros and other currencies. However, these falls are likely to be of short term duration as all western economies face major fiscal challenges and this will likely see all fiat currencies fall in value against gold in the long term.

Gold in EUR - 3 Months (Daily)

Gold in GBP - 3 Months (Daily)

While optimism and risk appetite has returned, as seen in surging equity markets, as ever significant risks lurk under the surface and these should support gold. Markets continue to remain complacent about the "elephant in the room" which is the deteriorating fiscal situation in the U.S. The federal budget deficit for the first nine months of the 2010 fiscal year was just over $1 trillion. The U.S. national debt is surging and it is hard to fathom how gold would suddenly return to a bear market in such circumstances.

The U.S.' debt jumped $166 billion in a single day last week, the third largest increase in U.S. history. The one day increase for June 30 totaled $165,931,038,264 - which is bigger than the entire annual deficit for fiscal year 2007. This one day increase is larger than the $140 billion in savings President Obama's health care bill is hoped to produce over its first 10 years. The complacency, and indeed denial, with which currency, bond and the wider markets has greeted this badly deteriorating position is very reminiscent of the calm before the storm of the subprime crisis and subsequent bankruptcies of Bear Stearns and Lehman Brothers.

Very little has changed with regard to the risks in the banking system and sovereign debt markets and very little has changed with regard to the supply demand fundamentals in the gold market. This mean that gold's upward trajectory, punctuated by periods of sharp retrenchment, is likely to continue for the foreseeable future.

Silver

Silver is currently trading at $17.85/oz, €14.09/oz and £11.75/oz.

Platinum Group Metals

Platinum is trading at $1,527/oz and palladium is currently trading at $448/oz. While rhodium is at $2,450/oz.

News

(Bloomberg) - Gold May Advance as Price Decline Spurs Buying, Survey Shows

Gold may advance on speculation that the metal's drop to the lowest level in more than six weeks will prompt some investors to increase holdings, a survey found.

Thirteen of 20 traders, investors and analysts surveyed by Bloomberg, or 65 percent, said bullion will climb next week. Four forecast lower prices and three were neutral. Gold for delivery in August was down 1.5 percent for this week at $1,189.50 an ounce at 11 a.m. yesterday on the Comex in New York. It reached a record $1,266.50 on June 21.

Gold slipped on July 7 to $1,185 an ounce, the lowest price since May 24, and is heading for a third weekly decline. The metal gained this year as investors sought to shield their wealth from financial turbulence in Europe and on concern the global recovery may slow. The European Central Bank yesterday left its main interest rate unchanged at a record low 1 percent and the Bank of England kept its rate at 0.5 percent.

"Many traders and investors who have been on the sidelines in recent weeks see the present selloff as a buying opportunity," analysts at broker GoldCore Ltd. said in a report. "Until savers and bondholders are compensated for considerable risk with higher yields, gold is likely to remain in a secular bull market."

(Reuters) - Shifts in China's FX reserves must be slow - IMF

Any changes to the makeup of China's massive pile of foreign exchange reserves will have to be gradual so as not to cause volatility in world markets, the International Monetary Fund's chief economist said. Shifts in the composition of the Chinese central bank's more than $2 trillion (1.3 trillion pound) portfolio would have to be "very, very slow," Olivier Blanchard, the IMF's economic counsellor and director of research, said at an Asia Society event in Hong Kong on Friday. China bought a record $7.9 billion in short-term Japanese debt in May, a surge that some analysts said was a sign of foreign reserves diversification into the yen and away from the euro and the dollar.

(AP) - Oil rises to $76 amid optimism on global economy

Oil prices rose to near $76 a barrel Friday in Asia, following stock markets higher as confidence rose the global economic recovery remains intact. Benchmark crude for August delivery was up 47 cents to $75.91 a barrel at midday Singapore time in electronic trading on the New York Mercantile Exchange. The contract rose $1.37 to settle at $75.44 on Thursday. Signs the global economic recovery remains on track eased fears of a new recession and helped boost investor confidence.

(AP) - Asia stocks gain amid respite from slowdown fears

Asian stock markets rose Friday after South Korea's surprise interest rate hike and a fall in U.S. unemployment benefit claims eased the worries that Europe's debt crisis will derail the global recovery. South Korea's central bank raised its benchmark interest rate from a record low -- following rate hikes by Taiwan, India and Malaysia in the last two weeks -- amid prospects for faster economic growth.

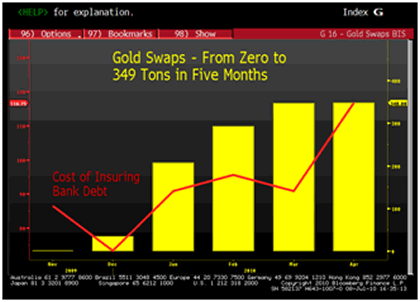

(Bloomberg) -- BIS Swaps $12.6 Billion for Gold with Banks - Chart of the Day

The Bank for International Settlements swapped about $12.6 billion for gold with commercial banks in five months through April, more than eight times the amount sold globally by central banks last year. The CHART OF THE DAY shows the amount of metal related to swaps held by the BIS grew from about zero in November to about 349 metric tons by the end of April. The figures are calculated by subtracting the bank's own gold holdings, currently at 120 tons, from its total amount held as reported by the International Monetary Fund, the World Gold Council said.

"It demonstrates once again the effectiveness of gold as a reserve asset because even in the midst of a severe liquidity crisis, institutions owning gold were able to make use of it to generate dollars," said George Milling-Stanley, the producer-funded council's managing director of government affairs.

The BIS yesterday said the 346 tons held in connection with swap operations in the year through March, which it published in its annual report, was with commercial banks. European Union regulators are relying on stress tests on banks to restore confidence amid concern that some lenders don't have enough capital to withstand a default by a European country.

Gold reached a record $1,265.30 an ounce on June 21, while the cost of insuring financial company debt from default has doubled this year in Europe, with the Markit iTraxx Financial Index of credit-default swaps linked to 25 banks and insurers surging to 137 basis points as of yesterday.

Swap holdings rose by about 2.4 tons in April, the calculation shows. The amount of gold exchanged with the Basel, Switzerland-based BIS since the beginning of December would be worth about $12.6 billion, based on the metal's average price in the five months through April. Central banks and other official institutional sales were 41 tons last year, according to London- based researcher GFMS Ltd.

Note: Commercial banks having to resort to swapping their best performing asset in order to raise funds is a further sign of the distressed state of the international banking and financial system. The fact that the commercial banks swapped the gold rather than sold it is also an indication of their favourable view of gold and a sign that commercial banks, like central banks, are increasingly unlikely to liquidate gold holdings. Indeed, central banks look set to become net buyers of gold again in 2010. Although commercial banks, unlike central banks, are not known to own substantial quantities of bullion rather some of them store bullion on behalf of clients.

While 346 tonnes of gold sounds like a lot it is actually only worth some $13bn at current prices which is tiny miniscule compared to wholesale money markets and to foreign exchange reserves of creditor nations such as India, Russia and China. The news created uncertainty which may lead to further short term weakness but it is bullish for gold long term.

The role of gold itself as an important safe haven currency and asset within the financial and monetary system is being appreciated increasingly.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.