Barrick Gold Corporation and Goldcorp Incorporated Hedging Silver

Commodities / Gold & Silver Stocks Jul 12, 2010 - 01:51 AM GMTBy: Bob_Kirtley

The following is a comment received from one our readers regarding Barrick Gold Corporation (ABX) and Goldcorp Incorporated (GG) regarding their agreements with Silver Wheaton Corporation (SLW) to forward sell their silver and reads as below:

What I do not understand is why companies like Barrick and Goldcorp would enter into an agreement with SLW. Both of these companies can surely borrow the amounts of money that SLW pays them in advance for this agreement to sell SLW silver at prices around $3.90 per oz. I was told that there was a benefit to Barrick and Goldcorp to enter into these kinds of contracts with SLW because there is no dilution of stock values with this type of capital raising.

Am I missing something here or is this type of business model sound and I think more importantly is this a type of business plan that will be renewed and thus remain a viable business model into the future. As I understand it this is hedging on the part of Barrick and Goldcorp.

Tom

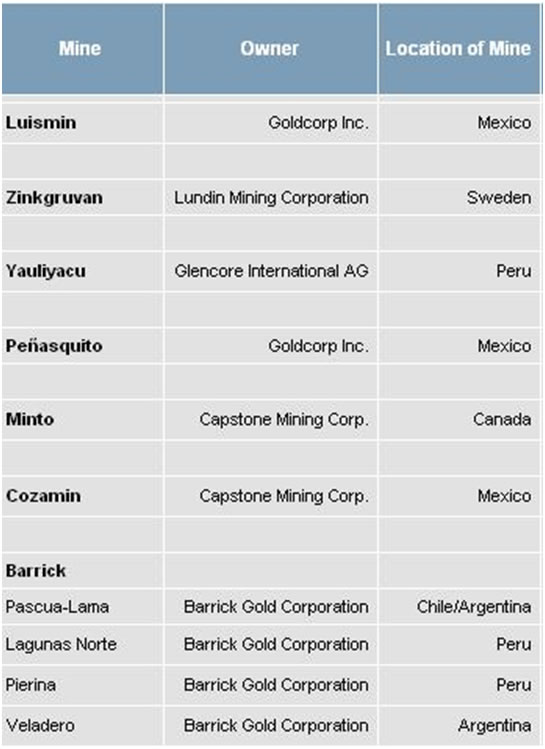

Now, as we can see from the above chart taken from Silver Wheaton’s web site, which shows the extent of their involvement in terms of their willingness to forward sell their silver production. It puzzles us that companies of this size would need to do this, after all Barrick has a market capitalization of $42.90 billion and Goldcorp is no small fry with a market capitalization $30.52 billion. Barrick has recently come to the party in terms of unwinding its hedge book on gold, however, it did take them a long time to do so. The decision to accept an upfront payment plus $3.90/oz for their silver production reminds us of someone playing chess who takes a pawn because he was able to, but eventually loses the game due to lack of vision. If silver prices fall apart then they will have made the right move. However, should silver prices find their stirrups and head north to say, $25.00/oz, then the stock price of Silver Wheaton will go ballistic as their costs are fixed but their profits are free to run.

Another minor irritation we have is that both Barrick and Goldcorp are listed in the gold bugs index known as the HUI. This index is often referred to as the index for unhedged producers IE those who do not forward sell their gold.

The description of the HUI being as follows:

The AMEX Gold BUGS(Basket of Unhedged Gold Stocks)Index represents a portfolio of 14 major gold mining companies. The Index is designed to give investors significant exposure to near term movements in gold prices - by including companies that do not hedge their gold production beyond 1 1/2 years.

We know that this index refers to gold producers and not silver producers but in our book if you hedge your product then you are a hedger, be it gold or silver.

We do need to point out that we do not own any stock in either Barrick or Goldcorp but we do own Silver Wheaton’s stock. In our very humble opinion the Silver Wheaton business model is innovative and manages to avoid the risks inherent in any mining operation and we think that they have the better side of these transactions.

Have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

The latest trade from our options team was slightly more sophisticated in that we shorted a PUT as follows:

On Friday 7th May our premium options trading service OPTIONTRADER opened a speculative short term trade on GLD Puts, signalling to short sell the $105 May-10 Puts series at $0.09.

On Tuesday the 11th May we bought back the puts for just $0.05, making a 44.44% profit in just 4 days.

Recently our premium options trading service OPTIONTRADER has been putting in a great performance, the last 16 trades with an average gain of 42.73% per trade, in an average of just under 38 days per trade. Click here to sign up or find out more.

Silver-prices.net have been rather fortunate to close both the $15.00 and the$16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.