The Cloud With A Silver Lining

Commodities / Gold and Silver 2010 Jul 11, 2010 - 02:11 PM GMTBy: Charles_Maley

With all the conflicting forces in the markets today it is difficult to see where real long term value might be hiding. No one is hard pressed for opinions about what to buy or sell, but a large percentage of those opinions are based on short term momentum ideas and not long term value.

With all the conflicting forces in the markets today it is difficult to see where real long term value might be hiding. No one is hard pressed for opinions about what to buy or sell, but a large percentage of those opinions are based on short term momentum ideas and not long term value.

So where is long term value? Is it in the stock market…. or are we headed for the dreaded double dip recession or worse, a depression under the weight of deflation? Is it bonds…. or is this the calm before the inflation storm? Maybe it’s cash. Even though there is no yield, at least it’s safe. I think.

Honestly, I don’t know how the experts can be so sure of their opinions on the inflation/deflation debate. There seems to be forces on both sides of the argument that imply either or both could unfold. Not a very comforting thought, but there is clear cut evidence of the two forces at work. For example, when is the last time you saw Gold and Bonds go up together for any length of time? The deflationists lean on unemployment and the weak housing market while the inflationists talk of the massive easy monetary policy, and the trillions of dollars of spending by the current administration.

The Nobel Prize winning economist Paul Krugman recently said in the New York Times, that we are entering the Third Depression. Meanwhile, John Paulson the famous hedge fund manager has taken the opposite stance and positioned his money behind a huge bet on gold. Krugman says unemployment and housing continues to weigh on a recovery and will keep inflation at bay. He noted where May 2010 was the worst month for new home sales in America since records began in 1963. Paulson says there is “less than a 10%” chance of a double dip recession. The list of good thinkers goes on with Nouriel Roubini and Robert Precter behind deflation and Jim Rogers and Nassim Taleb backing the inflation horse. Who knows? I’m confused.

Sometimes when I’m confused I look at which investments are doing well to confirm which forecast is more likely to be accurate. This time that’s not working either. Deflationists who are short housing and long bonds over the last several years are doing well. So are the inflationists who own gold and some other commodities, yet stock investors are struggling.

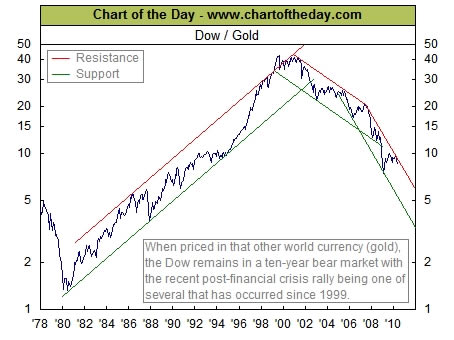

The stock market has rallied somewhat in price from the lows but not really in value when looked at in terms of gold and not the dollar. The Dow divided by the price of one ounce of gold (the Dow / gold ratio) is currently 8.5 ounces of gold. In other words you can buy the Dow with 8.5 ounces of gold. In 1999 it took close to 45 ounces of gold to buy the Dow. So, when priced in gold, the US stock market has been in a severe bear market for the entire 21st century.

Gold on the other hand has been a great investment in the last several years but sometimes it’s hard to buy something that has gone up so much. Personally I believe gold is going higher in the long term but perhaps silver should be taken more seriously at this point. Silver might be a better investment for long term value when compared to gold, stocks or bonds.

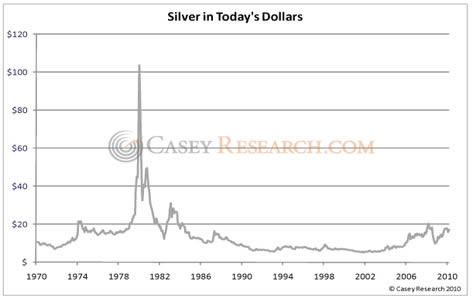

In 1980 Gold traded at $800 per ounce and silver at $50 per ounce. Today Gold is around $1200 per ounce and silver is around $17. This baffles me as much as the bonds and gold going up together for years.

In 1980 it took about 16 ounces of silver to buy an ounce of gold (The gold/silver ratio). Now it takes 70 ounces of silver to buy an ounce of gold. If the ratio were 16 today silver would be $75 per ounce, a far cry from $17. In fact, silver could go up three fold just to reach the 1980 high, and that’s not adjusted for inflation.

Now, that of course is 1980 prices. The historical range of recent years has been more like 45-50 which would still put silver around $25 per ounce up from the current $17 which is still close to 50% higher than current levels. In any event either gold is very expensive or silver is cheap against gold. I think it’s more likely that silver is undervalued and the ratio should close favoring silver. Here is a chart that shows how far silver is below its inflation-adjusted peak reached in 1980.

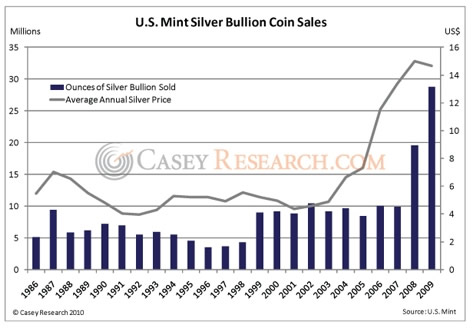

Also there seems to be major demand surfacing in the silver coin and silver ETF markets. Jeff Clarke of Casey’s Gold & Resource Report points out that even though silver has underperformed gold it has still been strong compared to other investments. “This price strength from the “poor man’s gold” has spilled over into tremendous investment demand – especially so for silver coins. The U.S. Mint sold more Silver Eagles in the first quarter of this year – just over nine million – than any prior quarter in its history. The Royal Canadian Mint produced 9.7 million silver maple leafs in 2009, also a record. Take a look at the jump in U.S. Mint coin sales since 2007: Silver bullion ETFs are growing, too, experiencing a five-fold increase in metal holdings since 2006.”

So considering the alternatives, perhaps we should buy silver on any weakness. It has a good chance to perform in either a deflationary scenario as a store of value or as a hedge against a falling dollar and inflation.

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them. Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley www.viewpointsofacommoditytrader.com Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2010 Copyright Charles Maley - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.